| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and tariff information for PMMA Flame Retardant Sheets and related products:

🔍 HS Code Classification Overview for PMMA Flame Retardant Sheets

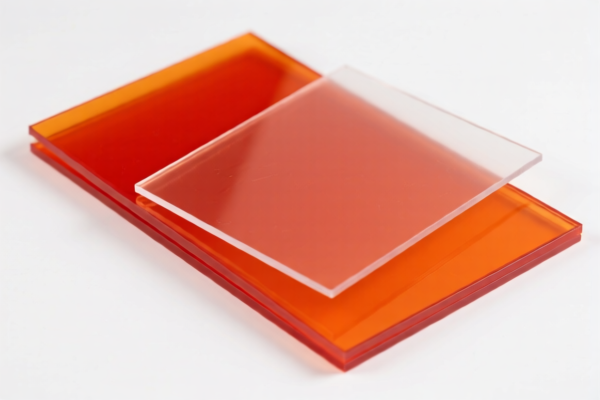

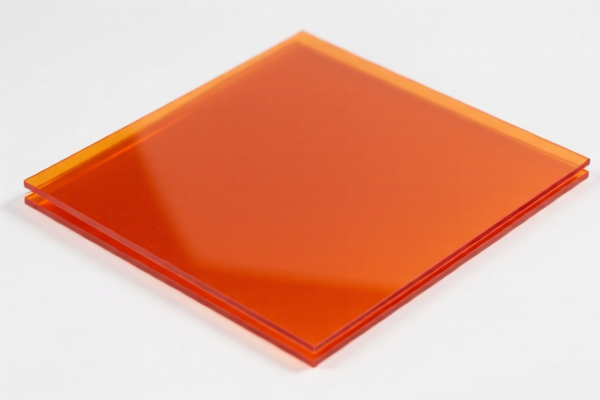

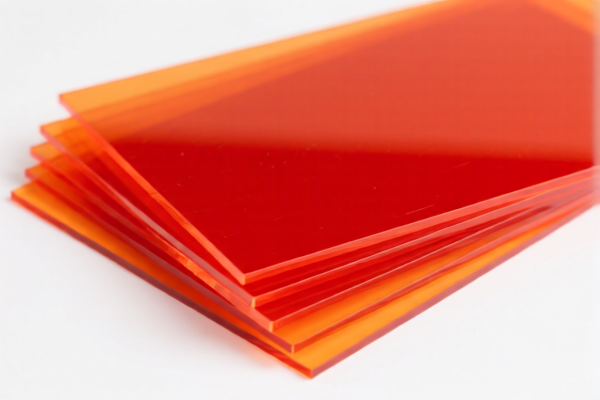

1. HS Code: 3920515050

Product Description: PMMA flame retardant sheets, non-flexible sheets containing flame retardants

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to PMMA sheets with flame retardants.

- Ensure the product contains flame retardants as specified in the description.

2. HS Code: 3920515090

Product Description: PMMA acrylic flame retardant transparent sheets, or other unspecified sheets without flame retardants

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to PMMA sheets that may or may not contain flame retardants, but are transparent.

- If the product does not contain flame retardants, this code may be more appropriate.

3. HS Code: 3920690000

Product Description: Polyester flame retardant sheets, non-cellular and non-reinforced plastic sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for polyester-based flame retardant sheets.

- Ensure the product is non-cellular and non-reinforced.

4. HS Code: 3920632000

Product Description: Polycarbonate flame retardant sheets, unsaturated polyester type

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to polycarbonate sheets with flame retardants, specifically unsaturated polyester type.

- Confirm the material type matches the description.

5. HS Code: 3920631000

Product Description: Polycarbonate flame retardant sheets, non-cellular and non-reinforced plastic sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for polycarbonate flame retardant sheets that are non-cellular and non-reinforced.

- Ensure the material and structure match the description.

⚠️ Important Alerts and Recommendations

- April 11, 2025 Special Tariff:

- All listed products are subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy—ensure your import timeline aligns with this date.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for these products, but always verify with the latest customs updates.

-

Certifications and Documentation:

- Confirm the material composition (e.g., presence of flame retardants, type of plastic) to ensure correct HS code classification.

-

Check if certifications (e.g., flame retardant compliance, safety standards) are required for import.

-

Unit Price and Material Verification:

- Verify the unit price and material specifications to avoid misclassification and potential penalties.

✅ Proactive Advice for Importers

- Double-check the product description against the HS code to ensure accuracy.

- Consult with customs brokers or classification experts if the product description is unclear or ambiguous.

- Keep updated records of product specifications and certifications for customs compliance.

Let me know if you need help with customs documentation templates or HS code verification tools. Here is the structured and professional breakdown of the HS codes and tariff information for PMMA Flame Retardant Sheets and related products:

🔍 HS Code Classification Overview for PMMA Flame Retardant Sheets

1. HS Code: 3920515050

Product Description: PMMA flame retardant sheets, non-flexible sheets containing flame retardants

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to PMMA sheets with flame retardants.

- Ensure the product contains flame retardants as specified in the description.

2. HS Code: 3920515090

Product Description: PMMA acrylic flame retardant transparent sheets, or other unspecified sheets without flame retardants

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to PMMA sheets that may or may not contain flame retardants, but are transparent.

- If the product does not contain flame retardants, this code may be more appropriate.

3. HS Code: 3920690000

Product Description: Polyester flame retardant sheets, non-cellular and non-reinforced plastic sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for polyester-based flame retardant sheets.

- Ensure the product is non-cellular and non-reinforced.

4. HS Code: 3920632000

Product Description: Polycarbonate flame retardant sheets, unsaturated polyester type

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to polycarbonate sheets with flame retardants, specifically unsaturated polyester type.

- Confirm the material type matches the description.

5. HS Code: 3920631000

Product Description: Polycarbonate flame retardant sheets, non-cellular and non-reinforced plastic sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for polycarbonate flame retardant sheets that are non-cellular and non-reinforced.

- Ensure the material and structure match the description.

⚠️ Important Alerts and Recommendations

- April 11, 2025 Special Tariff:

- All listed products are subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy—ensure your import timeline aligns with this date.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for these products, but always verify with the latest customs updates.

-

Certifications and Documentation:

- Confirm the material composition (e.g., presence of flame retardants, type of plastic) to ensure correct HS code classification.

-

Check if certifications (e.g., flame retardant compliance, safety standards) are required for import.

-

Unit Price and Material Verification:

- Verify the unit price and material specifications to avoid misclassification and potential penalties.

✅ Proactive Advice for Importers

- Double-check the product description against the HS code to ensure accuracy.

- Consult with customs brokers or classification experts if the product description is unclear or ambiguous.

- Keep updated records of product specifications and certifications for customs compliance.

Let me know if you need help with customs documentation templates or HS code verification tools.

Customer Reviews

No reviews yet.