| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 4008111000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008210000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7326908645 | Doc | 82.9% | CN | US | 2025-05-12 |

| 8307106000 | Doc | 58.8% | CN | US | 2025-05-12 |

| 8307906000 | Doc | 58.8% | CN | US | 2025-05-12 |

| 5911900040 | Doc | 58.8% | CN | US | 2025-05-12 |

| 8708998180 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8714998000 | Doc | 47.5% | CN | US | 2025-05-12 |

| 4418999195 | Doc | 58.2% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes you've provided for "PROTECTIVE STRIP" and discuss the implications for customs clearance. I'll structure this to be as clear and helpful as possible.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while additional digits can vary by country. Here's how to interpret them:

- Chapter (First 2 digits): Broad category of the product.

- Heading (First 4 digits): More specific classification within the chapter.

- Subheading (First 6 digits): Even more detailed classification.

- Additional Digits: Country-specific for tariff and statistical purposes.

Analysis of Your HS Codes

Here's a breakdown of each code, with explanations and potential considerations:

-

3926.90.99.89 – Other articles of plastics…

- 39: Plastics and articles thereof.

- 3926: Other articles of plastics and articles of other materials.

- 3926.90: Other.

- 3926.90.99: Other.

- 3926.90.99.89: Other.

- Tax: 5.3% Basic Tariff + 7.5% Additional Tariff (increasing to 30% after April 2, 2025) = 42.8% Total.

- Considerations: This code is very broad. Please confirm the exact plastic composition of the strip. Different types of plastic may fall under more specific codes.

-

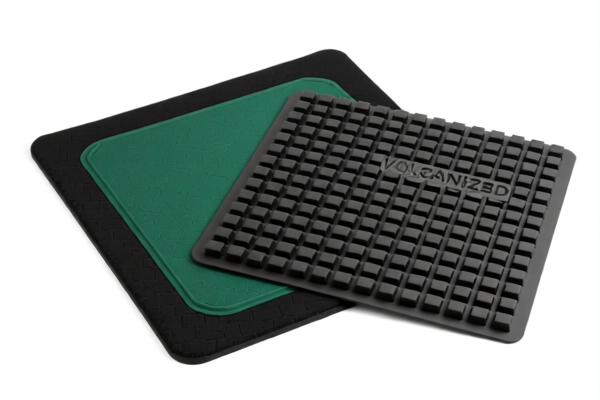

4008.11.10.00 – Plates, sheets, strip, rods… of vulcanized rubber (natural rubber)

- 40: Rubber and articles thereof.

- 4008: Plates, sheets, strip, rods and profile shapes, of vulcanized rubber other than hard rubber.

- 4008.11: Of cellular rubber.

- 4008.11.10: Plates, sheets and strip.

- 4008.11.10.00: Of natural rubber.

- Tax: 0.0% Basic Tariff + 25.0% Additional Tariff (increasing to 30% after April 2, 2025) = 55.0% Total.

- Considerations: Confirm if the rubber is indeed natural rubber. Synthetic rubber would have a different code.

-

4008.21.00.00 – Plates, sheets, strip, rods… of vulcanized rubber (non-cellular rubber)

- 40: Rubber and articles thereof.

- 4008: Plates, sheets, strip, rods and profile shapes, of vulcanized rubber other than hard rubber.

- 4008.21: Of noncellular rubber.

- 4008.21.00: Plates, sheets and strip.

- 4008.21.00.00: Other.

- Tax: 0.0% Basic Tariff + 25.0% Additional Tariff (increasing to 30% after April 2, 2025) = 55.0% Total.

- Considerations: Confirm if the rubber is non-cellular.

-

7326.90.86.45 – Other articles of iron or steel (barbed tape)

- 73: Iron or steel articles.

- 7326: Other articles of iron or steel.

- 7326.90: Other.

- 7326.90.86: Other.

- 7326.90.86.45: Barbed tape.

- Tax: 2.9% Basic Tariff + 25.0% Additional Tariff (increasing to 30% after April 2, 2025) = 82.9% Total.

- Considerations: Confirm the material is indeed iron or steel.

-

8307.10.60.00 – Flexible tubing of base metal (iron or steel)

- 83: Base metal articles.

- 8307: Flexible tubing of base metal.

- 8307.10: Of iron or steel.

- 8307.10.60: Other.

- 8307.10.60.00: Other.

- Tax: 3.8% Basic Tariff + 25.0% Additional Tariff (increasing to 30% after April 2, 2025) = 58.8% Total.

-

8307.90.60.00 – Flexible tubing of base metal (other base metal)

- 83: Base metal articles.

- 8307: Flexible tubing of base metal.

- 8307.90: Of other base metal.

- 8307.90.60: Other.

- 8307.90.60.00: Other.

- Tax: 3.8% Basic Tariff + 25.0% Additional Tariff (increasing to 30% after April 2, 2025) = 58.8% Total.

-

5911.90.00.40 – Textile products (cords, braids, packing/lubricating material)

- 59: Textile fabrics.

- 5911: Textile products for technical uses.

- 5911.90: Other.

- 5911.90.00: Other.

- 5911.90.00.40: Other.

- Tax: 3.8% Basic Tariff + 25.0% Additional Tariff (increasing to 30% after April 2, 2025) = 58.8% Total.

-

8708.99.81.80 – Parts/accessories of motor vehicles (other)

- 87: Vehicles.

- 8708: Parts and accessories of motor vehicles.

- 8708.99: Other parts and accessories.

- 8708.99.81: Other.

- 8708.99.81.80: Other.

- Tax: 2.5% Basic Tariff + 25.0% Additional Tariff (increasing to 30% after April 2, 2025) = 57.5% Total.

-

8714.99.80.00 – Parts/accessories of vehicles (other)

- 87: Vehicles.

- 8714: Parts and accessories of vehicles.

- 8714.99: Other.

- 8714.99.80: Other.

- 8714.99.80.00: Other.

- Tax: 10.0% Basic Tariff + 7.5% Additional Tariff (increasing to 30% after April 2, 2025) = 47.5% Total.

-

4418.99.91.95 – Builders' joinery/carpentry (wood)

- 44: Wood.

- 4418: Builders' joinery and carpentry.

- 4418.99: Other.

- 4418.99.91: Other.

- 4418.99.91.95: Other.

- Tax: 3.2% Basic Tariff + 25.0% Additional Tariff (increasing to 30% after April 2, 2025) = 58.2% Total.

Recommendations & Next Steps

- Material Confirmation: Crucially, confirm the exact material composition of the "PROTECTIVE STRIP." This will determine the correct HS code.

- Detailed Specification: Provide a detailed specification sheet of the strip, including dimensions, weight, and intended use.

- Intended Use: Clarify the specific application of the strip. This can help narrow down the classification.

- Country of Origin: Double-check the country of origin, as this impacts tariff rates and potential trade agreements.

- April 2, 2025: Be aware of the tariff changes coming into effect on April 2, 2025.

- Consider a Binding Ruling: For complex cases, consider applying for a binding tariff ruling from the customs authorities. This provides legal certainty on the correct classification.

Disclaimer: I am an AI assistant and cannot provide definitive customs advice. This information is for general guidance only. You should consult with a qualified customs broker or consultant for specific advice tailored to your situation.

Customer Reviews

The page provided a good overview of HS codes for protective strips, but I would have liked more guidance on how to confirm the material composition of the product.

I found the analysis of HS code 8307106000 very useful. It helped me understand the 58.8% tariff and the classification of flexible tubing.

The detailed explanation of the 55.0% tariff for 4008111000 was clear, but I wish there were more examples of natural rubber products.

The HS code breakdown for 3926909989 was incredibly helpful. I now understand the 42.8% tariff rate and what it applies to.