| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

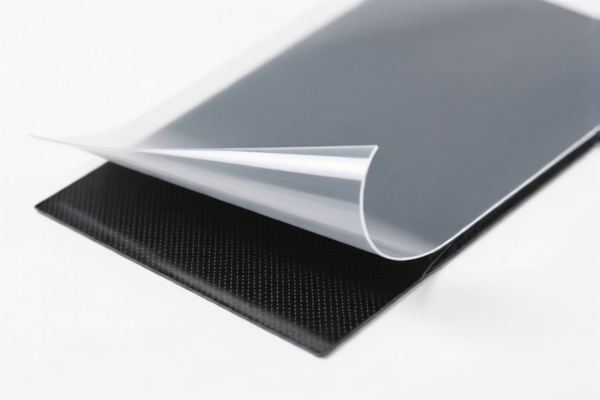

Here is the structured classification and tariff information for the PET Plastic Scratch Resistant Sheet based on the provided HS codes and tax details:

✅ HS CODE: 3920620050

Product Description: Metalized PET Film for Gift Packaging / Other Uses

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to metalized PET film, including those used for gift packaging or other unspecified purposes.

✅ HS CODE: 3920620020

Product Description: Metalized PET Film for Gift Packaging

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specifically for metalized PET film used in gift packaging.

✅ HS CODE: 3920620090

Product Description: PET Plastic Sheets, Films, Foils, Strips – Scratch Resistant

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for general PET plastic sheets or films with scratch-resistant properties.

✅ HS CODE: 3921905050

Product Description: Other Plastic Sheets, Films, Foils, Strips – PET Protective Film

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to other types of plastic films, including PET protective films, but not covered under the 39206200 series.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

-

Anti-Dumping Duties: Not applicable for PET plastic products in this category (no specific anti-dumping duties listed for this HS code group).

-

Material and Certification Verification: Ensure the product is indeed PET-based and not a composite or blended material. Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for your destination country.

-

Unit Price and Classification: Double-check the product description and unit price to ensure the correct HS code is applied. Misclassification can lead to delays and additional costs.

🛠️ Proactive Advice:

- If your product is not metalized, consider using HS CODE 3921905050 for a potentially lower tax rate.

- If your product is metalized, ensure it is classified under 39206200 series, with the correct use description (e.g., gift packaging or other).

- Always confirm with customs or a qualified customs broker for the most up-to-date and accurate classification. Here is the structured classification and tariff information for the PET Plastic Scratch Resistant Sheet based on the provided HS codes and tax details:

✅ HS CODE: 3920620050

Product Description: Metalized PET Film for Gift Packaging / Other Uses

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to metalized PET film, including those used for gift packaging or other unspecified purposes.

✅ HS CODE: 3920620020

Product Description: Metalized PET Film for Gift Packaging

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specifically for metalized PET film used in gift packaging.

✅ HS CODE: 3920620090

Product Description: PET Plastic Sheets, Films, Foils, Strips – Scratch Resistant

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for general PET plastic sheets or films with scratch-resistant properties.

✅ HS CODE: 3921905050

Product Description: Other Plastic Sheets, Films, Foils, Strips – PET Protective Film

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to other types of plastic films, including PET protective films, but not covered under the 39206200 series.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

-

Anti-Dumping Duties: Not applicable for PET plastic products in this category (no specific anti-dumping duties listed for this HS code group).

-

Material and Certification Verification: Ensure the product is indeed PET-based and not a composite or blended material. Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for your destination country.

-

Unit Price and Classification: Double-check the product description and unit price to ensure the correct HS code is applied. Misclassification can lead to delays and additional costs.

🛠️ Proactive Advice:

- If your product is not metalized, consider using HS CODE 3921905050 for a potentially lower tax rate.

- If your product is metalized, ensure it is classified under 39206200 series, with the correct use description (e.g., gift packaging or other).

- Always confirm with customs or a qualified customs broker for the most up-to-date and accurate classification.

Customer Reviews

No reviews yet.