| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920910000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 7007211190 | Doc | 59.9% | CN | US | 2025-05-12 |

| 7007110090 | Doc | 60.5% | CN | US | 2025-05-12 |

| 7007215100 | Doc | 59.9% | CN | US | 2025-05-12 |

| 7007215100 | Doc | 59.9% | CN | US | 2025-05-12 |

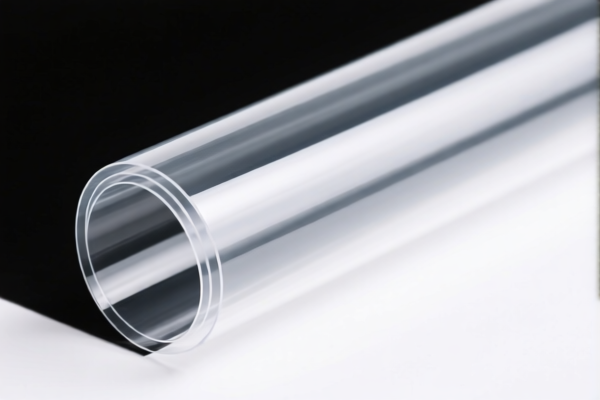

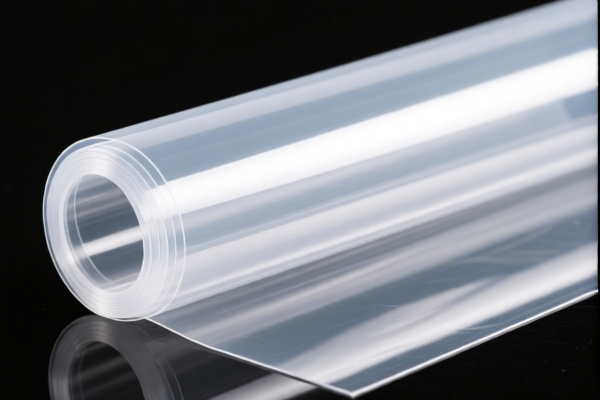

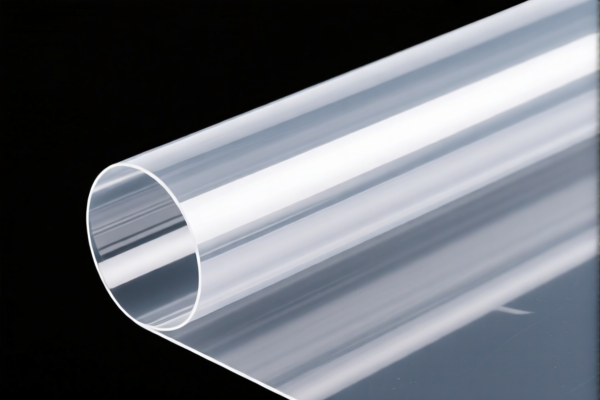

Product Classification: PVB Film for Laminated Glass

Customs Compliance Analysis and Tax Overview

✅ HS CODE: 3920910000

Product Description:

PVB (Polyvinyl Butyral) film used for laminated glass, classified under non-cellular plastics and non-reinforced plastics, used in combination with other materials (e.g., glass).

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

Not applicable for this HS code (3920910000), as it is a plastic film and not an iron or aluminum product.

📌 Proactive Advice:

- Verify Material Composition: Ensure the PVB film is not mixed with other materials that might change its classification.

- Check Unit Price and Certification: Confirm whether any specific certifications (e.g., safety, environmental) are required for import.

- Monitor Tariff Updates: Keep track of any changes in customs policies, especially after April 11, 2025.

📊 Comparison with Other HS Codes (for Reference):

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax |

|---|---|---|---|---|---|

| 3920910000 | PVB Film | 4.2% | 25.0% | 30.0% | 59.2% |

| 7007211190 | Windshields | 4.9% | 25.0% | 30.0% | 59.9% |

| 7007110090 | Tempered Glass | 5.5% | 25.0% | 30.0% | 60.5% |

| 7007215100 | Laminated Glass | 4.9% | 25.0% | 30.0% | 59.9% |

📢 Final Reminder:

If your product is PVB film used in laminated glass, HS CODE 3920910000 is the correct classification. However, always confirm with customs or a qualified customs broker to ensure compliance with the latest regulations and avoid delays in customs clearance.

Product Classification: PVB Film for Laminated Glass

Customs Compliance Analysis and Tax Overview

✅ HS CODE: 3920910000

Product Description:

PVB (Polyvinyl Butyral) film used for laminated glass, classified under non-cellular plastics and non-reinforced plastics, used in combination with other materials (e.g., glass).

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

Not applicable for this HS code (3920910000), as it is a plastic film and not an iron or aluminum product.

📌 Proactive Advice:

- Verify Material Composition: Ensure the PVB film is not mixed with other materials that might change its classification.

- Check Unit Price and Certification: Confirm whether any specific certifications (e.g., safety, environmental) are required for import.

- Monitor Tariff Updates: Keep track of any changes in customs policies, especially after April 11, 2025.

📊 Comparison with Other HS Codes (for Reference):

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax |

|---|---|---|---|---|---|

| 3920910000 | PVB Film | 4.2% | 25.0% | 30.0% | 59.2% |

| 7007211190 | Windshields | 4.9% | 25.0% | 30.0% | 59.9% |

| 7007110090 | Tempered Glass | 5.5% | 25.0% | 30.0% | 60.5% |

| 7007215100 | Laminated Glass | 4.9% | 25.0% | 30.0% | 59.9% |

📢 Final Reminder:

If your product is PVB film used in laminated glass, HS CODE 3920910000 is the correct classification. However, always confirm with customs or a qualified customs broker to ensure compliance with the latest regulations and avoid delays in customs clearance.

Customer Reviews

No reviews yet.