| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 9405920000 | Doc | 58.7% | CN | US | 2025-05-12 |

Product Classification and Customs Duty Analysis for PVC Signage (PVC指示牌)

Below is a detailed breakdown of the HS codes and associated customs duties for various PVC signage products. Please note that the following information is based on the latest available data as of April 2025.

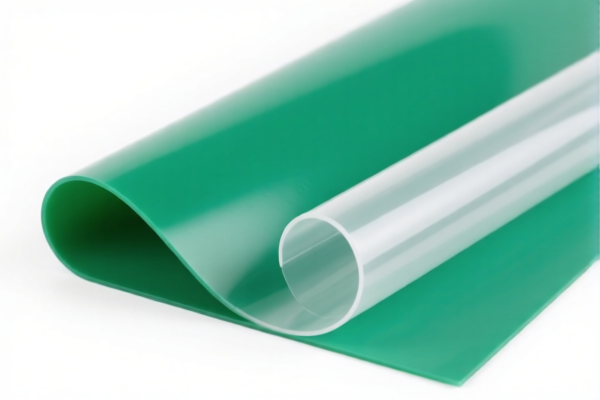

✅ HS CODE: 3921125000

Product Description: PVC指示牌 (PVC Signage) – classified under plastic sheets, plates, films, foils, and strips.

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most common classification for general PVC signage.

- Ensure the product is not classified under a more specific code (e.g., 3920490000 or 3904220000) based on its exact composition and use.

✅ HS CODE: 3920490000

Product Description: PVC电缆标记条 (PVC Cable Marking Strip) – classified under other plastic sheets, plates, films, foils, and strips.

Total Tax Rate: 60.8%

Breakdown of Tariffs:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for specialized PVC strips used in cable marking.

- Confirm the product's intended use to avoid misclassification.

✅ HS CODE: 3904220000

Product Description: PVC标签 (PVC Labels) – classified under plastic products of halogenated ethylene polymers.

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to adhesive or non-adhesive PVC labels.

- Verify if the product is intended for industrial or commercial use, which may affect classification.

✅ HS CODE: 3916200091

Product Description: PVC塑料标识棒 (PVC Plastic Identification Rod) – classified under plastic rods, sticks, and profiles.

Total Tax Rate: 60.8%

Breakdown of Tariffs:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for PVC rods used in identification or signage.

- Ensure the product is not classified under a more specific code (e.g., 3921125000).

✅ HS CODE: 9405920000

Product Description: PVC灯牌 (PVC Light Sign) – classified under parts of lighting fixtures and lamps.

Total Tax Rate: 58.7%

Breakdown of Tariffs:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to PVC signs that are part of a lighting system.

- Confirm if the product is a standalone sign or part of a lighting fixture.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product is made of PVC and not a composite or mixed material, which may change the classification.

- Check Required Certifications: Some products may require CE, RoHS, or other certifications depending on the destination country.

- Confirm Product Use: The intended use (e.g., industrial, commercial, or residential) may influence the correct HS code.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant and should be factored into cost calculations.

- Consult a Customs Broker: For complex or high-value shipments, professional assistance is recommended to avoid misclassification and penalties.

Let me know if you need help determining the correct HS code for a specific product description or if you need a customs compliance checklist. Product Classification and Customs Duty Analysis for PVC Signage (PVC指示牌)

Below is a detailed breakdown of the HS codes and associated customs duties for various PVC signage products. Please note that the following information is based on the latest available data as of April 2025.

✅ HS CODE: 3921125000

Product Description: PVC指示牌 (PVC Signage) – classified under plastic sheets, plates, films, foils, and strips.

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most common classification for general PVC signage.

- Ensure the product is not classified under a more specific code (e.g., 3920490000 or 3904220000) based on its exact composition and use.

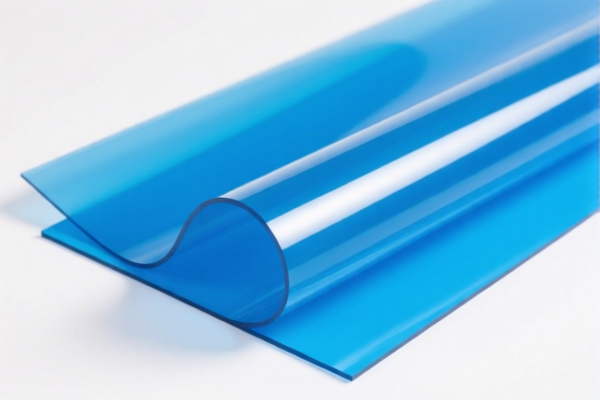

✅ HS CODE: 3920490000

Product Description: PVC电缆标记条 (PVC Cable Marking Strip) – classified under other plastic sheets, plates, films, foils, and strips.

Total Tax Rate: 60.8%

Breakdown of Tariffs:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for specialized PVC strips used in cable marking.

- Confirm the product's intended use to avoid misclassification.

✅ HS CODE: 3904220000

Product Description: PVC标签 (PVC Labels) – classified under plastic products of halogenated ethylene polymers.

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to adhesive or non-adhesive PVC labels.

- Verify if the product is intended for industrial or commercial use, which may affect classification.

✅ HS CODE: 3916200091

Product Description: PVC塑料标识棒 (PVC Plastic Identification Rod) – classified under plastic rods, sticks, and profiles.

Total Tax Rate: 60.8%

Breakdown of Tariffs:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for PVC rods used in identification or signage.

- Ensure the product is not classified under a more specific code (e.g., 3921125000).

✅ HS CODE: 9405920000

Product Description: PVC灯牌 (PVC Light Sign) – classified under parts of lighting fixtures and lamps.

Total Tax Rate: 58.7%

Breakdown of Tariffs:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to PVC signs that are part of a lighting system.

- Confirm if the product is a standalone sign or part of a lighting fixture.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product is made of PVC and not a composite or mixed material, which may change the classification.

- Check Required Certifications: Some products may require CE, RoHS, or other certifications depending on the destination country.

- Confirm Product Use: The intended use (e.g., industrial, commercial, or residential) may influence the correct HS code.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant and should be factored into cost calculations.

- Consult a Customs Broker: For complex or high-value shipments, professional assistance is recommended to avoid misclassification and penalties.

Let me know if you need help determining the correct HS code for a specific product description or if you need a customs compliance checklist.

Customer Reviews

No reviews yet.