| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5907003500 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4811516000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811906090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810296000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4823906700 | Doc | 55.0% | CN | US | 2025-05-12 |

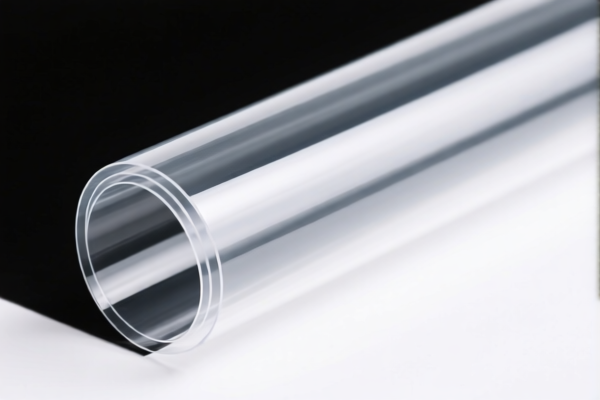

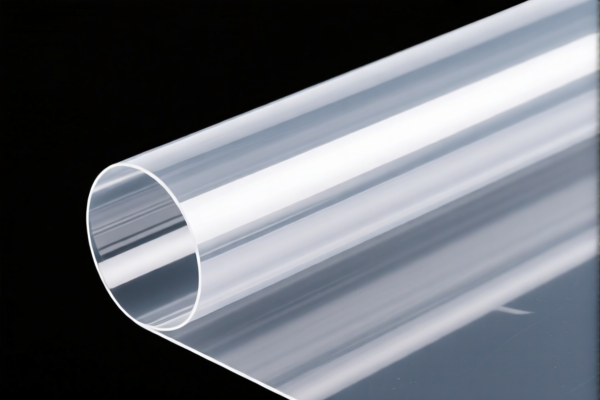

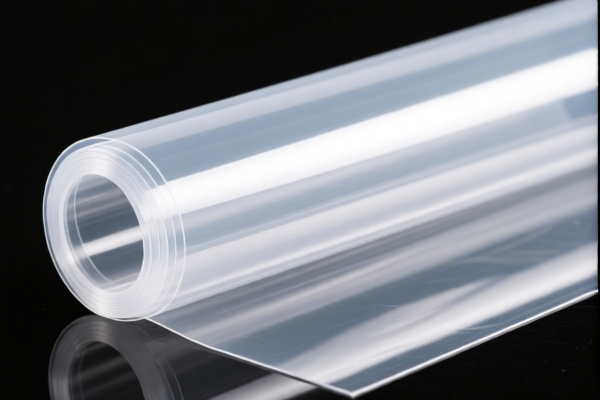

Product Name: PVB Coated Film

Classification: Coated or laminated materials (specifically PVB-coated film)

Here is the detailed HS code classification and tariff information for your product:

✅ HS CODE: 5907003500

Description: Other impregnated, coated, or covered textile fabrics

Total Tax Rate: 63.0%

Breakdown of Tariffs:

- Base Tariff: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this category is textile-related, not metal-based)

⚠️ Important Notes:

- April 11 Special Tariff: Applies to all imports after April 11, 2025. This is a significant increase in duty, so it's crucial to plan your import schedule accordingly.

- Material Verification: Ensure that the product is indeed a textile fabric and not a paper or paperboard product, as misclassification could lead to higher tariffs or customs delays.

- Certifications Required: Confirm if any specific certifications (e.g., textile origin, environmental compliance) are needed for import.

📌 Alternative HS Codes (for reference):

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 4811516000 | Coated paper or paperboard (over 150g/m²) | 55.0% | Applicable if the product is paper-based |

| 4811906090 | Coated, printed, or decorated paper | 55.0% | Applicable if the product is paper-based |

| 4810296000 | Paper coated with china clay or other inorganic substances | 55.0% | Applicable if the product is paper-based |

| 4823906700 | Other coated paper or paperboard products | 55.0% | Applicable if the product is paper-based |

🛑 Proactive Advice:

- Confirm Material Type: If your product is PVB-coated film and is not paper-based, then HS CODE 5907003500 is the correct classification.

- Check Unit Price: The total tax rate is 63.0%, which is significantly higher than the paper-based alternatives. This may affect your cost structure.

- Consult Customs Broker: For accurate classification and to avoid penalties, it's recommended to consult a customs broker or a classification expert.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: PVB Coated Film

Classification: Coated or laminated materials (specifically PVB-coated film)

Here is the detailed HS code classification and tariff information for your product:

✅ HS CODE: 5907003500

Description: Other impregnated, coated, or covered textile fabrics

Total Tax Rate: 63.0%

Breakdown of Tariffs:

- Base Tariff: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this category is textile-related, not metal-based)

⚠️ Important Notes:

- April 11 Special Tariff: Applies to all imports after April 11, 2025. This is a significant increase in duty, so it's crucial to plan your import schedule accordingly.

- Material Verification: Ensure that the product is indeed a textile fabric and not a paper or paperboard product, as misclassification could lead to higher tariffs or customs delays.

- Certifications Required: Confirm if any specific certifications (e.g., textile origin, environmental compliance) are needed for import.

📌 Alternative HS Codes (for reference):

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 4811516000 | Coated paper or paperboard (over 150g/m²) | 55.0% | Applicable if the product is paper-based |

| 4811906090 | Coated, printed, or decorated paper | 55.0% | Applicable if the product is paper-based |

| 4810296000 | Paper coated with china clay or other inorganic substances | 55.0% | Applicable if the product is paper-based |

| 4823906700 | Other coated paper or paperboard products | 55.0% | Applicable if the product is paper-based |

🛑 Proactive Advice:

- Confirm Material Type: If your product is PVB-coated film and is not paper-based, then HS CODE 5907003500 is the correct classification.

- Check Unit Price: The total tax rate is 63.0%, which is significantly higher than the paper-based alternatives. This may affect your cost structure.

- Consult Customs Broker: For accurate classification and to avoid penalties, it's recommended to consult a customs broker or a classification expert.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.