| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4811512020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3926206000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

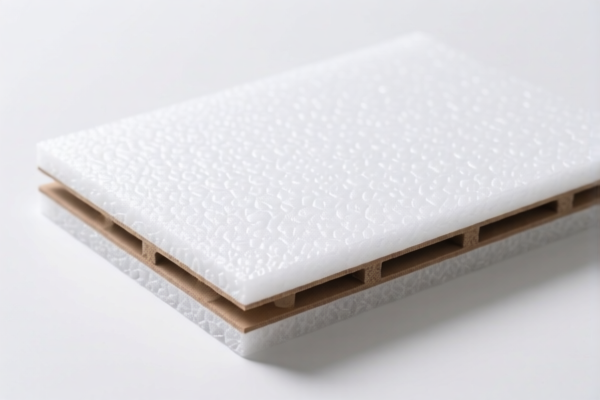

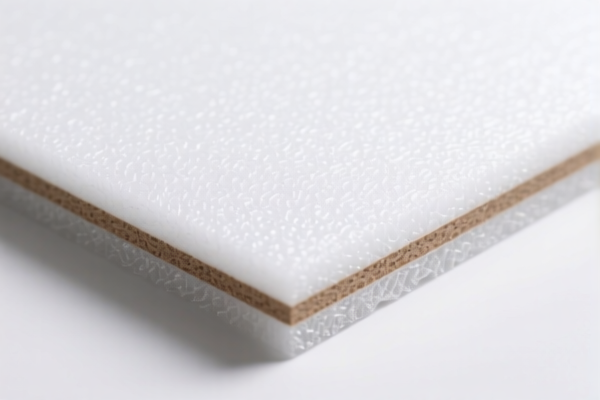

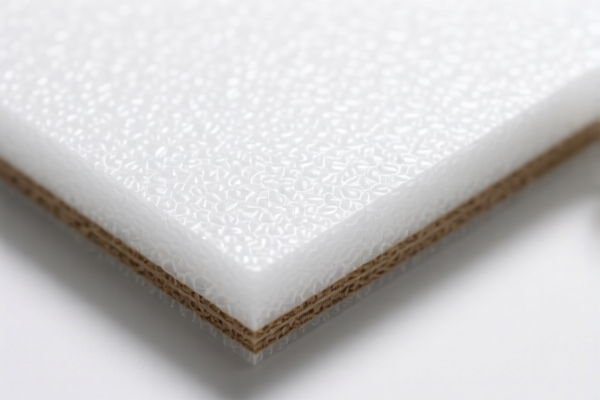

Product Classification: PVC Folding Board

HS CODE: 3921125000 (Primary Classification)

🔍 Classification Summary

PVC folding board is classified under HS CODE 3921125000, which falls under the category of "Other plastic plates, sheets, films, foils and strips, based on polyvinyl chloride polymers."

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning.

- No Anti-Dumping Duties: No specific anti-dumping duties on iron or aluminum are applicable for this product classification.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or coated material, which may fall under a different HS code (e.g., 4811512020 for coated paperboard).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH) are required for import compliance.

- Review Documentation: Ensure proper documentation (e.g., commercial invoice, packing list, and product specifications) is prepared to support the HS code classification.

🔄 Alternative HS Codes for Similar Products

- 3920490000 – PVC sheets, non-cellular, not reinforced, not laminated (total tax: 60.8%)

- 3920995000 – Other non-cellular, non-reinforced plastic sheets (total tax: 60.8%)

- 4811512020 – Coated folding paperboard (total tax: 55.0%)

- 3926206000 – PVC raincoats or rain covers (total tax: 55.0%)

Note: If your product is a coated paperboard or used as a rain cover, the HS code may differ. Always confirm the exact product description and composition before finalizing the classification.

✅ Conclusion

For PVC folding board, the most accurate HS code is 3921125000, with a total tariff rate of 61.5%. Be mindful of the April 11, 2025 tariff increase and ensure your product description aligns with the classification.

Product Classification: PVC Folding Board

HS CODE: 3921125000 (Primary Classification)

🔍 Classification Summary

PVC folding board is classified under HS CODE 3921125000, which falls under the category of "Other plastic plates, sheets, films, foils and strips, based on polyvinyl chloride polymers."

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning.

- No Anti-Dumping Duties: No specific anti-dumping duties on iron or aluminum are applicable for this product classification.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or coated material, which may fall under a different HS code (e.g., 4811512020 for coated paperboard).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH) are required for import compliance.

- Review Documentation: Ensure proper documentation (e.g., commercial invoice, packing list, and product specifications) is prepared to support the HS code classification.

🔄 Alternative HS Codes for Similar Products

- 3920490000 – PVC sheets, non-cellular, not reinforced, not laminated (total tax: 60.8%)

- 3920995000 – Other non-cellular, non-reinforced plastic sheets (total tax: 60.8%)

- 4811512020 – Coated folding paperboard (total tax: 55.0%)

- 3926206000 – PVC raincoats or rain covers (total tax: 55.0%)

Note: If your product is a coated paperboard or used as a rain cover, the HS code may differ. Always confirm the exact product description and composition before finalizing the classification.

✅ Conclusion

For PVC folding board, the most accurate HS code is 3921125000, with a total tariff rate of 61.5%. Be mindful of the April 11, 2025 tariff increase and ensure your product description aligns with the classification.

Customer Reviews

No reviews yet.