| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

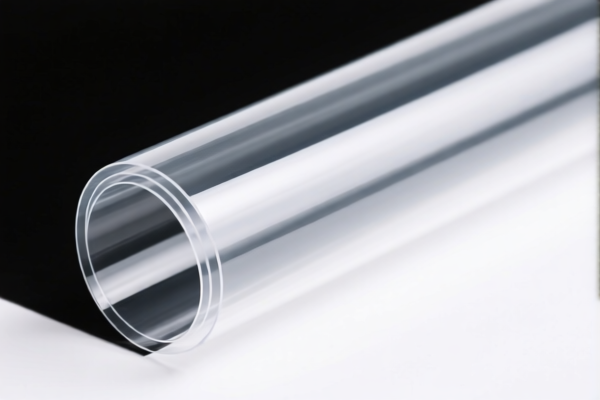

Product Name: PVB阻隔膜

HS CODE: 3920910000

✅ Product Classification Summary:

- PVB阻隔膜属于塑料板、片、薄膜类制品,符合HS编码 3920910000 的描述。

- 该编码特指由 聚(乙烯醇丁缩醛)(PVB)制成的塑料板、片、薄膜、箔和条。

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

No Anti-Dumping Duties on Iron or Aluminum:

This product is not classified under iron or aluminum, so anti-dumping duties related to those materials do not apply.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PVB (polyvinyl butyral) and not a composite or blended material, which may affect classification.

- Check Unit Price and Packaging: Tariff calculations may depend on the unit price and packaging method (e.g., bulk vs. retail).

- Certifications Required: Confirm if any customs or industry certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Monitor Policy Updates: Stay informed about tariff changes after April 11, 2025, as this could impact your import costs significantly.

📚 Example:

If you import 1,000 units of PVB阻隔膜 with a total value of $100,000, the total customs duty would be:

- Base + General Tariff: $100,000 × (4.2% + 25.0%) = $29,200

- After April 11, 2025: $100,000 × (4.2% + 30.0%) = $34,200

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

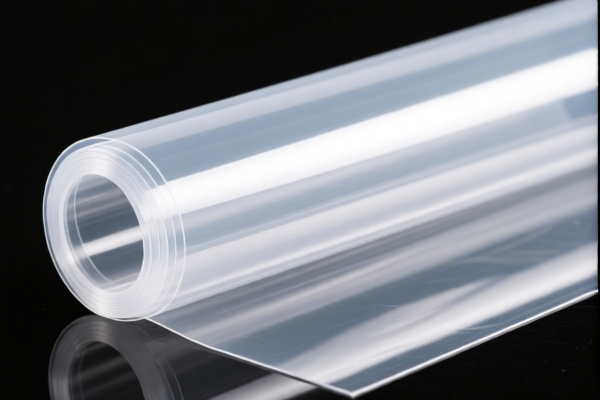

Product Name: PVB阻隔膜

HS CODE: 3920910000

✅ Product Classification Summary:

- PVB阻隔膜属于塑料板、片、薄膜类制品,符合HS编码 3920910000 的描述。

- 该编码特指由 聚(乙烯醇丁缩醛)(PVB)制成的塑料板、片、薄膜、箔和条。

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

No Anti-Dumping Duties on Iron or Aluminum:

This product is not classified under iron or aluminum, so anti-dumping duties related to those materials do not apply.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PVB (polyvinyl butyral) and not a composite or blended material, which may affect classification.

- Check Unit Price and Packaging: Tariff calculations may depend on the unit price and packaging method (e.g., bulk vs. retail).

- Certifications Required: Confirm if any customs or industry certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Monitor Policy Updates: Stay informed about tariff changes after April 11, 2025, as this could impact your import costs significantly.

📚 Example:

If you import 1,000 units of PVB阻隔膜 with a total value of $100,000, the total customs duty would be:

- Base + General Tariff: $100,000 × (4.2% + 25.0%) = $29,200

- After April 11, 2025: $100,000 × (4.2% + 30.0%) = $34,200

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

Customer Reviews

No reviews yet.