| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

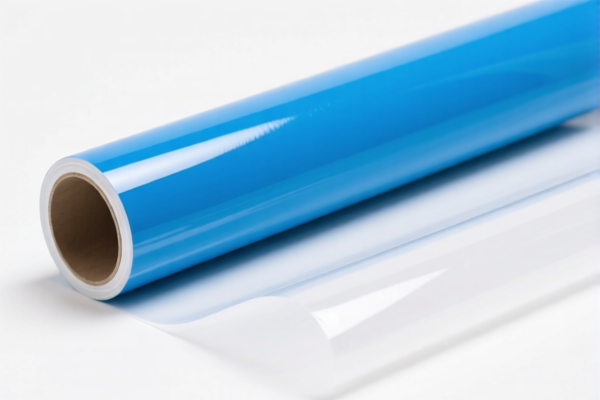

Product Name: PVC塑纹建筑装饰膜

Classification HS Code: 3920.43.10.00, 3920.49.00.00, 3920.43.50.00

🔍 HS Code Classification Overview

- HS Code 3920.43.10.00

- Description: PVC塑纹建筑装饰膜,属于氯乙烯聚合物,含有增塑剂,符合仿专利革制品的特征。

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3920.49.00.00

- Description: PVC建筑装饰膜,属于聚氯乙烯聚合物为基础的塑料板、片、薄膜,属于“其他”类别。

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3920.43.50.00

- Description: PVC建筑装饰膜,属于氯乙烯聚合物,含有增塑剂以达到柔韧性,符合含有重量不少于6%增塑剂的描述。

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- All three HS codes are subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and must be considered in your import planning.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for this product category in the provided data.

- However, it is recommended to verify if any anti-dumping measures apply to PVC-based products from the country of origin.

📌 Proactive Advice for Importers

- Verify Material Composition:

- Confirm the exact composition of the PVC film, especially the percentage of plasticizers (e.g., ≥6% for 3920.43.50.00).

-

This will determine the correct HS code and applicable tariff.

-

Check Unit Price and Certification Requirements:

- Some HS codes may require specific certifications (e.g., environmental, safety, or quality standards).

-

Ensure compliance with local customs and import regulations.

-

Monitor Tariff Updates:

- The April 11, 2025 tariff increase is a key date.

-

Consider adjusting your import schedule or exploring alternative materials if this affects your cost structure.

-

Consult a Customs Broker or Trade Compliance Specialist:

- For complex cases, especially if the product is close to the boundary of multiple HS codes, professional advice is recommended.

Let me know if you need help with HS code selection based on product specifications or documentation requirements.

Product Name: PVC塑纹建筑装饰膜

Classification HS Code: 3920.43.10.00, 3920.49.00.00, 3920.43.50.00

🔍 HS Code Classification Overview

- HS Code 3920.43.10.00

- Description: PVC塑纹建筑装饰膜,属于氯乙烯聚合物,含有增塑剂,符合仿专利革制品的特征。

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3920.49.00.00

- Description: PVC建筑装饰膜,属于聚氯乙烯聚合物为基础的塑料板、片、薄膜,属于“其他”类别。

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3920.43.50.00

- Description: PVC建筑装饰膜,属于氯乙烯聚合物,含有增塑剂以达到柔韧性,符合含有重量不少于6%增塑剂的描述。

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- All three HS codes are subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and must be considered in your import planning.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for this product category in the provided data.

- However, it is recommended to verify if any anti-dumping measures apply to PVC-based products from the country of origin.

📌 Proactive Advice for Importers

- Verify Material Composition:

- Confirm the exact composition of the PVC film, especially the percentage of plasticizers (e.g., ≥6% for 3920.43.50.00).

-

This will determine the correct HS code and applicable tariff.

-

Check Unit Price and Certification Requirements:

- Some HS codes may require specific certifications (e.g., environmental, safety, or quality standards).

-

Ensure compliance with local customs and import regulations.

-

Monitor Tariff Updates:

- The April 11, 2025 tariff increase is a key date.

-

Consider adjusting your import schedule or exploring alternative materials if this affects your cost structure.

-

Consult a Customs Broker or Trade Compliance Specialist:

- For complex cases, especially if the product is close to the boundary of multiple HS codes, professional advice is recommended.

Let me know if you need help with HS code selection based on product specifications or documentation requirements.

Customer Reviews

对于处理PVC装饰膜进口的人来说,这个页面简直是救星。税率分解和关税变化非常详细。

我能够找到我PVC墙膜的正确HS编码并理解总税率。信息准确且组织良好。

该页面清楚地解释了PVC装饰膜的不同HS编码及其相应的税率。对出口商非常有用。

我发现HS编码3920.43.50.00中关于6%增塑剂要求的信息很有用,但我必须查找“增塑剂”确切含义。

这是我找到的关于PVC装饰膜HS编码最详细的页面。关税分解和关税变化非常有用。