| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

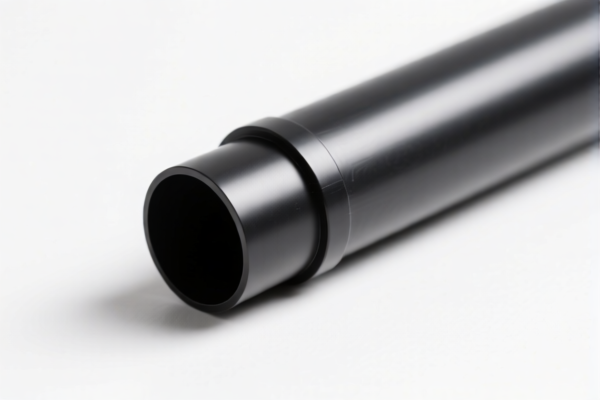

Product Classification: PP Rigid Tube (Polypropylene Rigid Tube)

HS CODE: 3917220000 (for polypropylene rigid tubes)

HS CODE: 3917210000 (for polyethylene rigid tubes)

🔍 Classification Overview

- Product Type: Rigid plastic tubes made from polypropylene (PP) or polyethylene (PE), used in industrial or general applications.

- HS Code:

- 3917220000 – Polypropylene rigid tubes

- 3917210000 – Polyethylene rigid tubes

- Tariff Summary:

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes

- Base Tariff: 3.1% (applies to all imports)

- Additional Tariff: 25.0% (standard additional duty)

- April 11 Special Tariff (2025): 30.0% (applies to imports after April 11, 2025)

- No Anti-dumping duties reported for this product category (as of current data)

⏱️ Time-Sensitive Policy Alert

⚠️ Additional Tariff Increase After April 11, 2025

If your product is imported after April 11, 2025, the additional tariff will increase to 30.0%, raising the total tax rate to 58.1%.

This is a critical date for customs clearance planning and cost estimation.

📦 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polypropylene (PP) or polyethylene (PE) and not a blend or composite.

- Check Unit Price and Quantity: Accurate declaration of unit price and quantity is essential for customs valuation and duty calculation.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for import into the destination country.

- Consult Customs Broker: For complex classifications or large shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📊 Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3917220000 | Polypropylene rigid tube | 3.1% | 25.0% | 30.0% | 58.1% |

| 3917210000 | Polyethylene rigid tube | 3.1% | 25.0% | 30.0% | 58.1% |

If you have more details about the product (e.g., thickness, application, or origin), I can provide a more tailored analysis.

Product Classification: PP Rigid Tube (Polypropylene Rigid Tube)

HS CODE: 3917220000 (for polypropylene rigid tubes)

HS CODE: 3917210000 (for polyethylene rigid tubes)

🔍 Classification Overview

- Product Type: Rigid plastic tubes made from polypropylene (PP) or polyethylene (PE), used in industrial or general applications.

- HS Code:

- 3917220000 – Polypropylene rigid tubes

- 3917210000 – Polyethylene rigid tubes

- Tariff Summary:

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes

- Base Tariff: 3.1% (applies to all imports)

- Additional Tariff: 25.0% (standard additional duty)

- April 11 Special Tariff (2025): 30.0% (applies to imports after April 11, 2025)

- No Anti-dumping duties reported for this product category (as of current data)

⏱️ Time-Sensitive Policy Alert

⚠️ Additional Tariff Increase After April 11, 2025

If your product is imported after April 11, 2025, the additional tariff will increase to 30.0%, raising the total tax rate to 58.1%.

This is a critical date for customs clearance planning and cost estimation.

📦 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polypropylene (PP) or polyethylene (PE) and not a blend or composite.

- Check Unit Price and Quantity: Accurate declaration of unit price and quantity is essential for customs valuation and duty calculation.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for import into the destination country.

- Consult Customs Broker: For complex classifications or large shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📊 Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3917220000 | Polypropylene rigid tube | 3.1% | 25.0% | 30.0% | 58.1% |

| 3917210000 | Polyethylene rigid tube | 3.1% | 25.0% | 30.0% | 58.1% |

If you have more details about the product (e.g., thickness, application, or origin), I can provide a more tailored analysis.

Customer Reviews

No reviews yet.