| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the structured and professional analysis of the HS codes and tariff rates for PVC flooring boards:

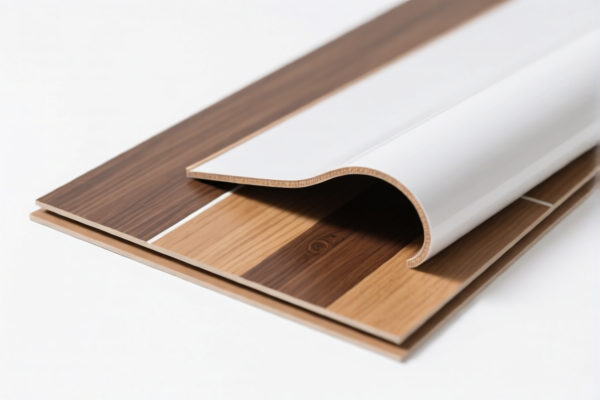

✅ HS CODE: 3921125000

Product Description: PVC flooring boards, classified under "Other plastic sheets, plates, films, foils and strips", specifically those made of polyvinyl chloride (PVC).

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

✅ HS CODE: 3918101030

Product Description: PVC flooring, classified under "Floor coverings made of polyvinyl chloride polymer", which includes PVC flooring as a floor covering.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

✅ HS CODE: 3904220000

Product Description: PVC flooring, classified under "Other polyvinyl chloride (PVC): plasticized", which typically refers to PVC products that have been plasticized (softened with plasticizers), a common process for flooring.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

✅ HS CODE: 3918102000

Product Description: PVC flooring sheets, classified under "Plastic floor coverings in the form of rolls or tiles", which includes PVC flooring sheets.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

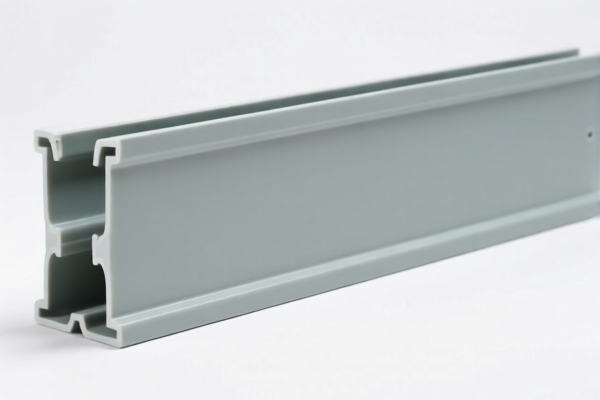

✅ HS CODE: 3918101020

Product Description: PVC vinyl tiles, classified under "Vinyl tiles made of rigid solid polymer core", which is a specific category for rigid PVC tiles used as floor coverings.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

📌 Key Notes and Recommendations:

-

Tariff Increase Alert: A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is aligned with this policy change.

-

Material Verification: Confirm the exact composition of the product (e.g., whether it is plasticized, rigid, or flexible) to ensure correct HS code classification.

-

Certifications Required: Depending on the destination country, certifications such as CE, ISO, or fire resistance standards may be required. Verify local import regulations.

-

Unit Price and Packaging: Be aware of customs valuation rules—the unit price and packaging may affect the total duty payable.

-

Anti-Dumping Duties: While not explicitly mentioned here, anti-dumping duties may apply if the product is subject to such measures. Check with customs or a trade compliance expert if applicable.

If you need further assistance with HS code selection or customs documentation, feel free to ask. Here is the structured and professional analysis of the HS codes and tariff rates for PVC flooring boards:

✅ HS CODE: 3921125000

Product Description: PVC flooring boards, classified under "Other plastic sheets, plates, films, foils and strips", specifically those made of polyvinyl chloride (PVC).

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

✅ HS CODE: 3918101030

Product Description: PVC flooring, classified under "Floor coverings made of polyvinyl chloride polymer", which includes PVC flooring as a floor covering.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

✅ HS CODE: 3904220000

Product Description: PVC flooring, classified under "Other polyvinyl chloride (PVC): plasticized", which typically refers to PVC products that have been plasticized (softened with plasticizers), a common process for flooring.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

✅ HS CODE: 3918102000

Product Description: PVC flooring sheets, classified under "Plastic floor coverings in the form of rolls or tiles", which includes PVC flooring sheets.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

✅ HS CODE: 3918101020

Product Description: PVC vinyl tiles, classified under "Vinyl tiles made of rigid solid polymer core", which is a specific category for rigid PVC tiles used as floor coverings.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.3%

📌 Key Notes and Recommendations:

-

Tariff Increase Alert: A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is aligned with this policy change.

-

Material Verification: Confirm the exact composition of the product (e.g., whether it is plasticized, rigid, or flexible) to ensure correct HS code classification.

-

Certifications Required: Depending on the destination country, certifications such as CE, ISO, or fire resistance standards may be required. Verify local import regulations.

-

Unit Price and Packaging: Be aware of customs valuation rules—the unit price and packaging may affect the total duty payable.

-

Anti-Dumping Duties: While not explicitly mentioned here, anti-dumping duties may apply if the product is subject to such measures. Check with customs or a trade compliance expert if applicable.

If you need further assistance with HS code selection or customs documentation, feel free to ask.

Customer Reviews

No reviews yet.