| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured customs compliance analysis for the PET Special Film product based on the provided HS codes and tax details:

📦 Product Classification Overview

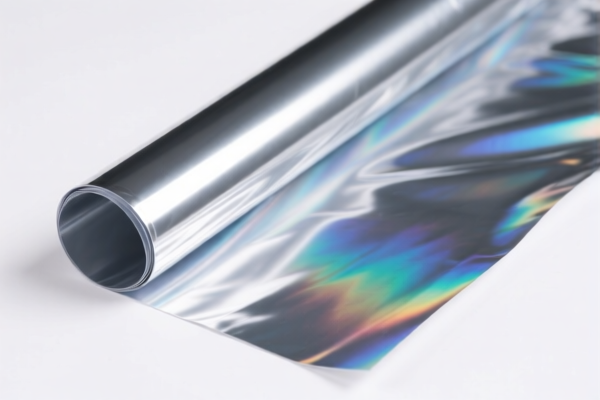

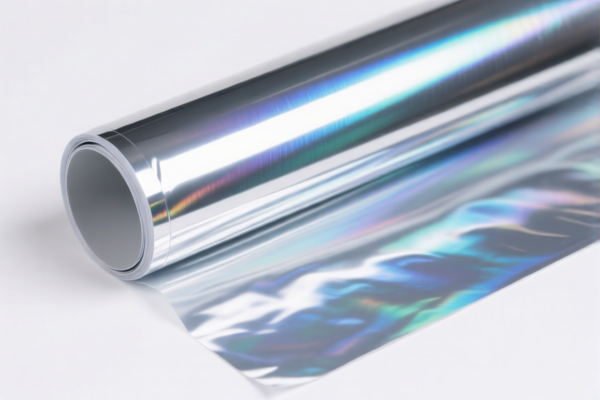

- Product Name: PET Special Film (including customized, protective, coated, and specialty films)

- HS Codes Involved:

- 3920620090 (PET Plastic Special Film, Custom Film, Protective Film, Coated Film)

- 3921905050 (PET Plastic Film)

📊 Tariff Breakdown by HS Code

1. HS Code: 3920620090

- Product Description: PET Plastic Special Film (including customized, protective, coated, etc.)

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to specialty PET films with added features or functions (e.g., coated, protective, or customized).

2. HS Code: 3921905050

- Product Description: PET Plastic Film (general-purpose)

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to standard PET films without special features or coatings.

⚠️ Important Policy Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all PET films (both 3920620090 and 3921905050) after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for PET films in the provided data. However, it is advisable to check for any ongoing investigations or duties related to iron and aluminum if your product contains such materials (not applicable here, but good to be aware).

📌 Proactive Compliance Advice

-

Verify Material and Unit Price:

Ensure the product is correctly classified based on its material composition and function (e.g., coated, protective, or general-purpose). -

Check Required Certifications:

Confirm if any customs documentation or certifications (e.g., product standards, origin certificates) are required for import. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this will significantly impact the total import cost. -

Consider HS Code Selection:

If your product is a general-purpose PET film, using 3921905050 may result in a lower total tax rate (34.8%) compared to 3920620090 (59.2%).

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured customs compliance analysis for the PET Special Film product based on the provided HS codes and tax details:

📦 Product Classification Overview

- Product Name: PET Special Film (including customized, protective, coated, and specialty films)

- HS Codes Involved:

- 3920620090 (PET Plastic Special Film, Custom Film, Protective Film, Coated Film)

- 3921905050 (PET Plastic Film)

📊 Tariff Breakdown by HS Code

1. HS Code: 3920620090

- Product Description: PET Plastic Special Film (including customized, protective, coated, etc.)

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to specialty PET films with added features or functions (e.g., coated, protective, or customized).

2. HS Code: 3921905050

- Product Description: PET Plastic Film (general-purpose)

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to standard PET films without special features or coatings.

⚠️ Important Policy Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all PET films (both 3920620090 and 3921905050) after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for PET films in the provided data. However, it is advisable to check for any ongoing investigations or duties related to iron and aluminum if your product contains such materials (not applicable here, but good to be aware).

📌 Proactive Compliance Advice

-

Verify Material and Unit Price:

Ensure the product is correctly classified based on its material composition and function (e.g., coated, protective, or general-purpose). -

Check Required Certifications:

Confirm if any customs documentation or certifications (e.g., product standards, origin certificates) are required for import. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this will significantly impact the total import cost. -

Consider HS Code Selection:

If your product is a general-purpose PET film, using 3921905050 may result in a lower total tax rate (34.8%) compared to 3920620090 (59.2%).

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.