| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

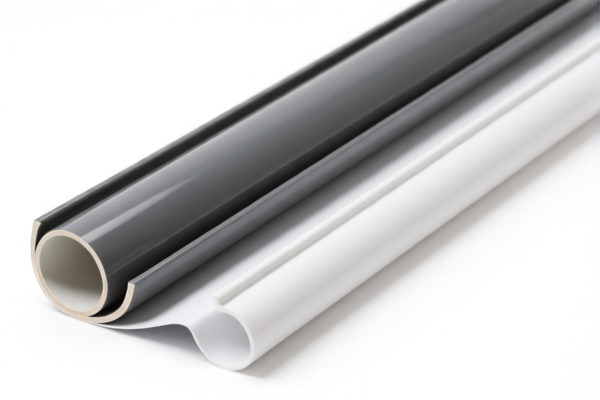

Product Name: PVC封边条材 (PVC Edge Banding Material)

Classification: Plastic products, specifically PVC-based edge banding materials.

✅ HS CODE Classification Overview

Below are the possible HS codes and corresponding tax details for PVC封边条材:

🔢 HS CODE: 3920490000

Description: Plastic sheets, plates, films, foils and strips, other.

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3904220000

Description: Other forms of polyvinyl chloride (PVC), including plasticized.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3904400000

Description: Other polyvinyl chloride copolymers.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3916200020

Description: Rods or profiles, not specified for particular uses.

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3921125000

Description: Other plastic sheets, plates, films, foils and strips.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

⚠️ Important Notes and Recommendations

- Tariff Increase Alert: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the PVC edge banding (e.g., whether it is plasticized, copolymer, or other forms) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that tariff calculations are based on the unit price of the product. Ensure accurate pricing for customs valuation.

📌 Proactive Advice

- Double-check the product's technical specifications (e.g., thickness, composition, and intended use) to ensure the most accurate HS code.

- Consult a customs broker or classification expert if the product is complex or if there is uncertainty in classification.

- Monitor policy updates related to anti-dumping duties or special tariffs, especially after April 11, 2025.

Let me know if you need help with HS code selection or customs documentation!

Product Name: PVC封边条材 (PVC Edge Banding Material)

Classification: Plastic products, specifically PVC-based edge banding materials.

✅ HS CODE Classification Overview

Below are the possible HS codes and corresponding tax details for PVC封边条材:

🔢 HS CODE: 3920490000

Description: Plastic sheets, plates, films, foils and strips, other.

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3904220000

Description: Other forms of polyvinyl chloride (PVC), including plasticized.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3904400000

Description: Other polyvinyl chloride copolymers.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3916200020

Description: Rods or profiles, not specified for particular uses.

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

🔢 HS CODE: 3921125000

Description: Other plastic sheets, plates, films, foils and strips.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

⚠️ Important Notes and Recommendations

- Tariff Increase Alert: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the PVC edge banding (e.g., whether it is plasticized, copolymer, or other forms) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that tariff calculations are based on the unit price of the product. Ensure accurate pricing for customs valuation.

📌 Proactive Advice

- Double-check the product's technical specifications (e.g., thickness, composition, and intended use) to ensure the most accurate HS code.

- Consult a customs broker or classification expert if the product is complex or if there is uncertainty in classification.

- Monitor policy updates related to anti-dumping duties or special tariffs, especially after April 11, 2025.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

HS编码3916200020及其对杆或型材的描述正是我所寻找的。对出口商来说是一个极好的资源。

这个页面信息非常丰富,但我发现有太多HS编码,有点令人不知所措。或许可以加一个筛选功能。

我需要确认产品的成分以获得正确的HS编码。关于材料验证的说明非常准确。

HS编码3904220000的61.5%关税分解很清楚。我只是希望有更多的类似产品的例子。

我正在寻找PVC边缘带的HS编码详细信息,这个页面正好给了我需要的内容。对每个分类的解释非常棒。