| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

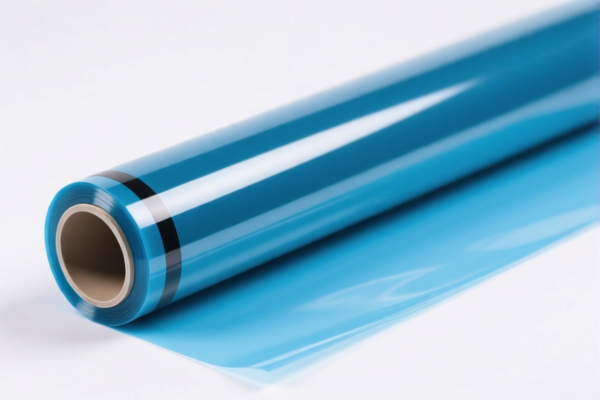

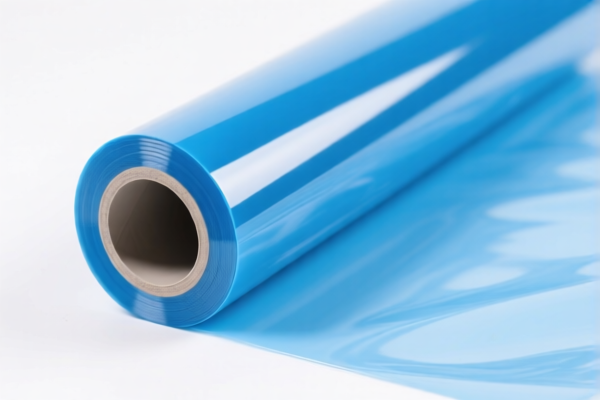

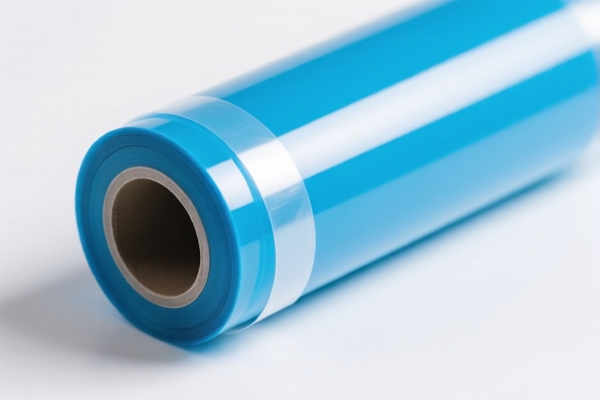

Product Name: PVC工业包装膜 (PVC Industrial Packaging Film)

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for PVC industrial packaging film. Please note that the classification depends on specific product attributes such as material composition, additives (e.g., plasticizers), and product form (e.g., whether it is laminated or combined with other materials).

🔍 HS Code: 3920.49.00.00

Description:

Other plastic sheets, plates, films, foils and strips, non-cellular and not reinforced, laminated, backed or otherwise combined with other materials: → Vinyl chloride polymers: → Other

Tariff Details: - Base Tariff Rate: 5.8% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.8%

Key Notes: - This code applies to PVC films that are not laminated or combined with other materials, or if they are, they fall under a different category. - If your product is laminated or combined with other materials, consider checking HS 3920.49.00.00 again or HS 3920.43.50.00 if it contains ≥6% plasticizers.

🔍 HS Code: 3920.43.50.00

Description:

PVC plastic sheets, plates, films, foils and strips containing not less than 6% plasticizers

Tariff Details: - Base Tariff Rate: 4.2% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 59.2%

Key Notes: - This code is specific to PVC films with ≥6% plasticizers. - If your product contains plasticizers, this may be the correct classification. - Verify the exact percentage of plasticizers in your product to ensure correct classification.

🔍 HS Code: 3904.40.00.00

Description:

Other polyvinyl chloride (PVC) copolymers

Tariff Details: - Base Tariff Rate: 5.3% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.3%

Key Notes: - This code applies to PVC copolymers, not finished products like films or sheets. - If your product is a finished film or sheet, this code is not applicable.

🔍 HS Code: 3904.22.00.00

Description:

Plasticized polyvinyl chloride (PVC)

Tariff Details: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This code applies to plasticized PVC, which is a raw material. - If your product is a finished film or sheet, this code is not applicable.

📌 Proactive Advice for Users:

- Verify the exact composition of your product (e.g., whether it contains plasticizers, and the percentage).

- Check if the product is laminated or combined with other materials, as this may change the HS code.

- Confirm the product form (e.g., film, sheet, etc.) to ensure correct classification.

- Review the April 11, 2025, special tariff and ensure your import plans are adjusted accordingly.

- Check if any certifications (e.g., RoHS, REACH) are required for customs clearance.

📅 Important Policy Reminder:

- Additional tariffs of 30.0% will be applied after April 11, 2025.

- Ensure your import documentation and classification are up to date to avoid unexpected delays or penalties.

Let me know if you need help with certification requirements or customs documentation for your specific product.

Product Name: PVC工业包装膜 (PVC Industrial Packaging Film)

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for PVC industrial packaging film. Please note that the classification depends on specific product attributes such as material composition, additives (e.g., plasticizers), and product form (e.g., whether it is laminated or combined with other materials).

🔍 HS Code: 3920.49.00.00

Description:

Other plastic sheets, plates, films, foils and strips, non-cellular and not reinforced, laminated, backed or otherwise combined with other materials: → Vinyl chloride polymers: → Other

Tariff Details: - Base Tariff Rate: 5.8% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.8%

Key Notes: - This code applies to PVC films that are not laminated or combined with other materials, or if they are, they fall under a different category. - If your product is laminated or combined with other materials, consider checking HS 3920.49.00.00 again or HS 3920.43.50.00 if it contains ≥6% plasticizers.

🔍 HS Code: 3920.43.50.00

Description:

PVC plastic sheets, plates, films, foils and strips containing not less than 6% plasticizers

Tariff Details: - Base Tariff Rate: 4.2% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 59.2%

Key Notes: - This code is specific to PVC films with ≥6% plasticizers. - If your product contains plasticizers, this may be the correct classification. - Verify the exact percentage of plasticizers in your product to ensure correct classification.

🔍 HS Code: 3904.40.00.00

Description:

Other polyvinyl chloride (PVC) copolymers

Tariff Details: - Base Tariff Rate: 5.3% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.3%

Key Notes: - This code applies to PVC copolymers, not finished products like films or sheets. - If your product is a finished film or sheet, this code is not applicable.

🔍 HS Code: 3904.22.00.00

Description:

Plasticized polyvinyl chloride (PVC)

Tariff Details: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This code applies to plasticized PVC, which is a raw material. - If your product is a finished film or sheet, this code is not applicable.

📌 Proactive Advice for Users:

- Verify the exact composition of your product (e.g., whether it contains plasticizers, and the percentage).

- Check if the product is laminated or combined with other materials, as this may change the HS code.

- Confirm the product form (e.g., film, sheet, etc.) to ensure correct classification.

- Review the April 11, 2025, special tariff and ensure your import plans are adjusted accordingly.

- Check if any certifications (e.g., RoHS, REACH) are required for customs clearance.

📅 Important Policy Reminder:

- Additional tariffs of 30.0% will be applied after April 11, 2025.

- Ensure your import documentation and classification are up to date to avoid unexpected delays or penalties.

Let me know if you need help with certification requirements or customs documentation for your specific product.

Customer Reviews

我对海关分类是新手,这个页面让事情变得容易多了。HS编码3920.43.50.00的分解以及关于增塑剂的备注正是我所需要的。

主动建议部分真是个宝藏。它让我在发货前考虑验证产品的成分。HS编码3904.40.00.00的解释非常清晰。

我正在寻找PVC工业包装膜的HS编码细节,这个页面正好有我需要的内容。关税分解和分类技巧非常有用。

对PVC薄膜不同HS编码的解释非常清晰。我希望有更多图片来帮助可视化产品,但信息本身是可靠的。

这个页面为我节省了数小时的研究时间。关于HS编码3920.49.00.00的细节以及关于层压材料的备注正是我出口计划所需要的。