| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3916200010 | Doc | 60.8% | CN | US | 2025-05-12 |

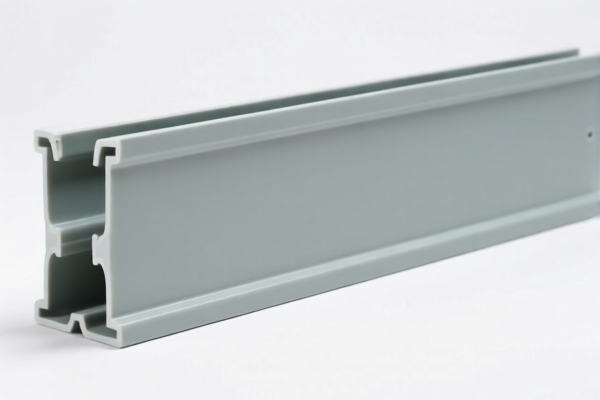

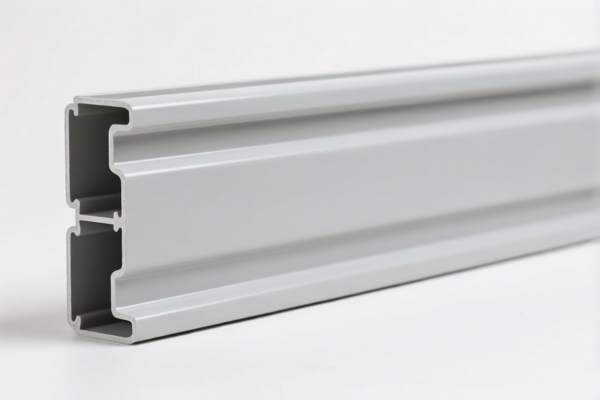

Product Name: PVC墙面装饰板 (PVC Wall Decorative Panels)

Classification: Plastic wall coverings, falling under Chapter 3918 (Plastic articles of a length ≥ 10 cm, not elsewhere specified).

Note: Depending on specific product features (e.g., thickness, use, material composition), it may also fall under Chapter 3916 (Plastic articles of a length < 10 cm, or for specific construction uses).

🔍 HS CODE Classification and Tax Details (as of now):

- HS CODE: 3918103210

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC wall panels with specific technical specifications.

-

HS CODE: 3918102000

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Common classification for standard PVC wall panels.

-

HS CODE: 3918104050

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: May apply to panels with specific surface treatments or designs.

-

HS CODE: 3918105000

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Likely for thinner or simpler PVC panels.

-

HS CODE: 3916200010

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: For PVC panels used in construction, such as exterior wall panels.

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-dumping duties:

Not applicable for PVC products unless specifically targeted by anti-dumping investigations (not indicated in this case). -

Material and Certification Requirements:

- Confirm the exact composition of the PVC panels (e.g., whether it contains additives, flame retardants, etc.).

- Check if certifications (e.g., fire resistance, environmental standards) are required for import or local use.

- Verify unit price and product specifications to ensure correct HS code classification.

✅ Proactive Advice:

- Double-check the HS code based on the product's thickness, use (interior/exterior), and design.

- Consult customs authorities or a customs broker for confirmation, especially if the product has special features.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Keep documentation (e.g., product specs, certificates) ready for customs inspection.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: PVC墙面装饰板 (PVC Wall Decorative Panels)

Classification: Plastic wall coverings, falling under Chapter 3918 (Plastic articles of a length ≥ 10 cm, not elsewhere specified).

Note: Depending on specific product features (e.g., thickness, use, material composition), it may also fall under Chapter 3916 (Plastic articles of a length < 10 cm, or for specific construction uses).

🔍 HS CODE Classification and Tax Details (as of now):

- HS CODE: 3918103210

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC wall panels with specific technical specifications.

-

HS CODE: 3918102000

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Common classification for standard PVC wall panels.

-

HS CODE: 3918104050

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: May apply to panels with specific surface treatments or designs.

-

HS CODE: 3918105000

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Likely for thinner or simpler PVC panels.

-

HS CODE: 3916200010

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: For PVC panels used in construction, such as exterior wall panels.

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-dumping duties:

Not applicable for PVC products unless specifically targeted by anti-dumping investigations (not indicated in this case). -

Material and Certification Requirements:

- Confirm the exact composition of the PVC panels (e.g., whether it contains additives, flame retardants, etc.).

- Check if certifications (e.g., fire resistance, environmental standards) are required for import or local use.

- Verify unit price and product specifications to ensure correct HS code classification.

✅ Proactive Advice:

- Double-check the HS code based on the product's thickness, use (interior/exterior), and design.

- Consult customs authorities or a customs broker for confirmation, especially if the product has special features.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Keep documentation (e.g., product specs, certificates) ready for customs inspection.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.