| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance information for the PET Transparent Film product based on the provided HS codes and tax details:

📦 Product Classification Overview: PET Transparent Film

Below are the HS codes and associated customs tariff details for different types of PET transparent film:

🔢 HS Code: 3920620050

Product Description: PET metallized transparent film, used for gift packaging or other purposes

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to metallized PET films, which may have different customs treatment due to the metallization process.

- Proactive Advice: Confirm if the film is metallized and whether it is used for packaging or industrial purposes, as this may affect classification.

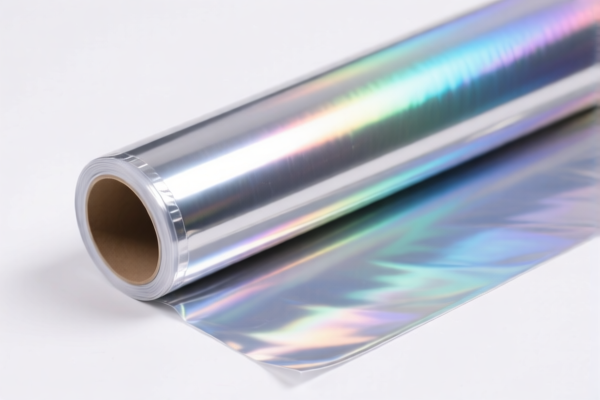

🔢 HS Code: 3920620090

Product Description: PET plastic transparent sheets or protective films, laminated, supported, or combined with other materials

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to composite or laminated PET films.

- Proactive Advice: Verify if the product is a composite material and ensure the correct description is used to avoid misclassification.

🔢 HS Code: 3921904090

Product Description: Transparent polyester (PET) film, not specially reinforced with paper

Total Tax Rate: 34.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to pure PET transparent film without paper reinforcement.

- Proactive Advice: Confirm that the product is not reinforced with paper to ensure correct classification.

🔢 HS Code: 3919905040

Product Description: Transparent PET tape

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to transparent PET adhesive tape.

- Proactive Advice: Ensure the product is not classified under a different adhesive or tape category (e.g., 3919905060 for self-adhesive labels).

🔢 HS Code: 3919905060

Product Description: PET self-adhesive transparent labels

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to self-adhesive PET labels.

- Proactive Advice: Confirm if the product is used for labeling or packaging, as this may influence the correct HS code.

⚠️ Important Reminders:

- April 11, 2025 Special Tariff: All the above products are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for PET transparent film (no specific anti-dumping duties listed for this category).

- Certifications: Ensure compliance with any required certifications (e.g., RoHS, REACH, or import permits) depending on the destination country.

- Material Verification: Confirm the material composition, thickness, application, and processing (e.g., metallized, laminated, adhesive) to ensure correct HS code classification.

✅ Action Steps for Importers:

- Verify the exact product description and technical specifications.

- Confirm the HS code based on the product's material, processing, and intended use.

- Check for additional tariffs applicable after April 11, 2025.

- Ensure all customs documentation is accurate and complete.

- Consult with a customs broker or compliance expert if unsure about classification.

Let me know if you need help with a specific product description or customs documentation. Here is the structured analysis and customs compliance information for the PET Transparent Film product based on the provided HS codes and tax details:

📦 Product Classification Overview: PET Transparent Film

Below are the HS codes and associated customs tariff details for different types of PET transparent film:

🔢 HS Code: 3920620050

Product Description: PET metallized transparent film, used for gift packaging or other purposes

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to metallized PET films, which may have different customs treatment due to the metallization process.

- Proactive Advice: Confirm if the film is metallized and whether it is used for packaging or industrial purposes, as this may affect classification.

🔢 HS Code: 3920620090

Product Description: PET plastic transparent sheets or protective films, laminated, supported, or combined with other materials

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to composite or laminated PET films.

- Proactive Advice: Verify if the product is a composite material and ensure the correct description is used to avoid misclassification.

🔢 HS Code: 3921904090

Product Description: Transparent polyester (PET) film, not specially reinforced with paper

Total Tax Rate: 34.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to pure PET transparent film without paper reinforcement.

- Proactive Advice: Confirm that the product is not reinforced with paper to ensure correct classification.

🔢 HS Code: 3919905040

Product Description: Transparent PET tape

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to transparent PET adhesive tape.

- Proactive Advice: Ensure the product is not classified under a different adhesive or tape category (e.g., 3919905060 for self-adhesive labels).

🔢 HS Code: 3919905060

Product Description: PET self-adhesive transparent labels

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to self-adhesive PET labels.

- Proactive Advice: Confirm if the product is used for labeling or packaging, as this may influence the correct HS code.

⚠️ Important Reminders:

- April 11, 2025 Special Tariff: All the above products are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for PET transparent film (no specific anti-dumping duties listed for this category).

- Certifications: Ensure compliance with any required certifications (e.g., RoHS, REACH, or import permits) depending on the destination country.

- Material Verification: Confirm the material composition, thickness, application, and processing (e.g., metallized, laminated, adhesive) to ensure correct HS code classification.

✅ Action Steps for Importers:

- Verify the exact product description and technical specifications.

- Confirm the HS code based on the product's material, processing, and intended use.

- Check for additional tariffs applicable after April 11, 2025.

- Ensure all customs documentation is accurate and complete.

- Consult with a customs broker or compliance expert if unsure about classification.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.