| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923300090 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923500000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 7616995190 | Doc | 82.5% | CN | US | 2025-05-12 |

| 7606113030 | Doc | 33.0% | CN | US | 2025-05-12 |

| 7606113060 | Doc | 33.0% | CN | US | 2025-05-12 |

| 8309900010 | Doc | 57.6% | CN | US | 2025-05-12 |

| 8309100000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8301700000 | Doc | 42.0% | CN | US | 2025-05-12 |

| 8301500000 | Doc | 40.6% | CN | US | 2025-05-12 |

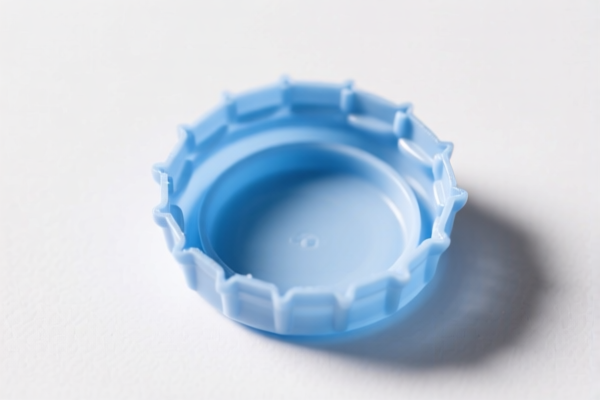

Here's a breakdown of potential HS codes for "PLASTIC BOTTLE WITH ALUMINUM CAP," based on the provided reference data. Since the item is a composite of materials, we need to consider each component.

- 3923300090: Articles for the conveyance or packing of goods, of plastics; stoppers, lids, caps and other closures, of plastics: Carboys, bottles, flasks and similar articles Other. (39: Plastics and articles thereof; 23: Packaging articles, including containers; 30: Other). This HS code covers the plastic bottle itself. The base tariff is 3.0%, with additional tariffs of 25.0% currently and 30% after April 2, 2025, resulting in a total tariff of 58.0%.

- 8309900010: Stoppers, caps and lids (including crown corks, screw caps and pouring stoppers), capsules for bottles, threaded bungs, bung covers, seals and other packing accessories, and parts thereof, of base metal: Other Of aluminum. (83: Miscellaneous manufactured articles of base metal; 09: Closures, seals; 90: Other). This code applies to the aluminum cap. The base tariff is 2.6%, with additional tariffs of 25.0% currently and 30% after April 2, 2025, resulting in a total tariff of 57.6%.

Important Considerations & Recommendations:

- Material Composition: Confirm the exact type of plastic used for the bottle. Different plastic types could fall under slightly different HS codes within Chapter 39.

- Cap Type: The description "aluminum cap" is broad. If it’s a crown cork,

8309100000(Stoppers, caps and lids...: Crown corks) might be more accurate, with a total tariff of 55.0%. - Combined vs. Separate Classification: Depending on customs interpretation, the bottle and cap could be classified as a single item or separately. Separate classification (as above) is generally safer and more transparent.

- Declaration Accuracy: Ensure the declared value accurately reflects the cost of both the plastic bottle and the aluminum cap.

- Import Regulations: Check for any specific import regulations or certifications required for plastic packaging or aluminum products in your destination country.

- 2025 Tariff Changes: Be aware of the tariff increases scheduled for April 2, 2025, and factor them into your cost calculations.

- Single Declaration: If declaring as a single item, consult with a customs broker to determine the most appropriate HS code and tariff rate.

- Further Information: Provide more details about the bottle (e.g., its intended use, plastic type) and cap (e.g., screw cap, crown cork) for a more precise classification.

Customer Reviews

The page is helpful, but I wish there were more examples of similar products. Still, the info on the HS codes and tariffs was exactly what I needed.

The explanation of the aluminum cap classification under 8309900010 was spot on. I was worried about getting the HS code right, but this page made it simple.

I found the details on the 3923300090 HS code really useful. It clarified how the tariff is calculated and when the rate will increase in 2025.

This page gave me the exact HS code for my plastic bottle with an aluminum cap. The breakdown of the tariff rates was very clear and helpful for my export planning.