| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 6210307000 | Doc | 40.8% | CN | US | 2025-05-12 |

| 6210207000 | Doc | 33.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

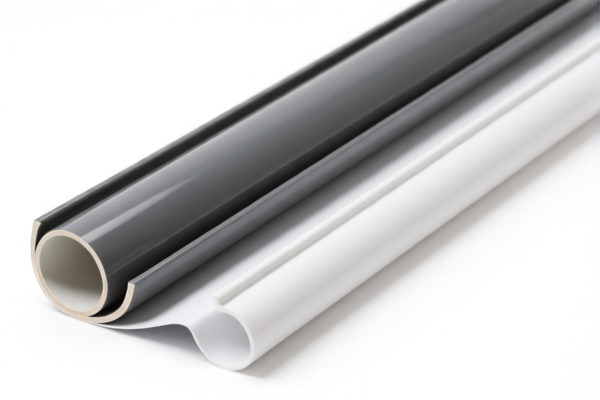

Product Name: PVC Coated Furniture Protective Covers

Classification Analysis and Tax Information:

- HS CODE: 3921121100

- Description: PVC coated furniture protective covers, classified under HS code 3921, which includes plastic sheets, films, foils, and strips. The coating may involve textile materials combined with plastic.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most relevant classification for your product, assuming it is primarily a plastic film or sheet with a textile layer.

-

HS CODE: 3920431000

- Description: PVC patterned furniture protective film, made of polyvinyl chloride (PVC) with plasticizers, and is a laminated or similarly combined plastic product.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is suitable if the product is a thin, flexible film with a decorative pattern.

-

HS CODE: 6210307000

- Description: PVC coated protective clothing, where the outer surface is impregnated, coated, covered, or laminated with rubber or plastic materials, fully covering the base fabric.

- Total Tax Rate: 40.8%

- Base Tariff: 3.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is for protective clothing, not for furniture covers, but may be relevant if the product is used as a protective garment.

-

HS CODE: 6210207000

- Description: PVC coated protective clothing, where the outer surface is impregnated, coated, covered, or laminated with rubber or plastic materials, fully covering the underlying fabric.

- Total Tax Rate: 33.3%

- Base Tariff: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Similar to the above, but with a lower additional tariff. Again, this is for clothing, not furniture covers.

-

HS CODE: 3921121910

- Description: PVC coated textile protective fabric, which is a combination of PVC (polyvinyl chloride polymer) with other textile materials, classified as plastic sheets, films, or foils.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another possible classification if the product is a fabric-like material made of PVC and textile.

✅ Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product is primarily a plastic film (3921121100 or 3921121910) or a textile-based product (6210307000 or 6210207000). This will determine the correct HS code.

- Check Required Certifications: Ensure compliance with any import certifications or standards required by the destination country.

- Monitor Tariff Changes: Be aware that the special tariff of 30.0% applies after April 11, 2025, which could significantly increase the total cost.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties.

Let me know if you need help determining the most accurate HS code based on your product's specifications.

Product Name: PVC Coated Furniture Protective Covers

Classification Analysis and Tax Information:

- HS CODE: 3921121100

- Description: PVC coated furniture protective covers, classified under HS code 3921, which includes plastic sheets, films, foils, and strips. The coating may involve textile materials combined with plastic.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most relevant classification for your product, assuming it is primarily a plastic film or sheet with a textile layer.

-

HS CODE: 3920431000

- Description: PVC patterned furniture protective film, made of polyvinyl chloride (PVC) with plasticizers, and is a laminated or similarly combined plastic product.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is suitable if the product is a thin, flexible film with a decorative pattern.

-

HS CODE: 6210307000

- Description: PVC coated protective clothing, where the outer surface is impregnated, coated, covered, or laminated with rubber or plastic materials, fully covering the base fabric.

- Total Tax Rate: 40.8%

- Base Tariff: 3.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is for protective clothing, not for furniture covers, but may be relevant if the product is used as a protective garment.

-

HS CODE: 6210207000

- Description: PVC coated protective clothing, where the outer surface is impregnated, coated, covered, or laminated with rubber or plastic materials, fully covering the underlying fabric.

- Total Tax Rate: 33.3%

- Base Tariff: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Similar to the above, but with a lower additional tariff. Again, this is for clothing, not furniture covers.

-

HS CODE: 3921121910

- Description: PVC coated textile protective fabric, which is a combination of PVC (polyvinyl chloride polymer) with other textile materials, classified as plastic sheets, films, or foils.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another possible classification if the product is a fabric-like material made of PVC and textile.

✅ Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product is primarily a plastic film (3921121100 or 3921121910) or a textile-based product (6210307000 or 6210207000). This will determine the correct HS code.

- Check Required Certifications: Ensure compliance with any import certifications or standards required by the destination country.

- Monitor Tariff Changes: Be aware that the special tariff of 30.0% applies after April 11, 2025, which could significantly increase the total cost.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties.

Let me know if you need help determining the most accurate HS code based on your product's specifications.

Customer Reviews

No reviews yet.