| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4911911000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 3926904800 | Doc | 33.4% | CN | US | 2025-05-12 |

| 4202999000 | Doc | 75.0% | CN | US | 2025-05-12 |

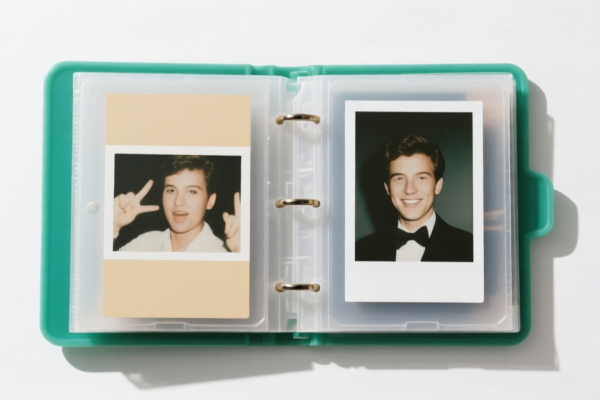

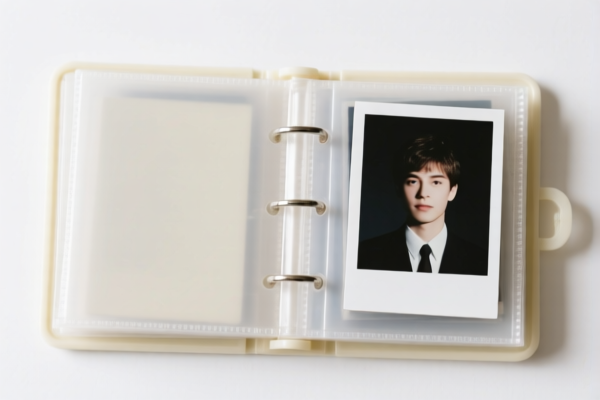

Customs Classification & Duty Analysis: PHOTO ALBUM (RETRO COLOR)

Based on the provided HS codes and descriptions, here's a detailed breakdown of the potential classifications for your "PHOTO ALBUM (RETRO COLOR)", along with duty implications. It appears there are three possible classifications depending on the album's composition and features.

Important Note: The final classification is determined by Customs officials based on the actual product inspection and supporting documentation. This analysis is for informational purposes only.

1. HS Code: 4911.91.10.00 – Other Printed Matter (Pictures, Designs & Photographs)

- Description: Other printed matter, including printed pictures and photographs: Other: Pictures, designs and photographs: Printed over 20 years at time of importation.

- Breakdown of HS Code:

- 49: Printed Books, Maps, and Other Printed Matter

- 11: Other Printed Matter, including Printed Pictures and Photographs

- 91: Other

- 10: Pictures, designs and photographs

- Applicability: This code is most suitable if the photo album is primarily considered a collection of printed pictures and designs, especially if the prints are vintage or over 20 years old at the time of import. Think of it as a historical collection presented in album format.

- Duty Rates:

- Basic Duty: 0.0%

- Additional Tariff: 7.5%

- Post April 2, 2025: Additional Tariff increases to 30%

- Total Duty: 37.5%

- Considerations: The age of the prints is critical for this classification. Documentation proving the print date may be required.

2. HS Code: 3926.90.48.00 – Plastics & Articles of Other Materials (Photo Albums)

- Description: Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Photo albums

- Breakdown of HS Code:

- 39: Plastics and articles thereof

- 26: Other articles of plastics and articles of other materials

- 90: Other

- 48: Photo albums

- Applicability: This is the most likely classification if the photo album is made of plastic or a combination of materials, with plastic being a significant component. This covers standard photo albums with plastic covers, rings, or internal sleeves.

- Duty Rates:

- Basic Duty: 3.4%

- Additional Tariff: 0.0%

- Post April 2, 2025: Additional Tariff increases to 30%

- Total Duty: 33.4%

- Considerations: The material composition of the album is key. If it's primarily plastic, this is the correct code.

3. HS Code: 4202.99.90.00 – Articles of Leather/Composition Leather (Other)

- Description: Trunks, suitcases, vanity cases, attache cases, briefcases, school satchels, spectacle cases, binocular cases, camera cases, musical instrument cases, gun cases, holsters and similar containers; traveling bags, insulated food or beverage bags, toiletry bags, knapsacks and backpacks, handbags, wallets, purses, etc.; and parts of these articles: Other: Other: Other

- Breakdown of HS Code:

- 42: Articles of leather or composition leather

- 02: Trunks, suitcases, vanity cases, etc.

- 99: Other

- 90: Other

- Applicability: This code is applicable if the photo album is made of leather or a composition leather material. This is less likely unless the album is specifically designed as a high-end leather-bound travel or presentation case.

- Duty Rates:

- Basic Duty: 20.0%

- Additional Tariff: 25.0%

- Post April 2, 2025: Additional Tariff increases to 30%

- Total Duty: 75.0%

- Considerations: This code carries the highest duty rate. Ensure the album is genuinely made of leather before considering this classification.

Recommendations & Next Steps:

- Material Verification: Confirm the primary material composition of the photo album. This is the most important factor in determining the correct HS code.

- Detailed Description: Provide a very detailed description of the album to Customs, including materials, construction, and intended use.

- Invoice Accuracy: Ensure the invoice accurately reflects the material composition and value of the goods.

- Certification (Potential): Depending on the material (especially leather), you may need to provide certification of origin or material composition.

- Post April 2, 2025 Tariff Changes: Be aware of the upcoming tariff increases and factor them into your cost calculations.

- Consult with a Customs Broker: For complex cases or high-value shipments, it's highly recommended to consult with a licensed Customs broker in China. They can provide expert guidance and ensure compliance with all regulations.

Disclaimer: This information is for general guidance only and does not constitute professional legal or customs advice. Always consult with a qualified customs professional for specific advice related to your shipment.

Customer Reviews

No reviews yet.