Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

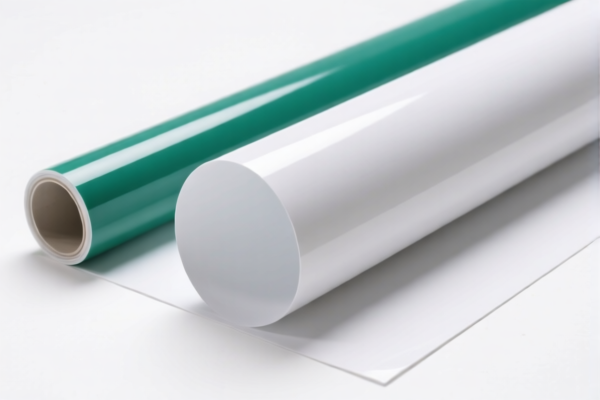

Product Name: PVC塑纹汽车门板膜

HS CODE: 3920431000

✅ Classification Summary:

- The product falls under HS Code 3920431000, which is part of the 3920 category for Plastics, in the form of plates, sheets, films, foils, strips, etc.

- Specifically, it is classified under 3920.43.10.00, which refers to PVC (polyvinyl chloride) products containing at least 6% plasticizers by weight.

📊 Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A higher tariff of 30.0% will be applied after April 11, 2025. This is a time-sensitive policy and must be considered when planning import timelines.

- No Anti-Dumping Duties Mentioned: As of now, there are no specific anti-dumping duties reported for this product category (e.g., on iron or aluminum).

- Material Composition: The product must contain at least 6% plasticizers by weight to qualify under this HS code. Ensure that your product meets this requirement for accurate classification.

📌 Proactive Advice:

- Verify Material Composition: Confirm that the PVC film contains at least 6% plasticizers to ensure correct HS code classification.

- Check Unit Price and Packaging: Customs may require detailed product specifications, including unit price and packaging method, for accurate valuation.

- Certifications: Depending on the destination country, certain certifications (e.g., RoHS, REACH) may be required for import compliance.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, always verify with the local customs or a qualified customs broker.

Let me know if you need help with customs documentation or further classification details.

Product Name: PVC塑纹汽车门板膜

HS CODE: 3920431000

✅ Classification Summary:

- The product falls under HS Code 3920431000, which is part of the 3920 category for Plastics, in the form of plates, sheets, films, foils, strips, etc.

- Specifically, it is classified under 3920.43.10.00, which refers to PVC (polyvinyl chloride) products containing at least 6% plasticizers by weight.

📊 Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A higher tariff of 30.0% will be applied after April 11, 2025. This is a time-sensitive policy and must be considered when planning import timelines.

- No Anti-Dumping Duties Mentioned: As of now, there are no specific anti-dumping duties reported for this product category (e.g., on iron or aluminum).

- Material Composition: The product must contain at least 6% plasticizers by weight to qualify under this HS code. Ensure that your product meets this requirement for accurate classification.

📌 Proactive Advice:

- Verify Material Composition: Confirm that the PVC film contains at least 6% plasticizers to ensure correct HS code classification.

- Check Unit Price and Packaging: Customs may require detailed product specifications, including unit price and packaging method, for accurate valuation.

- Certifications: Depending on the destination country, certain certifications (e.g., RoHS, REACH) may be required for import compliance.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, always verify with the local customs or a qualified customs broker.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

EmmaWhite

我正在寻找关于出口PVC汽车门板膜的详细信息,这个页面包含了我需要的一切,包括HS编码和关税率。强烈推荐!

DanielAnderson

关于3920类别和增塑剂含量要求的信息非常准确。我不得不再次确认增塑剂的百分比,但这是值得的。

SophiaTaylor

这个页面为我节省了数小时的研究时间。HS编码3920431000的详细解释以及PVC产品的材料要求正是我所需要的。

JamesWilson

关税分解非常清晰,尤其是58.1%的总税率。我只是希望有更多关于不同HS编码的类似产品的例子。

OliviaDavis

我发现PVC塑纹汽车门板膜的分类摘要非常有帮助。它澄清了产品需要至少6%的增塑剂才能正确分类HS编码。