| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

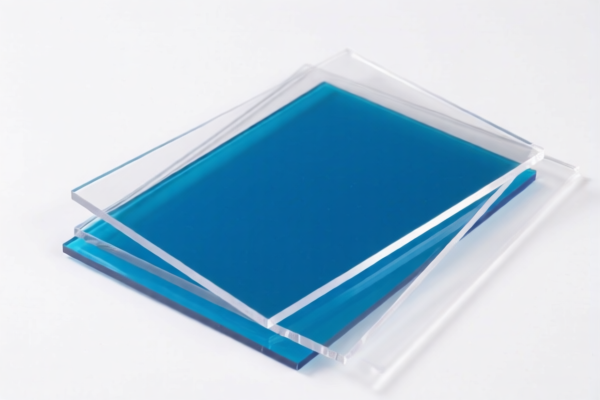

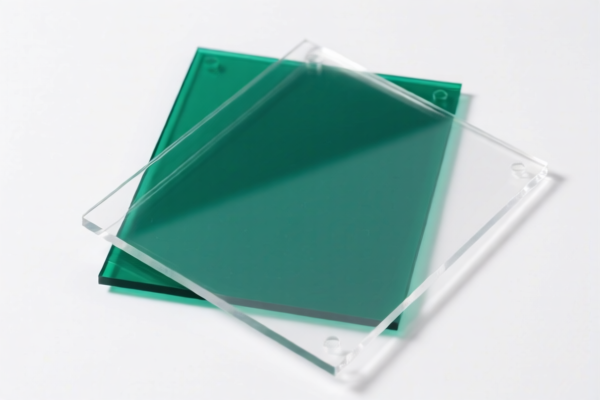

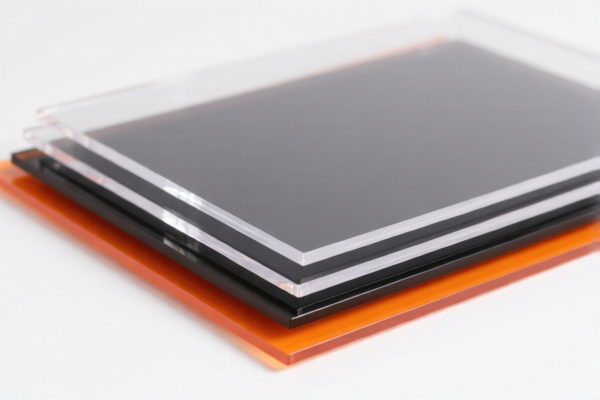

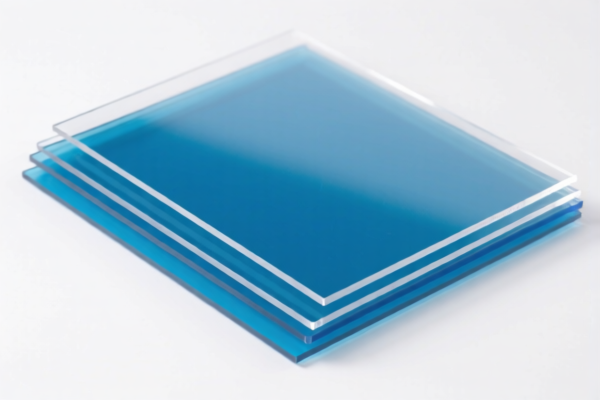

Product Name: PMMA Acrylic Sheets

Classification: Plastic Products (specifically PMMA acrylic sheets)

✅ HS CODE Classification Overview

Below are the HS codes and associated tariff details for PMMA acrylic sheets:

🔢 HS CODE: 3926909989

Description: Other plastic articles, not elsewhere specified or included.

Summary: This code is a general category for plastic products not specifically covered by other HS codes, including acrylic sheets.

Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: +30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3920594000

Description: Sheets, plates, films, foils and strips of polymers of acrylics.

Summary: This code is specifically for acrylic polymer-based sheets, including PMMA.

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: +30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3920515050

Description: Sheets of polymers of acrylics.

Summary: This code is more specific and applies to acrylic polymer sheets, including PMMA.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: +30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3920598000

Description: Other sheets, plates, films, foils and strips of plastics, non-cellular and not reinforced, not layered, supported or otherwise combined with other materials: based on acrylic polymers: other: other.

Summary: This code covers other types of acrylic-based sheets, including PMMA, but not specifically categorized under 392051.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: +30.0%

- Anti-dumping duties: Not applicable for this category.

⚠️ Important Notes and Recommendations

- April 11, 2025 Tariff Alert: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning.

- Material Verification: Confirm the exact composition of the acrylic sheets (e.g., whether it is 100% PMMA or contains additives or other materials), as this can affect the correct HS code.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware of unit price thresholds that may affect the applicable tariff rates or classification.

- Customs Declaration: Ensure that the HS code used in customs declaration matches the actual product description and material to avoid delays or penalties.

📌 Proactive Advice

- Double-check the product description and technical specifications to ensure the correct HS code is used.

- Consult with customs brokers or import experts if the product is borderline between categories.

- Monitor policy updates regarding the April 11, 2025 tariff changes and any potential future adjustments.

Let me know if you need help determining the most accurate HS code for your specific PMMA acrylic sheets.

Product Name: PMMA Acrylic Sheets

Classification: Plastic Products (specifically PMMA acrylic sheets)

✅ HS CODE Classification Overview

Below are the HS codes and associated tariff details for PMMA acrylic sheets:

🔢 HS CODE: 3926909989

Description: Other plastic articles, not elsewhere specified or included.

Summary: This code is a general category for plastic products not specifically covered by other HS codes, including acrylic sheets.

Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: +30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3920594000

Description: Sheets, plates, films, foils and strips of polymers of acrylics.

Summary: This code is specifically for acrylic polymer-based sheets, including PMMA.

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: +30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3920515050

Description: Sheets of polymers of acrylics.

Summary: This code is more specific and applies to acrylic polymer sheets, including PMMA.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: +30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3920598000

Description: Other sheets, plates, films, foils and strips of plastics, non-cellular and not reinforced, not layered, supported or otherwise combined with other materials: based on acrylic polymers: other: other.

Summary: This code covers other types of acrylic-based sheets, including PMMA, but not specifically categorized under 392051.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: +30.0%

- Anti-dumping duties: Not applicable for this category.

⚠️ Important Notes and Recommendations

- April 11, 2025 Tariff Alert: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning.

- Material Verification: Confirm the exact composition of the acrylic sheets (e.g., whether it is 100% PMMA or contains additives or other materials), as this can affect the correct HS code.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware of unit price thresholds that may affect the applicable tariff rates or classification.

- Customs Declaration: Ensure that the HS code used in customs declaration matches the actual product description and material to avoid delays or penalties.

📌 Proactive Advice

- Double-check the product description and technical specifications to ensure the correct HS code is used.

- Consult with customs brokers or import experts if the product is borderline between categories.

- Monitor policy updates regarding the April 11, 2025 tariff changes and any potential future adjustments.

Let me know if you need help determining the most accurate HS code for your specific PMMA acrylic sheets.

Customer Reviews

No reviews yet.