| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

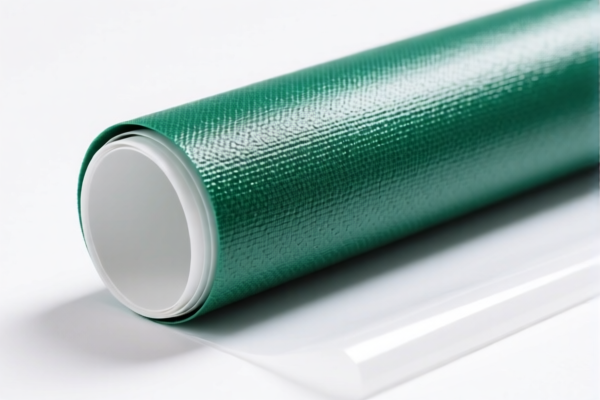

Product Name: PVC加厚纺织品包装膜

Classification HS CODEs and Tax Details:

- HS CODE: 3921121910

- Description: PVC加厚纺织品包装膜,符合HSCODE 3921121910的归类描述。

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code also applies to "PVC加厚纺织品礼品包装布" (PVC thick textile gift wrapping fabric).

-

HS CODE: 3921121950

- Description: PVC加厚纺织品包装膜,符合HSCODE 3921121950的归类描述。

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921901500

- Description: 纺织加固塑料包装膜,符合HSCODE 3921901500的归类描述。

-

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3904400000

- Description: PVC包装膜,符合HSCODE 3904400000的归类描述。

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- Starting April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes. This is a significant increase from the current 25.0% additional tariff.

-

Impact: This will increase the total tax burden by 5.0% for all products under these codes.

-

Material and Certification Check:

- Confirm the material composition (e.g., PVC thickness, textile reinforcement, etc.) to ensure correct HS code classification.

-

Verify if certifications (e.g., RoHS, REACH, or other import compliance documents) are required for the product.

-

Unit Price and Tax Calculation:

- Be aware that the total tax rate is calculated based on the CIF (Cost, Insurance, Freight) value of the product.

-

Ensure accurate unit price and quantity are used for customs declaration to avoid penalties or delays.

-

Anti-Dumping Duty Note:

- No specific anti-dumping duties are mentioned for this product category in the provided data. However, always check the latest anti-dumping duty list for PVC products, especially if importing from countries under such measures.

✅ Proactive Advice:

- Double-check the product description to ensure it matches the HS code description (e.g., "textile-reinforced" vs. "standard PVC film").

- Consult a customs broker or import compliance expert if the product is used for specific purposes (e.g., gift wrapping, industrial packaging) that may affect classification.

-

Monitor policy updates after April 11, 2025, as the special tariff may be extended or modified. Product Name: PVC加厚纺织品包装膜

Classification HS CODEs and Tax Details: -

HS CODE: 3921121910

- Description: PVC加厚纺织品包装膜,符合HSCODE 3921121910的归类描述。

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code also applies to "PVC加厚纺织品礼品包装布" (PVC thick textile gift wrapping fabric).

-

HS CODE: 3921121950

- Description: PVC加厚纺织品包装膜,符合HSCODE 3921121950的归类描述。

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921901500

- Description: 纺织加固塑料包装膜,符合HSCODE 3921901500的归类描述。

-

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3904400000

- Description: PVC包装膜,符合HSCODE 3904400000的归类描述。

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- Starting April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes. This is a significant increase from the current 25.0% additional tariff.

-

Impact: This will increase the total tax burden by 5.0% for all products under these codes.

-

Material and Certification Check:

- Confirm the material composition (e.g., PVC thickness, textile reinforcement, etc.) to ensure correct HS code classification.

-

Verify if certifications (e.g., RoHS, REACH, or other import compliance documents) are required for the product.

-

Unit Price and Tax Calculation:

- Be aware that the total tax rate is calculated based on the CIF (Cost, Insurance, Freight) value of the product.

-

Ensure accurate unit price and quantity are used for customs declaration to avoid penalties or delays.

-

Anti-Dumping Duty Note:

- No specific anti-dumping duties are mentioned for this product category in the provided data. However, always check the latest anti-dumping duty list for PVC products, especially if importing from countries under such measures.

✅ Proactive Advice:

- Double-check the product description to ensure it matches the HS code description (e.g., "textile-reinforced" vs. "standard PVC film").

- Consult a customs broker or import compliance expert if the product is used for specific purposes (e.g., gift wrapping, industrial packaging) that may affect classification.

- Monitor policy updates after April 11, 2025, as the special tariff may be extended or modified.

Customer Reviews

No reviews yet.