| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5601220050 | Doc | 61.3% | CN | US | 2025-05-12 |

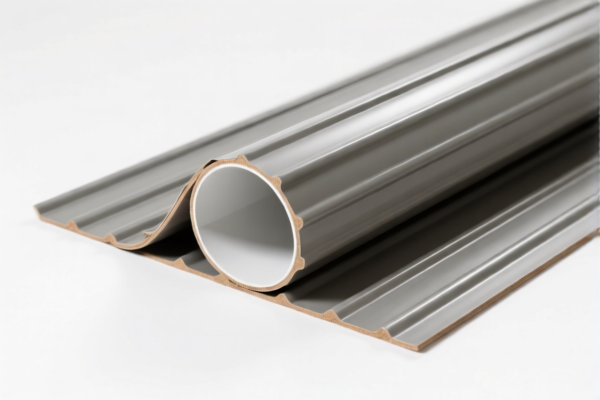

Product Classification and Tariff Analysis for "PVC加厚纺织品家具擦拭布" (Thick PVC Textile Furniture Wiping Cloth)

✅ HS CODE: 3921121910

-

Product Description:

This HS code applies to PVC-based thick textile wiping cloths that are composed of polyvinyl chloride (PVC) combined with textile materials, where vegetable fibers (e.g., cotton, flax) constitute the majority by weight and outweigh any other single textile fiber. -

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered when planning import timelines. -

Anti-dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin and product composition. -

Material Verification:

Ensure that the PVC content and textile fiber composition meet the HS code criteria (i.e., vegetable fibers are the dominant component by weight). Misclassification could lead to customs penalties or delayed clearance. -

Certifications Required:

Confirm if any import certifications (e.g., product safety, environmental compliance) are required for the product in the destination market.

📌 Alternative HS Code: 5601220050 (Non-woven thick wiping cloth)

-

Product Description:

This code applies to non-woven thick wiping cloths made from fiber products, cotton, waste cotton, yarn, or textile materials. -

Tariff Breakdown:

- Base Tariff Rate: 6.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.3%

-

Note:

This code is not applicable to PVC-based products. It is only suitable for non-woven textile products without PVC content.

✅ Proactive Advice:

-

Verify Material Composition:

Confirm the PVC content and dominant fiber type (e.g., cotton, flax) to ensure correct classification under HS 3921121910. -

Check Unit Price and Tax Impact:

The total tax rate of 60.3% is significant. Consider tax planning and import cost estimation accordingly. -

Consult Customs Authority:

If in doubt, seek confirmation from customs authorities or a certified customs broker to avoid misclassification and potential penalties. -

Stay Updated on Tariff Changes:

Monitor any new trade policies or tariff adjustments, especially after April 11, 2025, which may affect import costs.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools. Product Classification and Tariff Analysis for "PVC加厚纺织品家具擦拭布" (Thick PVC Textile Furniture Wiping Cloth)

✅ HS CODE: 3921121910

-

Product Description:

This HS code applies to PVC-based thick textile wiping cloths that are composed of polyvinyl chloride (PVC) combined with textile materials, where vegetable fibers (e.g., cotton, flax) constitute the majority by weight and outweigh any other single textile fiber. -

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered when planning import timelines. -

Anti-dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin and product composition. -

Material Verification:

Ensure that the PVC content and textile fiber composition meet the HS code criteria (i.e., vegetable fibers are the dominant component by weight). Misclassification could lead to customs penalties or delayed clearance. -

Certifications Required:

Confirm if any import certifications (e.g., product safety, environmental compliance) are required for the product in the destination market.

📌 Alternative HS Code: 5601220050 (Non-woven thick wiping cloth)

-

Product Description:

This code applies to non-woven thick wiping cloths made from fiber products, cotton, waste cotton, yarn, or textile materials. -

Tariff Breakdown:

- Base Tariff Rate: 6.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.3%

-

Note:

This code is not applicable to PVC-based products. It is only suitable for non-woven textile products without PVC content.

✅ Proactive Advice:

-

Verify Material Composition:

Confirm the PVC content and dominant fiber type (e.g., cotton, flax) to ensure correct classification under HS 3921121910. -

Check Unit Price and Tax Impact:

The total tax rate of 60.3% is significant. Consider tax planning and import cost estimation accordingly. -

Consult Customs Authority:

If in doubt, seek confirmation from customs authorities or a certified customs broker to avoid misclassification and potential penalties. -

Stay Updated on Tariff Changes:

Monitor any new trade policies or tariff adjustments, especially after April 11, 2025, which may affect import costs.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

Customer Reviews

No reviews yet.