| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

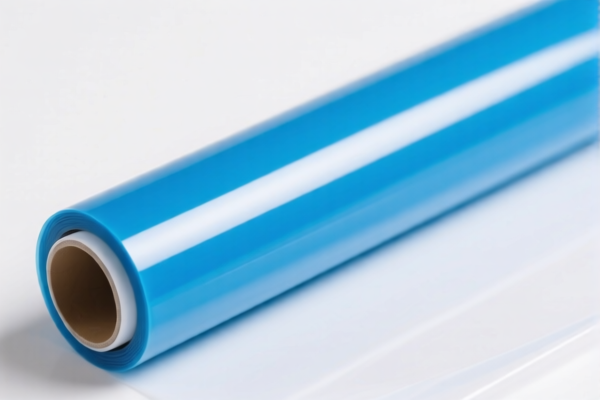

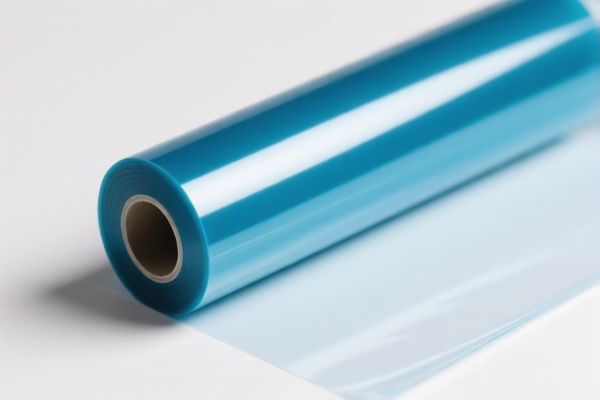

Product Name: PET Polyester Film

Classification: Plastic sheets, plates, films, foils, and strips

Here is the detailed HS code classification and tariff information for PET Polyester Film:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips (includes PET polyester film).

Total Tax Rate: 34.8%

Breakdown of Tariff Rates:

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

- No Anti-dumping duties: This product is not subject to anti-dumping duties on iron or aluminum, as it is a plastic product.

- Material Verification: Confirm that the product is indeed PET polyester film and not another type of plastic (e.g., polyethylene, polypropylene, or polycarbonate), as this will affect the correct HS code and applicable tariffs.

- Certifications Required: Depending on the country of import, you may need to provide documentation such as material specifications, origin certificates, or compliance with environmental regulations (e.g., REACH, RoHS).

📌 Proactive Advice:

- Double-check the product composition to ensure it falls under 3921905050 and not a more specific or different HS code.

- Review the unit price and total value of the goods, as this may affect the classification or trigger different tariff rules.

- Consult with customs brokers or trade compliance experts if the product is part of a larger kit or bundled with other items.

- Monitor updates on the April 11, 2025, tariff change to adjust your import strategy accordingly.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Name: PET Polyester Film

Classification: Plastic sheets, plates, films, foils, and strips

Here is the detailed HS code classification and tariff information for PET Polyester Film:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips (includes PET polyester film).

Total Tax Rate: 34.8%

Breakdown of Tariff Rates:

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

- No Anti-dumping duties: This product is not subject to anti-dumping duties on iron or aluminum, as it is a plastic product.

- Material Verification: Confirm that the product is indeed PET polyester film and not another type of plastic (e.g., polyethylene, polypropylene, or polycarbonate), as this will affect the correct HS code and applicable tariffs.

- Certifications Required: Depending on the country of import, you may need to provide documentation such as material specifications, origin certificates, or compliance with environmental regulations (e.g., REACH, RoHS).

📌 Proactive Advice:

- Double-check the product composition to ensure it falls under 3921905050 and not a more specific or different HS code.

- Review the unit price and total value of the goods, as this may affect the classification or trigger different tariff rules.

- Consult with customs brokers or trade compliance experts if the product is part of a larger kit or bundled with other items.

- Monitor updates on the April 11, 2025, tariff change to adjust your import strategy accordingly.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.