Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916200010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

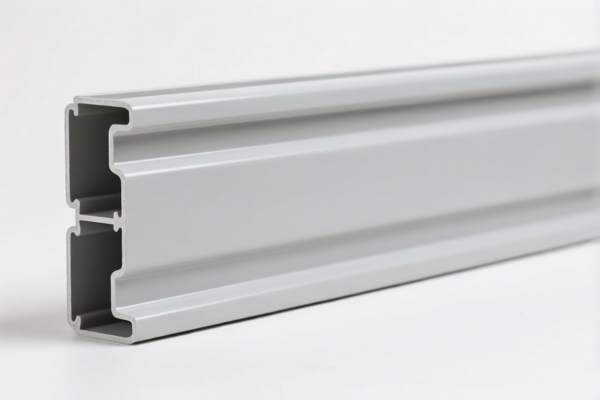

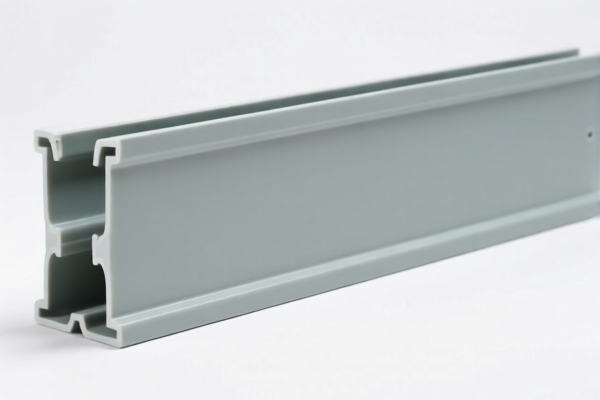

Product Name: PVC挂板

Classification Analysis and Tax Information:

- HS CODE: 3921125000

- Description: PVC挂板符合HSCODE 3921的描述,属于其他塑料板、片、薄膜、箔和条的范畴。

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general classification for PVC panels not specifically designated for construction or specific uses.

- HS CODE: 3916200010

- Description: PVC房屋外墙挂板与HS编码3916200010的描述完全匹配,属于以聚氯乙烯聚合物为材料的房屋或建筑物外墙板。

- Total Tax Rate: 60.8%

- Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most accurate classification for PVC panels used as exterior wall cladding in buildings.

- HS CODE: 3920490000

- Description: PVC挂画符合HSCODE 3920490000的解释,属于氯乙烯聚合物制成的塑料板。

- Total Tax Rate: 60.8%

- Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for decorative or artistic PVC panels, not for construction.

- HS CODE: 3904220000

- Description: PVC挂帘符合HS编码3904开头的描述,属于聚氯乙烯或其他卤代烯烃的聚合物,初级形态。

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for raw or semi-processed PVC materials, not finished products like panels.

- HS CODE: 3921905050

- Description: PVC塑料板符合HS CODE 3921905050的解释,属于其他塑料板、片、薄膜、箔和条的范畴。

- Total Tax Rate: 34.8%

- Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification may apply to PVC sheets with specific technical specifications or uses.

Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and intended use of the PVC panels to ensure correct classification.

- Check Required Certifications: Some products may require specific certifications (e.g., fire resistance, environmental compliance) for import.

- Monitor Tariff Changes: The additional tariff of 30% after April 11, 2025, will significantly increase the total cost. Plan accordingly.

-

Consult Customs Authority: For high-value or complex products, it is recommended to consult local customs or a customs broker for confirmation. Product Name: PVC挂板

Classification Analysis and Tax Information: -

HS CODE: 3921125000

- Description: PVC挂板符合HSCODE 3921的描述,属于其他塑料板、片、薄膜、箔和条的范畴。

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general classification for PVC panels not specifically designated for construction or specific uses.

- HS CODE: 3916200010

- Description: PVC房屋外墙挂板与HS编码3916200010的描述完全匹配,属于以聚氯乙烯聚合物为材料的房屋或建筑物外墙板。

- Total Tax Rate: 60.8%

- Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most accurate classification for PVC panels used as exterior wall cladding in buildings.

- HS CODE: 3920490000

- Description: PVC挂画符合HSCODE 3920490000的解释,属于氯乙烯聚合物制成的塑料板。

- Total Tax Rate: 60.8%

- Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for decorative or artistic PVC panels, not for construction.

- HS CODE: 3904220000

- Description: PVC挂帘符合HS编码3904开头的描述,属于聚氯乙烯或其他卤代烯烃的聚合物,初级形态。

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for raw or semi-processed PVC materials, not finished products like panels.

- HS CODE: 3921905050

- Description: PVC塑料板符合HS CODE 3921905050的解释,属于其他塑料板、片、薄膜、箔和条的范畴。

- Total Tax Rate: 34.8%

- Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification may apply to PVC sheets with specific technical specifications or uses.

Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and intended use of the PVC panels to ensure correct classification.

- Check Required Certifications: Some products may require specific certifications (e.g., fire resistance, environmental compliance) for import.

- Monitor Tariff Changes: The additional tariff of 30% after April 11, 2025, will significantly increase the total cost. Plan accordingly.

- Consult Customs Authority: For high-value or complex products, it is recommended to consult local customs or a customs broker for confirmation.

Customer Reviews

No reviews yet.