| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

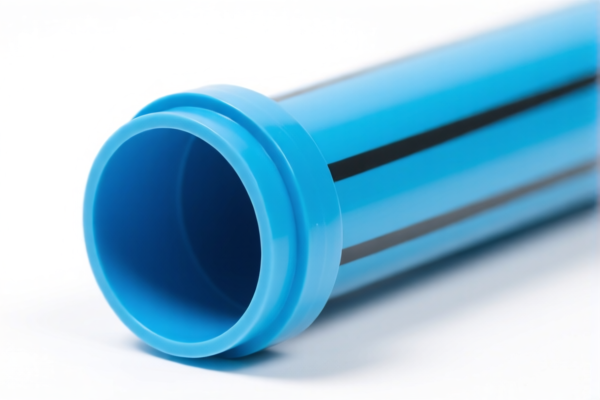

Product Name: PVC密封型材 (PVC Sealing Profiles)

Classification: Plastic rods, sticks, and profiles made of PVC, not specifically designated for window, door, terrace, or railing profiles, and not for exterior wall panels of buildings.

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for PVC密封型材:

🔢 HS CODE: 3916200020

Description: Plastic rods, sticks, and profiles (not specified for windows, doors, etc.), made of PVC.

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3920435000

Description: PVC profiles classified under sheets, films, foils, and strips, containing at least 6% plasticizers.

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3904400000

Description: PVC profiles classified under primary forms of polyvinyl chloride (PVC) or other halogenated ethylene polymers.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3904220000

Description: PVC profiles classified under primary forms of polyvinyl chloride (PVC) or other halogenated ethylene polymers.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3921125000

Description: PVC profiles classified under plastic sheets, films, foils, and strips.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the PVC profiles (e.g., presence of plasticizers, type of PVC, etc.) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that the total tax rate is based on the declared value, so accurate unit pricing is essential for customs compliance.

📌 Proactive Advice

- Double-check the product description to ensure it aligns with the HS code used.

- Consult a customs broker or a local customs authority for the most up-to-date and region-specific regulations.

- Keep records of product specifications, invoices, and certifications to support customs declarations.

Let me know if you need help with HS code selection or customs documentation!

Product Name: PVC密封型材 (PVC Sealing Profiles)

Classification: Plastic rods, sticks, and profiles made of PVC, not specifically designated for window, door, terrace, or railing profiles, and not for exterior wall panels of buildings.

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for PVC密封型材:

🔢 HS CODE: 3916200020

Description: Plastic rods, sticks, and profiles (not specified for windows, doors, etc.), made of PVC.

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3920435000

Description: PVC profiles classified under sheets, films, foils, and strips, containing at least 6% plasticizers.

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3904400000

Description: PVC profiles classified under primary forms of polyvinyl chloride (PVC) or other halogenated ethylene polymers.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3904220000

Description: PVC profiles classified under primary forms of polyvinyl chloride (PVC) or other halogenated ethylene polymers.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3921125000

Description: PVC profiles classified under plastic sheets, films, foils, and strips.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the PVC profiles (e.g., presence of plasticizers, type of PVC, etc.) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that the total tax rate is based on the declared value, so accurate unit pricing is essential for customs compliance.

📌 Proactive Advice

- Double-check the product description to ensure it aligns with the HS code used.

- Consult a customs broker or a local customs authority for the most up-to-date and region-specific regulations.

- Keep records of product specifications, invoices, and certifications to support customs declarations.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

No reviews yet.