| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

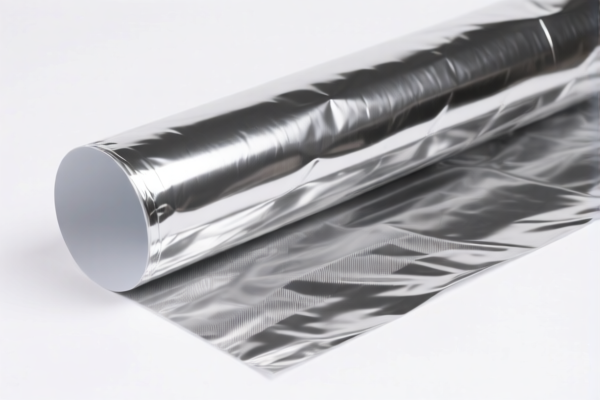

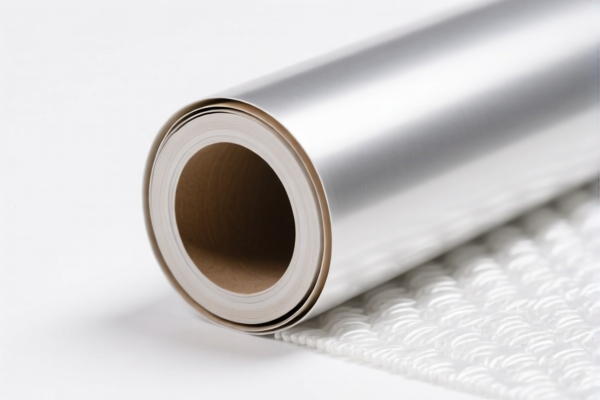

Product Name: PVC加厚纺织品抗紫外线布

HS CODE: 3921121910 (and 5903102010 as an alternative)

✅ HS CODE Classification Summary:

- HS CODE 3921121910

- Description: This code applies to PVC-based thick textile UV-resistant fabric that combines plastic (PVC) with textile materials, where vegetable fibers (e.g., cotton) dominate by weight over any other single textile fiber.

-

Key Features:

- PVC as the base material

- Combined with textile materials

- Vegetable fibers are the dominant component by weight

- Used for UV protection, sun protection, corrosion resistance, etc.

-

HS CODE 5903102010

- Description: This code applies to textile products coated with plastic, specifically PVC-coated UV-resistant fabric.

- Key Features:

- Textile base with PVC coating

- Clearly identified as "PVC-coated" in the product name

- May be used for similar applications (e.g., UV protection, sunshades)

📊 Tariff Overview (as of now):

For HS CODE 3921121910:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

For HS CODE 5903102010:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025, which significantly increases the total tax burden. - For 3921121910: 60.3% total tax

-

For 5903102010: 55.0% total tax

-

Anti-dumping duties:

Not applicable for this product category (no specific anti-dumping duties on PVC-coated or PVC-based textile products are currently in effect).

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure that the product is PVC-based and combined with textile materials, and that vegetable fibers are the dominant component by weight (for HS CODE 3921121910). -

Check Product Description:

If the product is clearly labeled as "PVC-coated", HS CODE 5903102010 may be more appropriate and could result in a lower total tax rate. -

Confirm Unit Price and Certification:

Some customs authorities may require certifications (e.g., material composition reports, UV protection ratings) to confirm the product classification. -

Plan for Tariff Increases:

If importing after April 11, 2025, be prepared for a 30.0% additional tariff. Consider tariff planning or alternative sourcing if cost-sensitive.

📌 Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|---|

| 3921121910 | PVC + Textile (vegetable fiber dominant) | 5.3% | 25.0% | 30.0% | 60.3% |

| 5903102010 | PVC-coated textile | 0.0% | 25.0% | 30.0% | 55.0% |

If you need further assistance with certification requirements or customs documentation, feel free to ask.

Product Name: PVC加厚纺织品抗紫外线布

HS CODE: 3921121910 (and 5903102010 as an alternative)

✅ HS CODE Classification Summary:

- HS CODE 3921121910

- Description: This code applies to PVC-based thick textile UV-resistant fabric that combines plastic (PVC) with textile materials, where vegetable fibers (e.g., cotton) dominate by weight over any other single textile fiber.

-

Key Features:

- PVC as the base material

- Combined with textile materials

- Vegetable fibers are the dominant component by weight

- Used for UV protection, sun protection, corrosion resistance, etc.

-

HS CODE 5903102010

- Description: This code applies to textile products coated with plastic, specifically PVC-coated UV-resistant fabric.

- Key Features:

- Textile base with PVC coating

- Clearly identified as "PVC-coated" in the product name

- May be used for similar applications (e.g., UV protection, sunshades)

📊 Tariff Overview (as of now):

For HS CODE 3921121910:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

For HS CODE 5903102010:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025, which significantly increases the total tax burden. - For 3921121910: 60.3% total tax

-

For 5903102010: 55.0% total tax

-

Anti-dumping duties:

Not applicable for this product category (no specific anti-dumping duties on PVC-coated or PVC-based textile products are currently in effect).

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure that the product is PVC-based and combined with textile materials, and that vegetable fibers are the dominant component by weight (for HS CODE 3921121910). -

Check Product Description:

If the product is clearly labeled as "PVC-coated", HS CODE 5903102010 may be more appropriate and could result in a lower total tax rate. -

Confirm Unit Price and Certification:

Some customs authorities may require certifications (e.g., material composition reports, UV protection ratings) to confirm the product classification. -

Plan for Tariff Increases:

If importing after April 11, 2025, be prepared for a 30.0% additional tariff. Consider tariff planning or alternative sourcing if cost-sensitive.

📌 Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|---|

| 3921121910 | PVC + Textile (vegetable fiber dominant) | 5.3% | 25.0% | 30.0% | 60.3% |

| 5903102010 | PVC-coated textile | 0.0% | 25.0% | 30.0% | 55.0% |

If you need further assistance with certification requirements or customs documentation, feel free to ask.

Customer Reviews

No reviews yet.