Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

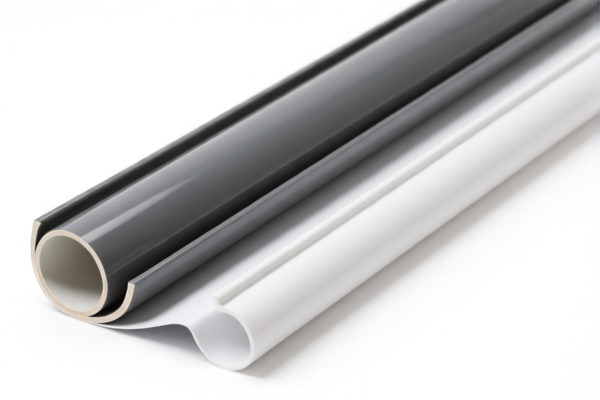

Product Name: PVC涂层尼龙墙布

Classification HS Codes and Tax Details:

✅ HS CODE: 3921121100

- Description: PVC涂层尼龙墙布,符合HS编码3921的描述,塑料重量占比超过70%。

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This classification is suitable if the product is primarily composed of plastic (over 70% by weight).

- Ensure the product description and composition match the HS code criteria.

✅ HS CODE: 3921121500

- Description: PVC涂层尼龙壁布,符合HS编码3921的归类描述,塑料涂层织物。

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to coated fabrics with plastic, but may be more specific than 3921121100.

- Confirm the exact composition and usage (e.g., wall fabric vs. general fabric).

✅ HS CODE: 5903102010

- Description: PVC涂层尼龙防水布,符合HS编码5903102010的描述,塑料浸渍、涂层、覆盖或层压。

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for waterproof fabrics with plastic coating.

- If the product is used for industrial or waterproof purposes, this may be the most accurate classification.

✅ HS CODE: 5903102500 (Two Entries)

- Description: PVC涂层尼龙防水涂层布 / 工业用布,符合HS编码5903102500的描述,塑料涂层和人造纤维。

- Total Tax Rate: 62.5%

- Tax Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to coated fabrics with plastic and synthetic fibers.

- If the product is used for industrial purposes, this may be the most appropriate classification.

- Ensure the fabric is not primarily composed of plastic (less than 70% by weight).

📌 Proactive Advice:

- Verify Material Composition: Confirm the percentage of plastic in the product to determine the correct HS code (e.g., over 70% plastic = 3921, less than 70% = 5903).

- Check Usage: If the product is for industrial or waterproof purposes, 5903102500 may be more accurate.

- Certifications: Ensure the product meets any required certifications (e.g., fire resistance, environmental standards) for import.

- Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, increasing the total tax by 30.0% in all cases.

- Unit Price: Confirm the unit price and quantity for accurate customs valuation.

Product Name: PVC涂层尼龙墙布

Classification HS Codes and Tax Details:

✅ HS CODE: 3921121100

- Description: PVC涂层尼龙墙布,符合HS编码3921的描述,塑料重量占比超过70%。

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This classification is suitable if the product is primarily composed of plastic (over 70% by weight).

- Ensure the product description and composition match the HS code criteria.

✅ HS CODE: 3921121500

- Description: PVC涂层尼龙壁布,符合HS编码3921的归类描述,塑料涂层织物。

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to coated fabrics with plastic, but may be more specific than 3921121100.

- Confirm the exact composition and usage (e.g., wall fabric vs. general fabric).

✅ HS CODE: 5903102010

- Description: PVC涂层尼龙防水布,符合HS编码5903102010的描述,塑料浸渍、涂层、覆盖或层压。

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for waterproof fabrics with plastic coating.

- If the product is used for industrial or waterproof purposes, this may be the most accurate classification.

✅ HS CODE: 5903102500 (Two Entries)

- Description: PVC涂层尼龙防水涂层布 / 工业用布,符合HS编码5903102500的描述,塑料涂层和人造纤维。

- Total Tax Rate: 62.5%

- Tax Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to coated fabrics with plastic and synthetic fibers.

- If the product is used for industrial purposes, this may be the most appropriate classification.

- Ensure the fabric is not primarily composed of plastic (less than 70% by weight).

📌 Proactive Advice:

- Verify Material Composition: Confirm the percentage of plastic in the product to determine the correct HS code (e.g., over 70% plastic = 3921, less than 70% = 5903).

- Check Usage: If the product is for industrial or waterproof purposes, 5903102500 may be more accurate.

- Certifications: Ensure the product meets any required certifications (e.g., fire resistance, environmental standards) for import.

- Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, increasing the total tax by 30.0% in all cases.

- Unit Price: Confirm the unit price and quantity for accurate customs valuation.

Customer Reviews

No reviews yet.