| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

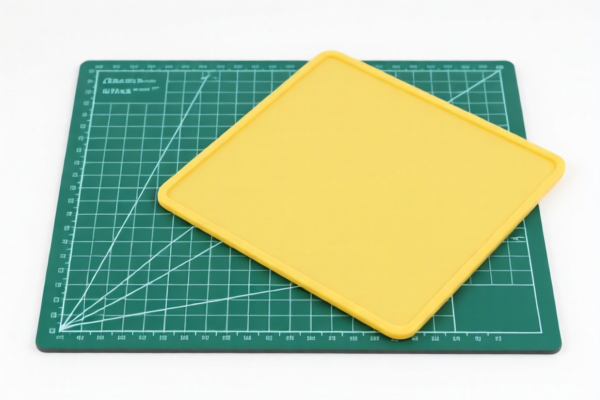

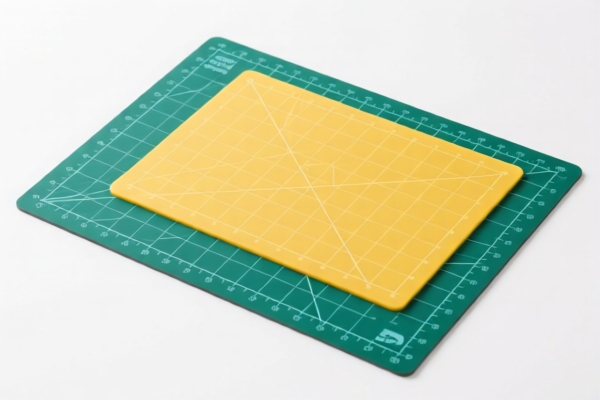

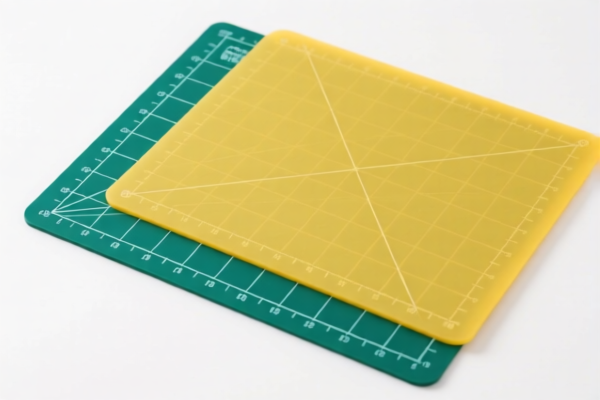

PLASTIC CUTTING MAT - HS Code Classification & Import Considerations

Based on the provided information, your declared item "PLASTIC CUTTING MAT" is classified under HS Code 3926.90.99.89. Let's break down this code and discuss the import implications:

1. HS Code Breakdown:

- 39: Plastics and articles thereof. This chapter covers a wide range of plastic products.

- 3926: Other articles of plastics and articles of other materials of headings 3901 to 3914. This narrows down the category to plastic articles not specifically covered elsewhere in Chapter 39.

- 3926.90: Other. This further specifies that the item falls into the "other" category within 3926.

- 3926.90.99: Other. This indicates a more specific "other" classification, often used for items not fitting into more defined subcategories.

- 3926.90.99.89: Other. This is a very granular classification, typically used for miscellaneous plastic articles. It suggests your cutting mat doesn't fall into any more specific category within the HS system.

2. Tax Details:

- Basic Tariff: 5.3% - This is the standard import duty applied to the item.

- Additional Tariff: 7.5% - An additional tariff is currently applied.

- Post-April 2025 Additional Tariff: 30% - Please note a significant increase to 30% additional tariff will be implemented after April 2025.

- Total Tax: 42.8% - This is the combined rate of the basic tariff and the current additional tariff.

3. Important Considerations & Recommendations:

- Material Composition: While classified as plastic, the exact plastic type is important. Different plastic types could potentially lead to a different HS code. Ensure the declared material accurately reflects the cutting mat's composition.

- Product Function & Use: The HS code is based on the item's function. Confirm that the cutting mat is primarily used for cutting and not another purpose.

- Valuation: The declared value (single price) of the cutting mat is crucial for accurate tax calculation. Ensure the declared value is accurate and reflects the transaction price.

- Certification/Standards: Depending on the intended use of the cutting mat (e.g., food contact), you may need to provide specific certifications (e.g., FDA compliance for food-grade plastic). Please verify the import requirements for your specific destination country regarding food contact materials.

- Trade Agreements: Check if any trade agreements exist between China and your destination country that could reduce or eliminate tariffs.

- Post-April 2025 Tariff Changes: Be prepared for the significant tariff increase in April 2025. Factor this into your cost calculations.

Disclaimer: HS code classification is complex and subject to interpretation. This information is for general guidance only. It is highly recommended to consult with a licensed customs broker or relevant authorities in your destination country to confirm the correct HS code and import requirements for your specific product. Incorrect classification can lead to delays, penalties, and additional costs.

Customer Reviews

The page provided a good overview of the HS code and tariff rates for plastic cutting mats. I would have liked to see more examples of how different plastic types might affect classification, but overall it was informative.

I was looking for HS code info on plastic cutting mats, and this page had exactly what I needed. The breakdown of the code and the tax implications were very helpful for my business.

Great breakdown of the HS Code 3926.90.99.89 for plastic cutting mats. The tariff details and upcoming changes after April 2025 were really helpful for my export planning.

The information on the 42.8% tariff rate was clear, but I wish there were more details on how to handle the 30% increase after April 2025. Still, it's a solid resource.