| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9617001000 | Doc | 37.2% | CN | US | 2025-05-12 |

| 9620005000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 9620005500 | Doc | 58.3% | CN | US | 2025-05-12 |

| 4202313000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 4202316000 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4205000500 | Doc | 57.9% | CN | US | 2025-05-12 |

| 4205004000 | Doc | 56.8% | CN | US | 2025-05-12 |

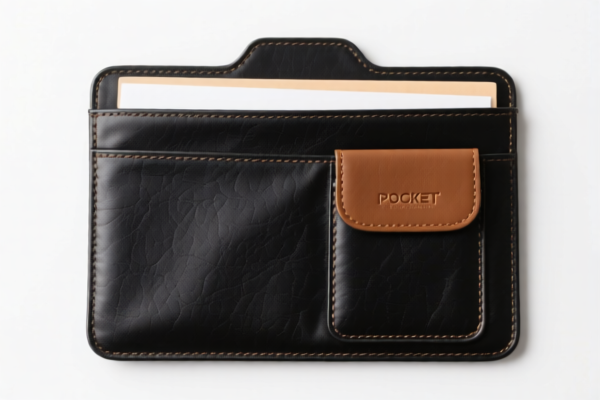

Based on the provided reference data and the user input "POCKET", here's a classification breakdown of potential HS codes, along with explanations and considerations:

-

4202.31.30.00: Articles of a kind normally carried in the pocket or in the handbag: With outer surface of leather or of composition leather: Of reptile leather

- 4202: Leather articles, saddlery and harness. This chapter broadly covers goods made of leather.

- 4202.31: Specifically targets articles designed to be carried in pockets or handbags.

- 4202.31.30: Further narrows down to those with an outer surface made of reptile leather. Example: A wallet made from crocodile skin.

- Total Tax Rate: 58.7%

-

4202.31.60.00: Articles of a kind normally carried in the pocket or in the handbag: With outer surface of leather or of composition leather: Other

- 4202: Leather articles, saddlery and harness.

- 4202.31: Articles for pocket or handbag.

- 4202.31.60: Those with an outer surface of leather or composition leather, excluding reptile leather. Example: A leather cardholder.

- Total Tax Rate: 63.0%

Important Considerations & Recommendations:

- Material Verification: The key differentiator between

4202.31.30.00and4202.31.60.00is the outer material. Confirm whether the "POCKET" is made of reptile leather. If it is,4202.31.30.00is the correct code. Otherwise, use4202.31.60.00. - Pocket as a Component: If the "POCKET" is not a finished article but a component sewn into another product (e.g., a pocket on a jacket), the classification might fall under the HS code of the finished product.

- Functionality: Consider the primary function of the "POCKET". Is it designed to hold small items like coins, cards, or keys? This will help confirm it falls under the "articles normally carried in the pocket or handbag" category.

- Additional Information: Providing more details about the "POCKET" (e.g., its material composition, dimensions, intended use) will allow for a more accurate classification.

- Certification: Depending on the material and intended use, specific certifications may be required for import. Please verify the necessary certifications based on the final HS code and import regulations.

Customer Reviews

The page provided a good overview of HS codes for pockets, but I wish there was more info on how to determine if a pocket is a finished article or a component.

I was looking for HS code details for a leather cardholder, and the info on 4202.31.60.00 was exactly what I needed. Great resource!

Clear explanation of the difference between 4202.31.30.00 and 4202.31.60.00. Very useful for someone unsure about the material of their product.

The breakdown of HS code 4202.31.30.00 was super helpful. I was able to determine the right classification for my reptile leather wallet.