Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

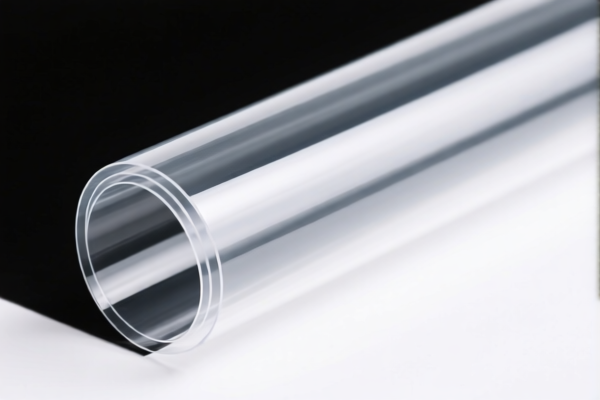

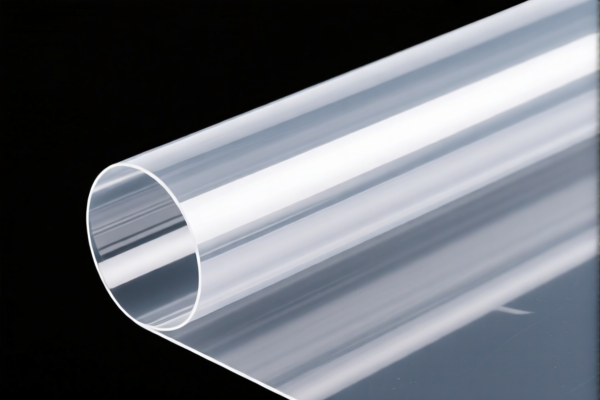

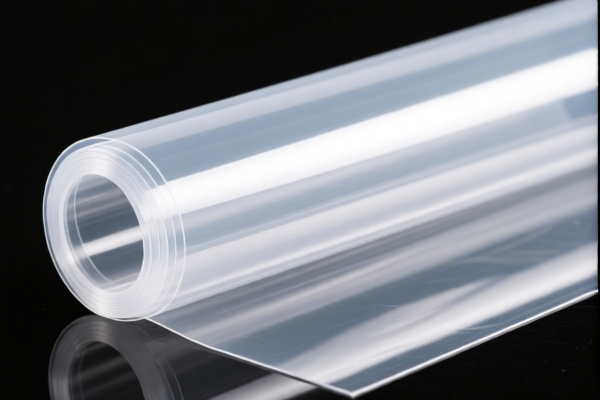

Product Name: PVB涂布薄膜

HS CODE: 3920910000

✅ Classification Summary:

- PVB涂布薄膜属于塑料板、片、薄膜类制品,通常与其他材料组合(如涂层、层压等),符合HS CODE 3920910000 的归类要求。

- 该编码适用于聚(乙烯基丁缩醛)(PVB)材料制成的薄膜,无论其是否用于装饰、粘合或复合材料。

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Note: The additional tariff of 30.0% applies after April 11, 2025, and may be subject to change based on trade policies or agreements.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed made of PVB (polyvinyl butyral) and not a different polymer or composite.

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for customs clearance.

- Product Description: Ensure the product description on the invoice and packing list clearly states it is a PVB-coated or laminated film to avoid misclassification.

- Anti-dumping Duties: Not applicable for this product category (no specific anti-dumping duties on PVB films as of now).

🛑 Proactive Advice:

- Verify Material Composition: Confirm the exact chemical composition of the PVB film to ensure it falls under the correct HS code.

- Check for Special Tariff Dates: Be aware that the 30.0% additional tariff applies after April 11, 2025 — plan accordingly for cost estimation.

- Consult Customs Broker: For large shipments or complex product configurations, consult a customs broker or trade compliance expert to ensure full compliance.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: PVB涂布薄膜

HS CODE: 3920910000

✅ Classification Summary:

- PVB涂布薄膜属于塑料板、片、薄膜类制品,通常与其他材料组合(如涂层、层压等),符合HS CODE 3920910000 的归类要求。

- 该编码适用于聚(乙烯基丁缩醛)(PVB)材料制成的薄膜,无论其是否用于装饰、粘合或复合材料。

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Note: The additional tariff of 30.0% applies after April 11, 2025, and may be subject to change based on trade policies or agreements.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed made of PVB (polyvinyl butyral) and not a different polymer or composite.

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for customs clearance.

- Product Description: Ensure the product description on the invoice and packing list clearly states it is a PVB-coated or laminated film to avoid misclassification.

- Anti-dumping Duties: Not applicable for this product category (no specific anti-dumping duties on PVB films as of now).

🛑 Proactive Advice:

- Verify Material Composition: Confirm the exact chemical composition of the PVB film to ensure it falls under the correct HS code.

- Check for Special Tariff Dates: Be aware that the 30.0% additional tariff applies after April 11, 2025 — plan accordingly for cost estimation.

- Consult Customs Broker: For large shipments or complex product configurations, consult a customs broker or trade compliance expert to ensure full compliance.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.