| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

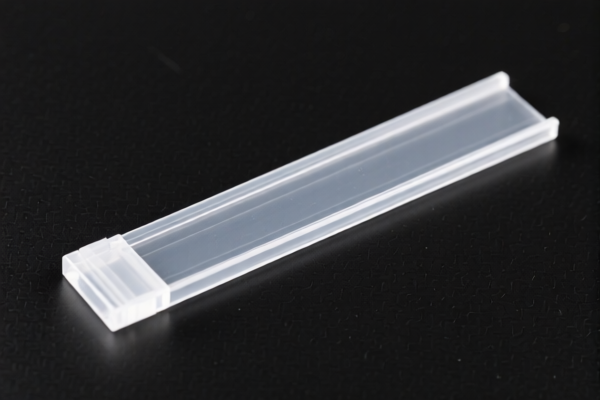

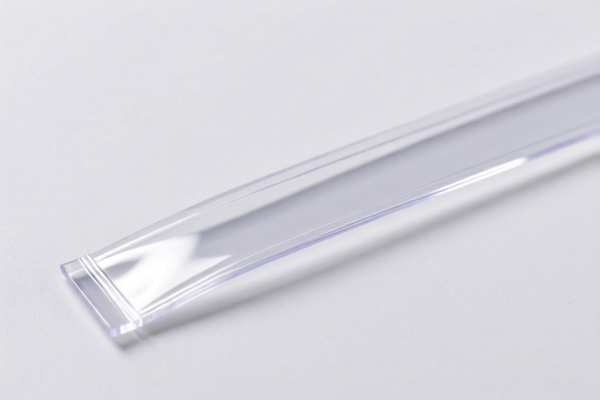

Here is the structured customs compliance analysis for the PET Plastic Transparent Strip product based on the provided HS codes and tax details:

🔍 Product Classification Overview

The product "PET Plastic Transparent Strip" can be classified under several HS codes depending on its specific form and use. Below are the relevant classifications and associated tax rates:

📦 HS Code Classification & Tax Details

1. HS CODE: 3920620090

Description: PET Plastic Transparent Sheet

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This classification is for sheet materials, not strips or tapes.

2. HS CODE: 3919905040

Description:

- Option A: Transparent PET Tape

- Option B: Transparent Plastic Sealing Strip

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This classification applies to tapes and strips made of PET or other plastics.

3. HS CODE: 3920690000

Description: Polyester Plastic Strip

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This is a general category for plastic strips not specifically covered by other codes.

4. HS CODE: 3920632000

Description: Polyester Plastic Strip

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This is a more specific classification for polyester strips.

⚠️ Important Notes & Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PET (Polyethylene Terephthalate) and not a different polymer, as this can affect classification.

- Check Unit Price: The tax rate may vary depending on the value per unit and whether the product is considered a finished good or raw material.

- Certifications Required: Confirm if any customs documentation (e.g., commercial invoice, packing list, certificate of origin) or product certifications (e.g., RoHS, REACH) are required for import.

- Consult a Customs Broker: For complex or high-value shipments, it is recommended to work with a licensed customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the most accurate HS code for your specific product or if you need assistance with customs documentation. Here is the structured customs compliance analysis for the PET Plastic Transparent Strip product based on the provided HS codes and tax details:

🔍 Product Classification Overview

The product "PET Plastic Transparent Strip" can be classified under several HS codes depending on its specific form and use. Below are the relevant classifications and associated tax rates:

📦 HS Code Classification & Tax Details

1. HS CODE: 3920620090

Description: PET Plastic Transparent Sheet

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This classification is for sheet materials, not strips or tapes.

2. HS CODE: 3919905040

Description:

- Option A: Transparent PET Tape

- Option B: Transparent Plastic Sealing Strip

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This classification applies to tapes and strips made of PET or other plastics.

3. HS CODE: 3920690000

Description: Polyester Plastic Strip

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This is a general category for plastic strips not specifically covered by other codes.

4. HS CODE: 3920632000

Description: Polyester Plastic Strip

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This is a more specific classification for polyester strips.

⚠️ Important Notes & Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PET (Polyethylene Terephthalate) and not a different polymer, as this can affect classification.

- Check Unit Price: The tax rate may vary depending on the value per unit and whether the product is considered a finished good or raw material.

- Certifications Required: Confirm if any customs documentation (e.g., commercial invoice, packing list, certificate of origin) or product certifications (e.g., RoHS, REACH) are required for import.

- Consult a Customs Broker: For complex or high-value shipments, it is recommended to work with a licensed customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the most accurate HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.