| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

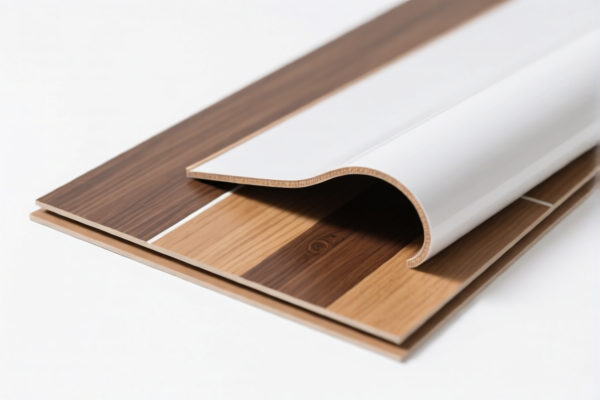

Product Classification: PVC Floor Profile Materials

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3916200020

- Description: PVC floor profile materials fall under the category of plastics and their products, matching the description of HS code 3916.20.00.91.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most relevant code for PVC floor profiles.

-

HS CODE: 3920435000

- Description: PVC profiles are categorized under sheets, films, foils, and strips, often containing plasticizers for flexibility.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff, but still subject to the same additional tariffs.

-

HS CODE: 3904400000

- Description: PVC profiles are classified under polyvinyl chloride (PVC) products, aligning with HS code 3904.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly higher base tariff than 3920435000.

-

HS CODE: 3904220000

- Description: PVC profiles are classified under polyvinyl chloride or other halogenated ethylene polymers in primary form.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Highest base tariff among the options, but still subject to the same additional tariffs.

-

HS CODE: 3921125000

- Description: PVC profiles are categorized under plastic sheets, films, foils, and strips.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same tax structure as 3904220000.

✅ Proactive Advice:

- Verify Material Composition: Confirm whether the product is in primary form (e.g., raw PVC) or processed (e.g., with additives like plasticizers).

- Check Unit Price and Certification: Ensure compliance with any required certifications (e.g., fire resistance, environmental standards) depending on the end-use.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant and should be factored into cost calculations.

- Consult Customs Authority: For precise classification, especially if the product has mixed materials or special features.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: PVC Floor Profile Materials

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3916200020

- Description: PVC floor profile materials fall under the category of plastics and their products, matching the description of HS code 3916.20.00.91.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most relevant code for PVC floor profiles.

-

HS CODE: 3920435000

- Description: PVC profiles are categorized under sheets, films, foils, and strips, often containing plasticizers for flexibility.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff, but still subject to the same additional tariffs.

-

HS CODE: 3904400000

- Description: PVC profiles are classified under polyvinyl chloride (PVC) products, aligning with HS code 3904.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly higher base tariff than 3920435000.

-

HS CODE: 3904220000

- Description: PVC profiles are classified under polyvinyl chloride or other halogenated ethylene polymers in primary form.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Highest base tariff among the options, but still subject to the same additional tariffs.

-

HS CODE: 3921125000

- Description: PVC profiles are categorized under plastic sheets, films, foils, and strips.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same tax structure as 3904220000.

✅ Proactive Advice:

- Verify Material Composition: Confirm whether the product is in primary form (e.g., raw PVC) or processed (e.g., with additives like plasticizers).

- Check Unit Price and Certification: Ensure compliance with any required certifications (e.g., fire resistance, environmental standards) depending on the end-use.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant and should be factored into cost calculations.

- Consult Customs Authority: For precise classification, especially if the product has mixed materials or special features.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.