| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903101000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

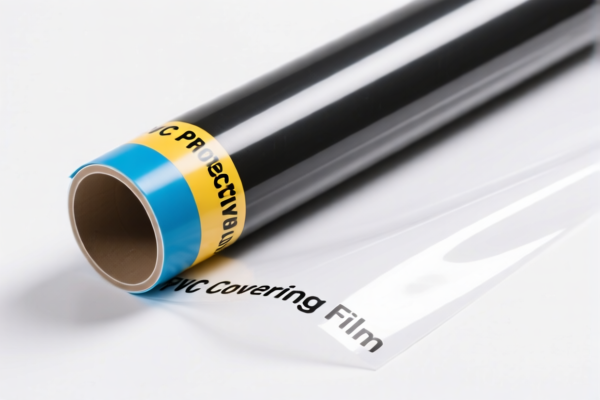

Product Name: PVC Coated Medical Protective Fabric

Classification Analysis and Tax Information:

- HS CODE: 5903103000

- Description: PVC-coated medical protective fabric, which is textile fabric impregnated, coated, covered, or laminated with plastic, specifically using polyvinyl chloride (PVC).

- Total Tax Rate: 57.7%

-

Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: PVC-coated medical protective fabric, classified under plastic sheets, films, or similar products, and described as combined with textile materials.

- Total Tax Rate: 59.2%

-

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5903102010

- Description: PVC-coated medical protective fabric, textile products impregnated, coated, covered, or laminated with plastic, with the product name explicitly mentioning PVC coating.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5903101000

- Description: PVC-coated cotton fabric for medical protection, textile fabric impregnated, coated, covered, or laminated with plastic, specifically cotton fabric coated with PVC.

- Total Tax Rate: 57.7%

-

Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910

- Description: PVC-coated textile protective fabric, classified under plastic sheets, films, or similar products, and not explicitly stating that vegetable fiber content exceeds any other single textile fiber.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes and Recommendations:

- Tariff Changes After April 11, 2025: All listed HS codes will be subject to an additional 30.0% special tariff. This is a critical date to be aware of for cost planning and compliance.

- Material Verification: Confirm the exact composition of the fabric (e.g., cotton vs. synthetic fibers) and whether it is classified as a textile or plastic product, as this will affect the correct HS code.

- Certifications: Ensure that the product meets any required certifications for medical use, especially if it is intended for export to countries with strict regulatory standards.

-

Unit Price and Classification: Double-check the unit price and classification criteria to avoid misclassification, which could lead to higher tariffs or customs delays. Product Name: PVC Coated Medical Protective Fabric

Classification Analysis and Tax Information: -

HS CODE: 5903103000

- Description: PVC-coated medical protective fabric, which is textile fabric impregnated, coated, covered, or laminated with plastic, specifically using polyvinyl chloride (PVC).

- Total Tax Rate: 57.7%

-

Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: PVC-coated medical protective fabric, classified under plastic sheets, films, or similar products, and described as combined with textile materials.

- Total Tax Rate: 59.2%

-

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5903102010

- Description: PVC-coated medical protective fabric, textile products impregnated, coated, covered, or laminated with plastic, with the product name explicitly mentioning PVC coating.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5903101000

- Description: PVC-coated cotton fabric for medical protection, textile fabric impregnated, coated, covered, or laminated with plastic, specifically cotton fabric coated with PVC.

- Total Tax Rate: 57.7%

-

Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910

- Description: PVC-coated textile protective fabric, classified under plastic sheets, films, or similar products, and not explicitly stating that vegetable fiber content exceeds any other single textile fiber.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes and Recommendations:

- Tariff Changes After April 11, 2025: All listed HS codes will be subject to an additional 30.0% special tariff. This is a critical date to be aware of for cost planning and compliance.

- Material Verification: Confirm the exact composition of the fabric (e.g., cotton vs. synthetic fibers) and whether it is classified as a textile or plastic product, as this will affect the correct HS code.

- Certifications: Ensure that the product meets any required certifications for medical use, especially if it is intended for export to countries with strict regulatory standards.

- Unit Price and Classification: Double-check the unit price and classification criteria to avoid misclassification, which could lead to higher tariffs or customs delays.

Customer Reviews

No reviews yet.