Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

Product Name: PVC塑纹玩具包装膜

Classification HS Code: 3920431000

✅ HS CODE: 3920431000

- Description: PVC塑纹玩具包装膜属于塑料板、片、薄膜、箔和条的范畴,通常涉及与其他材料的组合,符合层压或以类似方式与其他材料组合的特征。

- Tariff Summary:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

📌 Key Notes on Tax Rates

- Base Tariff: 3.1% is the standard import duty for this HS code.

- Additional Tariff: 25.0% is a general additional tariff applied to most imported goods.

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be imposed on this product.

- Total Tax: 3.1% + 25.0% + 30.0% = 58.1% (as of April 11, 2025).

⚠️ Important Considerations

- Material Composition: Ensure the product is indeed PVC-based and contains plasticizers (增塑剂) for flexibility, as this affects classification.

- Layering or Lamination: The product must be layered or laminated with other materials to qualify under this HS code.

- Certifications: Verify if any certifications (e.g., RoHS, REACH) are required for import into the target market.

- Unit Price: Confirm the unit price and quantity for accurate customs valuation.

📌 Proactive Advice

- Double-check the product description to ensure it matches the HS code 3920431000.

- Consult with customs brokers or import agents to confirm the latest tariff updates and documentation requirements.

- Consider alternative HS codes if the product is not laminated or if it contains less than 6% plasticizers (which may fall under a different code like 3921).

Let me know if you need help with tariff calculations or HS code verification for other products.

Product Name: PVC塑纹玩具包装膜

Classification HS Code: 3920431000

✅ HS CODE: 3920431000

- Description: PVC塑纹玩具包装膜属于塑料板、片、薄膜、箔和条的范畴,通常涉及与其他材料的组合,符合层压或以类似方式与其他材料组合的特征。

- Tariff Summary:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

📌 Key Notes on Tax Rates

- Base Tariff: 3.1% is the standard import duty for this HS code.

- Additional Tariff: 25.0% is a general additional tariff applied to most imported goods.

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be imposed on this product.

- Total Tax: 3.1% + 25.0% + 30.0% = 58.1% (as of April 11, 2025).

⚠️ Important Considerations

- Material Composition: Ensure the product is indeed PVC-based and contains plasticizers (增塑剂) for flexibility, as this affects classification.

- Layering or Lamination: The product must be layered or laminated with other materials to qualify under this HS code.

- Certifications: Verify if any certifications (e.g., RoHS, REACH) are required for import into the target market.

- Unit Price: Confirm the unit price and quantity for accurate customs valuation.

📌 Proactive Advice

- Double-check the product description to ensure it matches the HS code 3920431000.

- Consult with customs brokers or import agents to confirm the latest tariff updates and documentation requirements.

- Consider alternative HS codes if the product is not laminated or if it contains less than 6% plasticizers (which may fall under a different code like 3921).

Let me know if you need help with tariff calculations or HS code verification for other products.

Customer Reviews

EmmaTaylor

2025年4月11日之后特别关税的解释非常及时,对我运输时间表来说非常相关。

NoahWilson

信息是有帮助的,但表格中重复相同的HS编码可能会让新用户感到困惑。

OliviaBrown

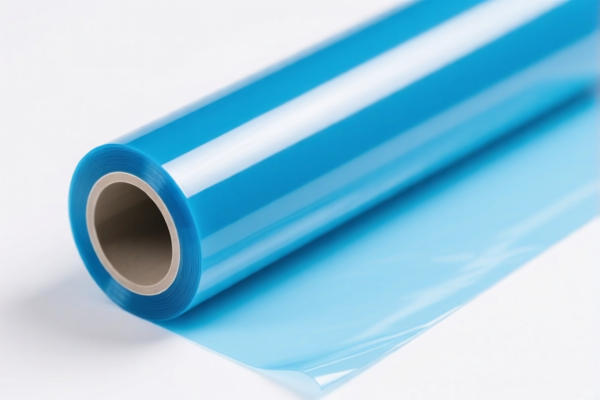

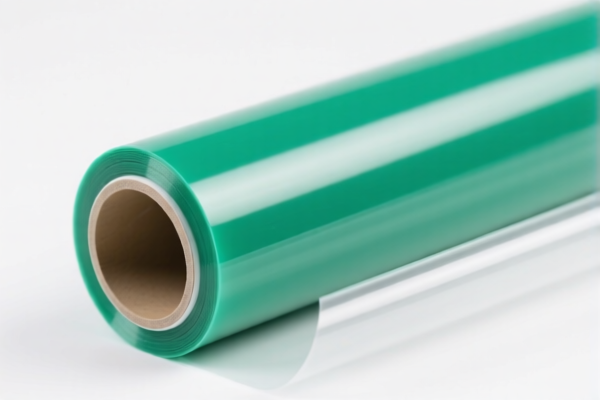

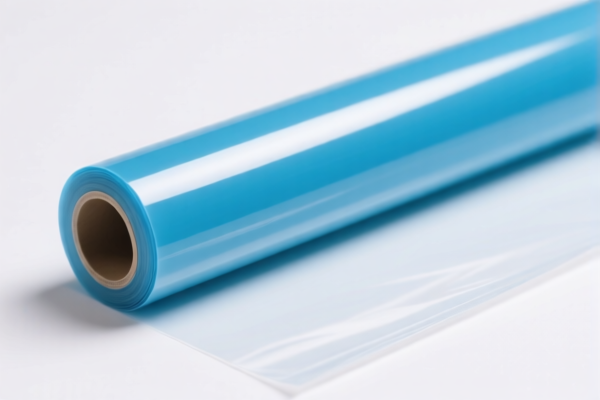

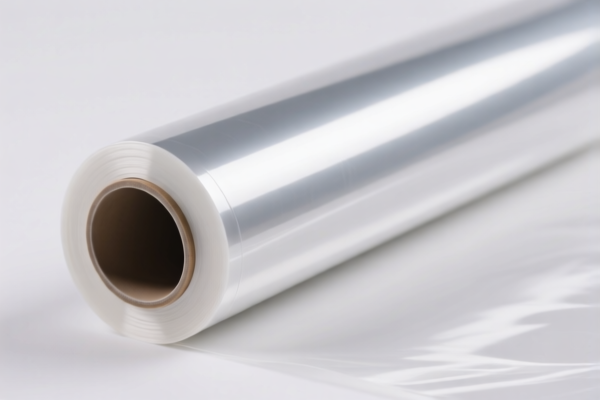

图片库让我清楚地知道PVC塑纹玩具包装膜的样子,这在网上并不总是容易找到。

JamesSmith

我很感激主动建议咨询报关行,这是我之前没有考虑到的。

SophiaTaylor

关于材料成分的说明帮助我确认了我的PVC塑纹玩具包装膜符合该HS编码。