| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

Here is the structured and professional analysis of the HS codes and tariff rates for PVC彩色软片 (PVC colored soft sheets):

✅ HS CODE: 3920435000

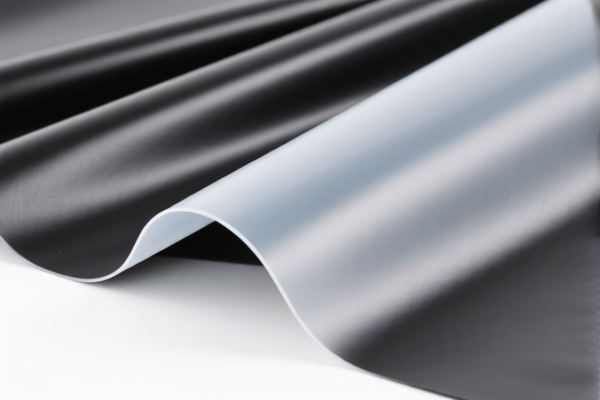

Product Description: PVC彩色软片 (PVC colored soft sheets)

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for "other" types of PVC products not specifically classified elsewhere under HS 3920.

- The product is not explicitly defined as "soft" or "cellular" in this classification.

- Proactive Advice: Confirm if the product is indeed not classified under more specific codes like 3904 or 3921.

✅ HS CODE: 3904220000

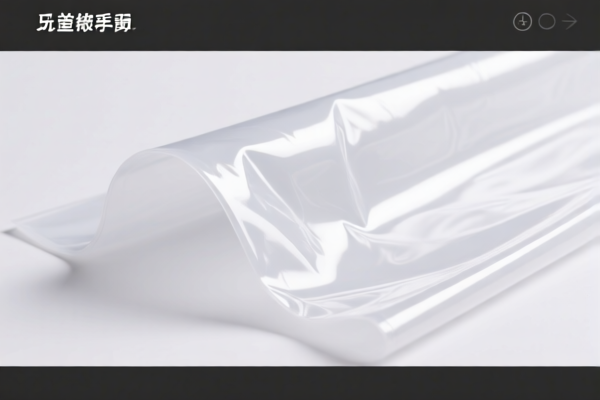

Product Description: PVC彩色软膜 (PVC colored soft film)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for plasticized polyvinyl chloride (PVC), which is a more specific classification.

- It is suitable for soft, flexible PVC films.

- Proactive Advice: Ensure the product is indeed plasticized PVC and not a different type of PVC.

✅ HS CODE: 3920490000

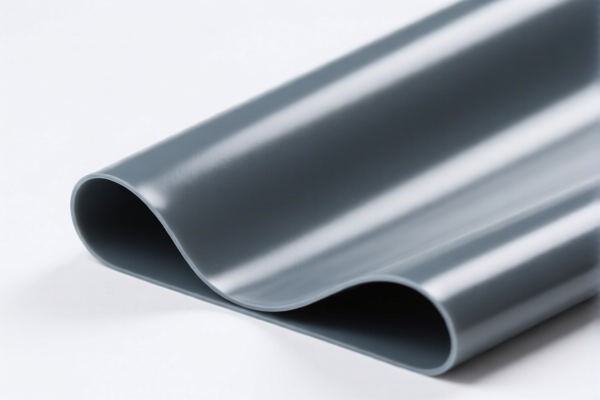

Product Description: PVC软质片材 (PVC soft sheets)

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code applies to non-cellular and non-reinforced plastic sheets, films, etc.

- It is a general category for PVC sheets that are not specifically classified elsewhere.

- Proactive Advice: Verify if the product is non-cellular and not reinforced (e.g., with fabric or fibers).

✅ HS CODE: 3921125000

Product Description: PVC彩色膜 (PVC colored film)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for plastic sheets, films, etc., and is a broader category.

- It may include PVC films but is less specific than 3904220000.

- Proactive Advice: Confirm if the product is not better classified under 3904 or 3920.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not applicable for PVC products in this category (no specific mention of anti-dumping duties on PVC).

- Certifications: Ensure your product meets any required certifications (e.g., RoHS, REACH, or specific import permits).

- Material and Unit Price: Verify the exact material composition and unit price, as this can affect classification and tax rates.

✅ Recommendation:

If your product is PVC彩色软片 (colored PVC soft sheet), HS CODE 3920435000 or 3920490000 may be the most appropriate, depending on the exact specifications. For PVC软膜 (soft film), HS CODE 3904220000 is more specific. Always double-check the product's technical details and consult with a customs broker for final confirmation. Here is the structured and professional analysis of the HS codes and tariff rates for PVC彩色软片 (PVC colored soft sheets):

✅ HS CODE: 3920435000

Product Description: PVC彩色软片 (PVC colored soft sheets)

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for "other" types of PVC products not specifically classified elsewhere under HS 3920.

- The product is not explicitly defined as "soft" or "cellular" in this classification.

- Proactive Advice: Confirm if the product is indeed not classified under more specific codes like 3904 or 3921.

✅ HS CODE: 3904220000

Product Description: PVC彩色软膜 (PVC colored soft film)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for plasticized polyvinyl chloride (PVC), which is a more specific classification.

- It is suitable for soft, flexible PVC films.

- Proactive Advice: Ensure the product is indeed plasticized PVC and not a different type of PVC.

✅ HS CODE: 3920490000

Product Description: PVC软质片材 (PVC soft sheets)

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code applies to non-cellular and non-reinforced plastic sheets, films, etc.

- It is a general category for PVC sheets that are not specifically classified elsewhere.

- Proactive Advice: Verify if the product is non-cellular and not reinforced (e.g., with fabric or fibers).

✅ HS CODE: 3921125000

Product Description: PVC彩色膜 (PVC colored film)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for plastic sheets, films, etc., and is a broader category.

- It may include PVC films but is less specific than 3904220000.

- Proactive Advice: Confirm if the product is not better classified under 3904 or 3920.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not applicable for PVC products in this category (no specific mention of anti-dumping duties on PVC).

- Certifications: Ensure your product meets any required certifications (e.g., RoHS, REACH, or specific import permits).

- Material and Unit Price: Verify the exact material composition and unit price, as this can affect classification and tax rates.

✅ Recommendation:

If your product is PVC彩色软片 (colored PVC soft sheet), HS CODE 3920435000 or 3920490000 may be the most appropriate, depending on the exact specifications. For PVC软膜 (soft film), HS CODE 3904220000 is more specific. Always double-check the product's technical details and consult with a customs broker for final confirmation.

Customer Reviews

关于HS编码3920435000的信息不错,但我希望有更多符合此分类的产品示例。尽管如此,它仍然非常有用。

HS编码3904220000的关税分解非常清晰。我现在知道它最适合塑化PVC薄膜,这与我的产品完全匹配。

2025年4月11日之后30%的特别关税的解释非常重要。我之前没有考虑到这一点,但现在我正在围绕它进行规划。

关于HS编码3920490000的部分对我使用的PVC软片非常有用。特别是关于非泡沫和非增强材料的说明,我非常欣赏。

该页面对不同PVC产品的HS编码提供了很好的概述。我不得不进行更多研究以确认我产品的正确编码,但它为我打下了坚实的基础。