| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

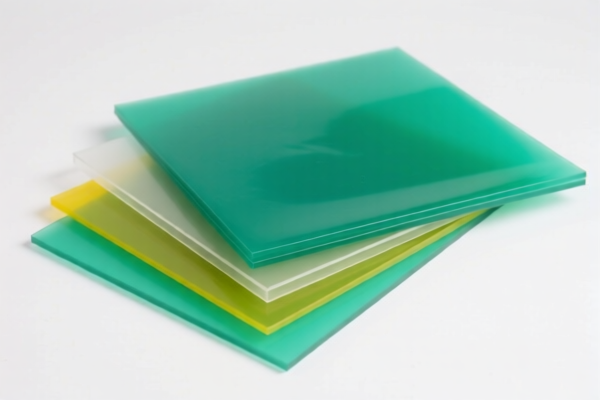

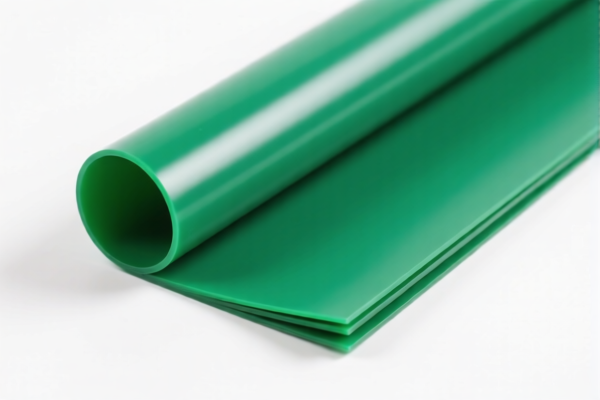

Product Name: PVC发泡卷材

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921125000

Description: PVC发泡卷材符合HSCODE 3921的归类描述,属于塑料板、片、薄膜、箔和条的范畴。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3916200020

Description: PVC发泡型材符合HS编码3916.20.00.91的归类描述,属于棒材、棍棒和型材的范畴。

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3921190090

Description: PVC气泡防护卷材符合HSCODE 3921.19.00.90的归类描述,属于板、片、薄膜、箔和条的范畴。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

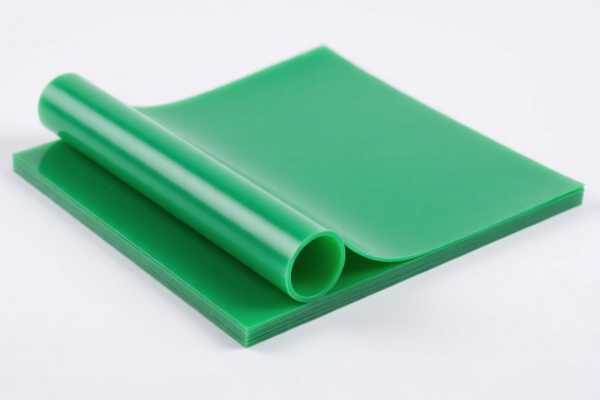

✅ HS CODE: 3904220000

Description: PVC发泡板符合HS编码3904的解释,属于其他聚氯乙烯制品。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3904400000

Description: PVC发泡板符合HS编码3904的描述,属于聚氯乙烯制品的一种。

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after this date. Ensure your customs declaration includes the correct HS code and product description to avoid penalties.

- Anti-dumping duties: Not applicable for PVC products unless specifically listed.

- Certifications: Verify if your product requires any specific certifications (e.g., RoHS, REACH) for import compliance.

- Material and Unit Price: Confirm the exact material composition and unit price, as these can affect classification and tax calculation.

📌 Proactive Advice:

- Double-check the HS code based on the product's exact specifications (e.g., thickness, use, and whether it's foam or solid).

- Keep updated records of product composition and certifications for customs compliance.

- If exporting to China, consider pre-clearance with customs or a customs broker to avoid delays.

Product Name: PVC发泡卷材

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921125000

Description: PVC发泡卷材符合HSCODE 3921的归类描述,属于塑料板、片、薄膜、箔和条的范畴。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3916200020

Description: PVC发泡型材符合HS编码3916.20.00.91的归类描述,属于棒材、棍棒和型材的范畴。

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3921190090

Description: PVC气泡防护卷材符合HSCODE 3921.19.00.90的归类描述,属于板、片、薄膜、箔和条的范畴。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3904220000

Description: PVC发泡板符合HS编码3904的解释,属于其他聚氯乙烯制品。

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3904400000

Description: PVC发泡板符合HS编码3904的描述,属于聚氯乙烯制品的一种。

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after this date. Ensure your customs declaration includes the correct HS code and product description to avoid penalties.

- Anti-dumping duties: Not applicable for PVC products unless specifically listed.

- Certifications: Verify if your product requires any specific certifications (e.g., RoHS, REACH) for import compliance.

- Material and Unit Price: Confirm the exact material composition and unit price, as these can affect classification and tax calculation.

📌 Proactive Advice:

- Double-check the HS code based on the product's exact specifications (e.g., thickness, use, and whether it's foam or solid).

- Keep updated records of product composition and certifications for customs compliance.

- If exporting to China, consider pre-clearance with customs or a customs broker to avoid delays.

Customer Reviews

No reviews yet.