| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916200010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariffs for PVC building materials, based on your input:

📦 Product Classification Overview: PVC Building Materials

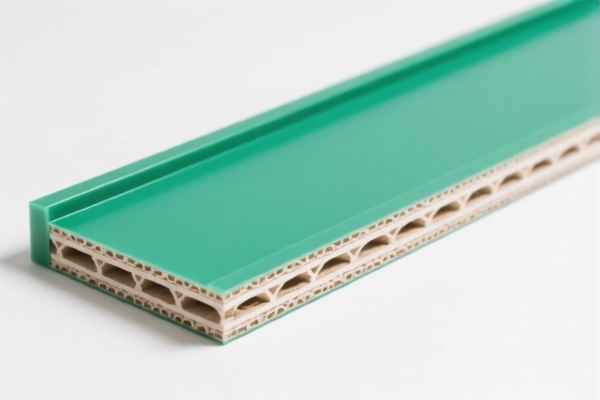

🔢 HS Code: 3921125000

Product Description: PVC Building Panels (General Plastic Sheets)

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general PVC building panels, not specifically for wall cladding.

🔢 HS Code: 3916200010

Product Description: PVC Building Wall Cladding Panels (Made of Polyvinyl Chloride)

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for exterior wall panels made of PVC.

🔢 HS Code: 3917390020

Product Description: PVC Building Pipes (Plastic Pipes and Fittings)

Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC pipes and fittings with no additional tariffs currently.

🔢 HS Code: 3917320010

Product Description: PVC Building Pipes (Plastic Pipes Made of PVC)

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC pipes only, not including fittings.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All four HS codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

-

Anti-Dumping Duties: Not applicable for PVC products under these HS codes (no mention of anti-dumping duties on iron or aluminum).

-

Material and Certification Verification:

- Confirm the exact composition of the PVC (e.g., whether it contains additives or is reinforced).

-

Check if certifications (e.g., fire resistance, environmental compliance) are required for import or local use.

-

Unit Price and Classification:

- Ensure the HS code matches the product description (e.g., wall cladding vs. general panels).

- Verify the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

✅ Proactive Advice:

- Consult a customs broker or import compliance expert to confirm the most accurate HS code and applicable tariffs.

- Track policy updates related to the April 11, 2025 tariff change.

- Maintain documentation on product specifications and certifications to avoid delays at customs.

Let me know if you need help with a specific product or import scenario. Here is the structured and professional breakdown of the HS codes and associated tariffs for PVC building materials, based on your input:

📦 Product Classification Overview: PVC Building Materials

🔢 HS Code: 3921125000

Product Description: PVC Building Panels (General Plastic Sheets)

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general PVC building panels, not specifically for wall cladding.

🔢 HS Code: 3916200010

Product Description: PVC Building Wall Cladding Panels (Made of Polyvinyl Chloride)

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for exterior wall panels made of PVC.

🔢 HS Code: 3917390020

Product Description: PVC Building Pipes (Plastic Pipes and Fittings)

Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC pipes and fittings with no additional tariffs currently.

🔢 HS Code: 3917320010

Product Description: PVC Building Pipes (Plastic Pipes Made of PVC)

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC pipes only, not including fittings.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All four HS codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

-

Anti-Dumping Duties: Not applicable for PVC products under these HS codes (no mention of anti-dumping duties on iron or aluminum).

-

Material and Certification Verification:

- Confirm the exact composition of the PVC (e.g., whether it contains additives or is reinforced).

-

Check if certifications (e.g., fire resistance, environmental compliance) are required for import or local use.

-

Unit Price and Classification:

- Ensure the HS code matches the product description (e.g., wall cladding vs. general panels).

- Verify the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

✅ Proactive Advice:

- Consult a customs broker or import compliance expert to confirm the most accurate HS code and applicable tariffs.

- Track policy updates related to the April 11, 2025 tariff change.

- Maintain documentation on product specifications and certifications to avoid delays at customs.

Let me know if you need help with a specific product or import scenario.

Customer Reviews

No reviews yet.