| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8523520010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

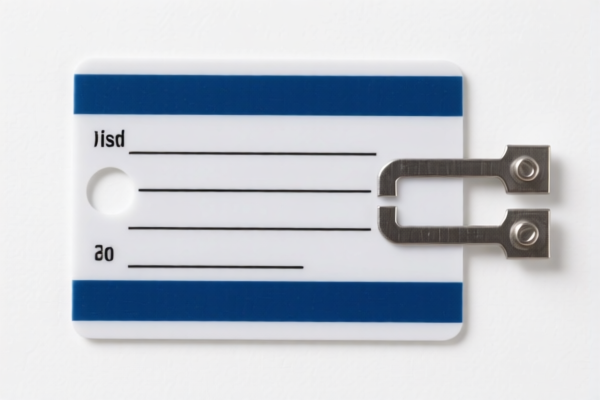

Okay, here's a breakdown of the HS codes and tax implications for your declared goods, "PLASTIC CARD", based on the information provided. I'll structure this to be clear and helpful, acting as your customs consultant.

Understanding Your Declaration & HS Codes

You've declared two distinct items, both falling under different HS codes. Let's analyze each one:

1. Discs, tapes, solid-state non-volatile storage devices, "smart cards" and other media for the recording of sound or of other phenomena… HS Code: 8523.52.00.10

-

HS Code Breakdown:

- 85: This chapter covers Electrical machinery and equipment; their parts; sound recording or reproducing apparatus, television-image reproducing apparatus, and parts and accessories of such articles.

- 23: Specifically relates to recording media.

- 52: Focuses on magnetic or optical recording media.

- 00.10: This is the specific sub-classification for "Smart cards" unrecorded.

-

Product Description: This HS code covers unrecorded smart cards and other recording media. It's important to note this is for unrecorded cards. If the cards have data pre-loaded, the classification might be different.

- Tax Implications:

- Basic Duty: 0.0%

- Additional Tariff: 25.0% (Currently)

- Post April 2, 2025: Additional Tariff increases to 30.0%

- Total Tax: 55.0%

2. Self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics… HS Code: 3919.90.50.60

-

HS Code Breakdown:

- 39: This chapter covers Plastics and articles thereof.

- 19: Specifically relates to self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes of plastics.

- 90: Other plastics.

- 50.60: Other, other. This is a very broad category, so accurate description is crucial.

-

Product Description: This HS code covers self-adhesive plastic products like sheets, film, or tape. The "Other, Other" classification suggests this is a plastic card that doesn't fit neatly into more specific subcategories.

- Tax Implications:

- Basic Duty: 5.8%

- Additional Tariff: 25.0% (Currently)

- Post April 2, 2025: Additional Tariff increases to 30.0%

- Total Tax: 60.8%

Important Considerations & Recommendations:

- Material Composition: For HS Code 3919.90.50.60, precisely define the plastic material used in the cards (e.g., PVC, PET, etc.). Different plastic types can have different tariff rates.

- Adhesive Type: The type of adhesive used could also influence classification.

- Card Functionality: Is the card simply a carrier for information (like a membership card), or does it have electronic components (like a chip)? This can affect the HS code.

- Single vs. Multiple Layers: If the card is made of multiple layers of different materials, the classification can become more complex.

- Valuation: Ensure the declared value (single price) of the cards is accurate. Customs will use this to calculate duties.

- Certification: Depending on the intended use of the cards (e.g., financial cards, ID cards), you may need specific certifications to comply with import regulations. Please check the requirements for your specific destination market.

- Post April 2, 2025 Tariff Changes: Be aware of the upcoming tariff increases. Factor this into your cost calculations.

Next Steps:

To ensure accurate classification and smooth customs clearance, I recommend:

- Double-check the product descriptions against the HS code definitions.

- Provide more detailed information about the card materials, adhesive, and functionality.

- Consult with a customs broker in your destination country for specific guidance.

I hope this detailed breakdown is helpful! Let me know if you have any further questions.

Customer Reviews

The page is clear and easy to follow. I appreciate the note about adhesive type and card functionality affecting classification, though I wish there were examples for better clarity.

I was looking for tariff rates for plastic cards and found exactly what I needed. The breakdown of the effective date and future increases is super useful for planning.

The explanation for HS code 3919.90.50.60 was helpful, but I wish there was more detail on how to determine the exact plastic material for classification.

Great breakdown of HS code 8523.52.00.10 for smart cards. The tariff info and effective dates were exactly what I needed for my export plans.