| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

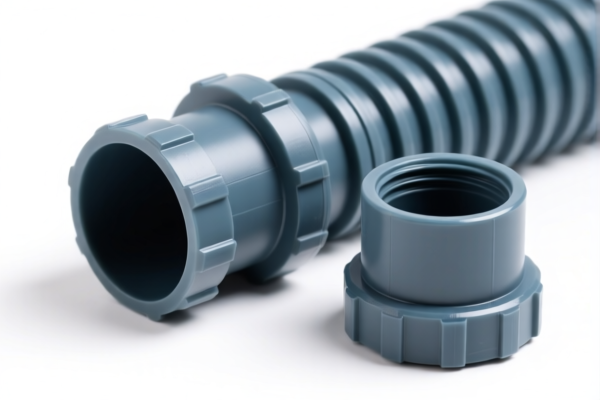

Product Classification: PP Drainage Fittings

HS CODEs and Tax Information Summary (English)

✅ HS CODE: 3917400050

Description: Non-pressure drainage fittings made of polypropylene (PP) or PVC.

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to both PP and PVC drainage fittings, provided they are non-pressure fittings.

✅ HS CODE: 3917400060

Description: Plastic drainage fittings made of polyvinyl chloride (PVC).

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specifically for PVC-made drainage fittings, not PP.

✅ HS CODE: 3917400095

Description: Other plastic drainage fittings (including PP).

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is a catch-all for other types of plastic drainage fittings, including PP, that do not fall under the more specific codes.

⚠️ Important Notes and Recommendations:

- Material Verification: Confirm whether the product is made of PP (polypropylene) or PVC (polyvinyl chloride), as this determines the correct HS CODE.

- Tariff Changes: A special tariff of 30.0% will be applied after April 11, 2025. Ensure your import timeline aligns with this.

- Certifications: Check if any customs certifications or product compliance documents are required for the product (e.g., material safety, origin, etc.).

- Unit Price: Be aware that tariff calculations are based on the unit price of the product. Ensure accurate pricing for customs declarations.

📌 Proactive Advice:

- Double-check the material of the drainage fittings (PP vs. PVC) to ensure correct HS CODE classification.

- Review the product packaging and documentation to confirm whether it is a set or individual fittings, as this may affect classification.

- Consult a customs broker or trade compliance expert if the product is part of a larger kit or system.

Product Classification: PP Drainage Fittings

HS CODEs and Tax Information Summary (English)

✅ HS CODE: 3917400050

Description: Non-pressure drainage fittings made of polypropylene (PP) or PVC.

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to both PP and PVC drainage fittings, provided they are non-pressure fittings.

✅ HS CODE: 3917400060

Description: Plastic drainage fittings made of polyvinyl chloride (PVC).

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specifically for PVC-made drainage fittings, not PP.

✅ HS CODE: 3917400095

Description: Other plastic drainage fittings (including PP).

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is a catch-all for other types of plastic drainage fittings, including PP, that do not fall under the more specific codes.

⚠️ Important Notes and Recommendations:

- Material Verification: Confirm whether the product is made of PP (polypropylene) or PVC (polyvinyl chloride), as this determines the correct HS CODE.

- Tariff Changes: A special tariff of 30.0% will be applied after April 11, 2025. Ensure your import timeline aligns with this.

- Certifications: Check if any customs certifications or product compliance documents are required for the product (e.g., material safety, origin, etc.).

- Unit Price: Be aware that tariff calculations are based on the unit price of the product. Ensure accurate pricing for customs declarations.

📌 Proactive Advice:

- Double-check the material of the drainage fittings (PP vs. PVC) to ensure correct HS CODE classification.

- Review the product packaging and documentation to confirm whether it is a set or individual fittings, as this may affect classification.

- Consult a customs broker or trade compliance expert if the product is part of a larger kit or system.

Customer Reviews

No reviews yet.