Found 6 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

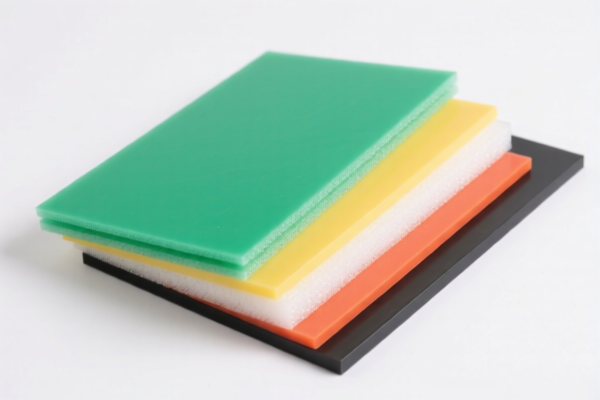

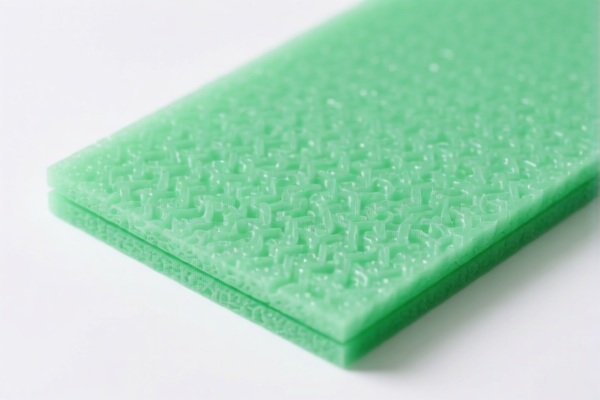

Product Name: PVC泡沫卷材 (PVC Foam Sheet)

HS CODE: 3921125000

✅ Classification Summary:

- HS CODE: 3921125000

- Description: Plastic plates, sheets, films, foils and strips of polyvinyl chloride (PVC) polymer, other than those of heading 3920.

- Product Type: PVC foam sheet (PVC泡沫卷材) falls under this category as it is a plastic sheet made of PVC polymer and is not classified under other specific headings like 3920 (non-cellular, non-reinforced plastics).

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: As of now, there are no specific anti-dumping duties reported for PVC foam sheets.

- No Specific Tariff for Iron or Aluminum: This product is PVC-based, so it is not subject to iron or aluminum-related tariffs.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PVC polymer and not a composite or reinforced material, which may fall under a different HS code.

- Check Unit Price and Packaging: Tariff calculations may depend on the unit of measurement (e.g., per square meter or per kg), so confirm with customs or a customs broker.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Monitor Tariff Updates: Keep an eye on any changes in tariff policies, especially the April 11, 2025, deadline for the special tariff.

📚 Example:

If you are importing 100 kg of PVC foam sheets (HS CODE 3921125000), the total tariff would be:

- Base Tariff: 6.5% of value

- Additional Tariff: 25.0% of value

- Special Tariff (after April 11, 2025): 30.0% of value

- Total: 61.5% of the product value

Let me know if you need help with customs documentation or further classification details.

Product Name: PVC泡沫卷材 (PVC Foam Sheet)

HS CODE: 3921125000

✅ Classification Summary:

- HS CODE: 3921125000

- Description: Plastic plates, sheets, films, foils and strips of polyvinyl chloride (PVC) polymer, other than those of heading 3920.

- Product Type: PVC foam sheet (PVC泡沫卷材) falls under this category as it is a plastic sheet made of PVC polymer and is not classified under other specific headings like 3920 (non-cellular, non-reinforced plastics).

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: As of now, there are no specific anti-dumping duties reported for PVC foam sheets.

- No Specific Tariff for Iron or Aluminum: This product is PVC-based, so it is not subject to iron or aluminum-related tariffs.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PVC polymer and not a composite or reinforced material, which may fall under a different HS code.

- Check Unit Price and Packaging: Tariff calculations may depend on the unit of measurement (e.g., per square meter or per kg), so confirm with customs or a customs broker.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Monitor Tariff Updates: Keep an eye on any changes in tariff policies, especially the April 11, 2025, deadline for the special tariff.

📚 Example:

If you are importing 100 kg of PVC foam sheets (HS CODE 3921125000), the total tariff would be:

- Base Tariff: 6.5% of value

- Additional Tariff: 25.0% of value

- Special Tariff (after April 11, 2025): 30.0% of value

- Total: 61.5% of the product value

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.