| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903101000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

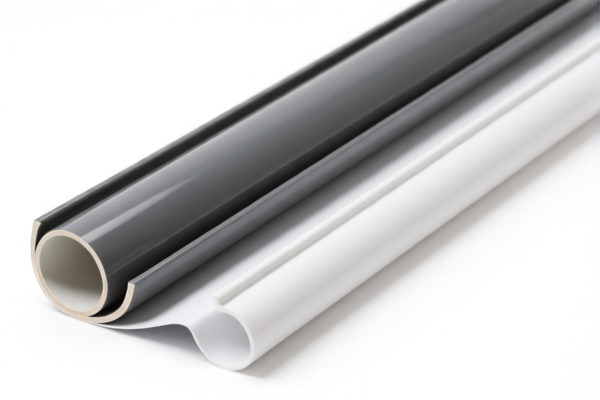

Product Name: PVC Coated Printed Wall Fabric

Classification Overview:

The product is a textile fabric coated with PVC (polyvinyl chloride), used as wall fabric. It may be combined with textile materials such as cotton, polyester, or other synthetic fibers. Based on the HS code and description, the product can be classified under Chapter 59 (Textile articles, impregnated, coated, covered or laminated with plastics) or Chapter 39 (Plastics and articles thereof), depending on the dominant material and structure.

✅ HS CODE: 5903.10.30.00

Description: PVC-coated printed fabric, textile fabric impregnated, coated, covered or laminated with plastic (PVC).

Total Tax Rate: 57.7%

Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total: 2.7% + 25.0% + 30.0% = 57.7%

✅ HS CODE: 3921.12.15.00

Description: PVC-coated printed wall fabric, made of plastic sheets, films, etc., combined with textile materials.

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total: 6.5% + 25.0% + 30.0% = 61.5%

📌 Key Notes and Recommendations:

- Classification Clarification:

- If the product is primarily a textile fabric with PVC coating, HS 5903.10.30.00 is more appropriate.

-

If the product is more of a plastic sheet/film with textile backing, HS 3921.12.15.00 may apply.

-

Tariff Alert (April 2, 2025):

A 30% additional tariff will be imposed on all products under these HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product in the provided data. However, always verify with customs or a compliance expert if the product is subject to any ongoing anti-dumping investigations. -

Certifications and Documentation:

- Confirm the material composition (e.g., cotton, polyester, or mixed) to ensure correct classification.

- Check if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

- Ensure accurate unit price and product description for customs declaration.

🛑 Proactive Advice:

- Verify the dominant material (textile vs. plastic) to determine the correct HS code.

- Review the product’s end use (e.g., interior decoration, construction) to ensure compliance with local regulations.

- Consult a customs broker or compliance expert for final classification and tariff calculation, especially if the product is complex or has multiple components.

Product Name: PVC Coated Printed Wall Fabric

Classification Overview:

The product is a textile fabric coated with PVC (polyvinyl chloride), used as wall fabric. It may be combined with textile materials such as cotton, polyester, or other synthetic fibers. Based on the HS code and description, the product can be classified under Chapter 59 (Textile articles, impregnated, coated, covered or laminated with plastics) or Chapter 39 (Plastics and articles thereof), depending on the dominant material and structure.

✅ HS CODE: 5903.10.30.00

Description: PVC-coated printed fabric, textile fabric impregnated, coated, covered or laminated with plastic (PVC).

Total Tax Rate: 57.7%

Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total: 2.7% + 25.0% + 30.0% = 57.7%

✅ HS CODE: 3921.12.15.00

Description: PVC-coated printed wall fabric, made of plastic sheets, films, etc., combined with textile materials.

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total: 6.5% + 25.0% + 30.0% = 61.5%

📌 Key Notes and Recommendations:

- Classification Clarification:

- If the product is primarily a textile fabric with PVC coating, HS 5903.10.30.00 is more appropriate.

-

If the product is more of a plastic sheet/film with textile backing, HS 3921.12.15.00 may apply.

-

Tariff Alert (April 2, 2025):

A 30% additional tariff will be imposed on all products under these HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product in the provided data. However, always verify with customs or a compliance expert if the product is subject to any ongoing anti-dumping investigations. -

Certifications and Documentation:

- Confirm the material composition (e.g., cotton, polyester, or mixed) to ensure correct classification.

- Check if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

- Ensure accurate unit price and product description for customs declaration.

🛑 Proactive Advice:

- Verify the dominant material (textile vs. plastic) to determine the correct HS code.

- Review the product’s end use (e.g., interior decoration, construction) to ensure compliance with local regulations.

- Consult a customs broker or compliance expert for final classification and tariff calculation, especially if the product is complex or has multiple components.

Customer Reviews

No reviews yet.