| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 39269000 | Doc | Error | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 9507906000 | Doc | 60.0% | CN | US | 2025-05-12 |

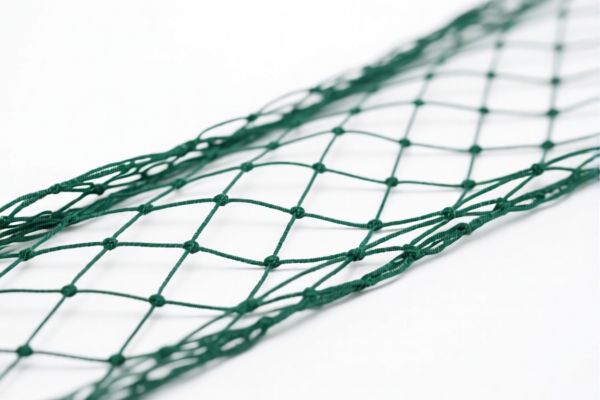

Okay, let's break down the HS codes and potential import considerations for your "PLASTIC NET" declaration. Here's a detailed analysis, presented in a structured format to help you understand the classification and associated duties.

Understanding HS Codes: A Quick Primer

The Harmonized System (HS) Code is a globally standardized system of names and numbers used to classify traded products. It's crucial for determining import duties, taxes, and regulations. Here's how the codes are generally structured:

- First 2 Digits (Chapter): Broadly defines the product category.

- First 4 Digits (Heading): More specific classification within the chapter.

- First 6 Digits (Subheading): Further narrows down the product description.

- Further Digits: National level specifications (can vary by country).

Analysis of Your HS Codes

Let's examine each code you provided:

1. HS Code: 3926.90.00 – Other articles of plastics and articles of other materials of headings 3901 to 3914

- 39: Plastics and articles thereof (Chapter). This indicates the product is made of plastic.

- 26: Other articles of plastics and articles of other materials. This suggests a broader category of plastic items.

- 90: Other. This is a residual subheading for plastic articles not specifically classified elsewhere.

- Tax Information: "Failed to retrieve tax information" – This is concerning. You must obtain accurate tax rates before importing. Contact your customs broker or the relevant customs authority in your importing country to get the correct duty rates.

2. HS Code: 3926.90.99.89 – Other articles of plastics and articles of other materials of headings 3901 to 3914

- 39: Plastics and articles thereof (Chapter).

- 26: Other articles of plastics and articles of other materials.

- 90: Other.

- 99: Other. This is a very specific "catch-all" within the "other" category.

- 89: Other. Further specification.

- Tax Information:

- Basic Duty: 5.3%

- Additional Duty: 7.5%

- Post April 2, 2025: Additional Duty increases to 30%.

- Total Tax: 42.8%

Important Considerations for 3926.90.99.89:

- Material Composition: Confirm the plastic type. Different plastics may have different duty rates.

- End Use: The specific application of the net could influence classification.

- Price Verification: Customs may scrutinize the declared value. Be prepared to justify the price.

3. HS Code: 9507.90.60.00 – Fishing rods, fish hooks and other line fishing tackle; fish landing nets, butterfly nets and similar nets; decoy "birds" (other than those of heading 9208 or 9705) and similar hunting or shooting equipment; parts and accessories thereof

- 95: Miscellaneous manufactured articles (Chapter). This is a broad category for diverse products.

- 07: Fishing rods, hooks, and tackle.

- 90: Other.

- 60: Fish landing nets, butterfly nets, and similar nets.

- Tax Information:

- Basic Duty: 5.0%

- Additional Duty: 0.0%

- Post April 2, 2025: Additional Duty increases to 30% (specifically for steel or aluminum products).

- Total Tax: 60.0% (if made of steel or aluminum)

Important Considerations for 9507.90.60.00:

- Material: The material of the net is critical. The 30% additional duty applies to steel or aluminum nets. If it's plastic, the duty will be lower.

- Functionality: Ensure the net is genuinely used for fishing or similar purposes.

- Components: If the net has metal parts, their value may be assessed separately for duty purposes.

Recommendations & Next Steps:

- Confirm Material Composition: Crucially, determine the exact material of each net. This will significantly impact the applicable duty rate.

- Obtain Accurate Tax Rates: The "Failed to retrieve tax information" for 3926.90.00 is a red flag. Contact your customs broker or the relevant customs authority immediately to get the correct duty rates.

- Review Import Regulations: Check for any specific import licenses, permits, or standards required for plastic nets in your importing country.

- Consider a Binding Ruling: If you are unsure about the correct classification, consider applying for a binding ruling from your customs authority. This provides legal certainty.

- Documentation: Ensure you have complete and accurate documentation, including invoices, packing lists, and certificates of origin.

- Valuation: Be prepared to justify the declared value of the goods.

Disclaimer: I am an AI assistant and cannot provide definitive customs advice. This information is for general guidance only. You should consult with a qualified customs broker or the relevant customs authority for specific advice tailored to your situation.

Customer Reviews

The page had good visuals and detailed explanations, but I wish there were more examples of how the material affects the tariff rates for plastic nets.

I found the explanation of the 3926.90.00 HS code very useful. It helped me understand why the tax info was missing and what I need to do next.

The breakdown of HS Code 9507906000 was good, but I was confused about the material impact on the 60% tariff. Still, it was a solid resource.

This page provided clear details on HS Code 3926909989 and the 42.8% tariff rate. Very helpful for understanding import costs for plastic nets.