Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

| 5903901800 | Doc | 63.0% | CN | US | 2025-05-12 |

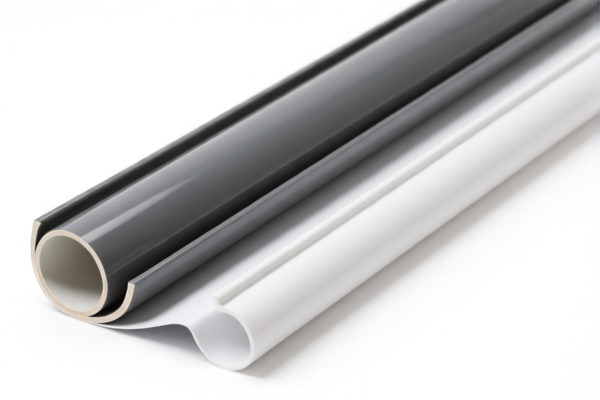

Product Name: PVC Coated Nylon Wall Fabric

Classification HS Code Analysis:

Below are the HS codes and corresponding tax details for PVC-coated nylon wall fabric, based on the provided data:

✅ HS CODE: 3921121500

- Description: PVC-coated nylon wall fabric, which is a combination of plastic (PVC) and other materials (nylon), with nylon content exceeding any other single textile fiber.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This classification applies when the textile component (nylon) is the dominant fiber.

✅ HS CODE: 3921121100

- Description: PVC-coated nylon wall fabric, where the plastic (PVC) content exceeds 70% by weight and is combined with textile materials (nylon).

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is suitable when the plastic (PVC) weight is more than 70% of the total product.

✅ HS CODE: 5903102010

- Description: PVC-coated nylon waterproof fabric, where the fabric is coated with plastic (PVC) and is classified under the category of textile fabrics coated with plastic.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is suitable for waterproof fabrics with a high plastic content (over 70%).

✅ HS CODE: 5903102500

- Description: PVC-coated nylon fabric with waterproof coating, classified under the category of textile fabrics coated with plastic.

- Total Tax Rate: 62.5%

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is for coated fabrics with specific waterproofing properties.

✅ HS CODE: 5903901800

- Description: Nylon-coated wall fabric, where the fabric is coated with plastic and is not classified under Chapter 5902.

- Total Tax Rate: 63.0%

- Base Tariff: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is for coated fabrics with nylon as the base textile.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of PVC and nylon in the product to determine the correct HS code.

- Check Unit Price and Certification: Ensure compliance with any required certifications (e.g., safety, environmental standards).

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs and plan accordingly.

- Consult Customs Authority: For complex cases, seek confirmation from local customs or a customs broker to avoid misclassification.

Let me know if you need help determining the most appropriate HS code for your specific product.

Product Name: PVC Coated Nylon Wall Fabric

Classification HS Code Analysis:

Below are the HS codes and corresponding tax details for PVC-coated nylon wall fabric, based on the provided data:

✅ HS CODE: 3921121500

- Description: PVC-coated nylon wall fabric, which is a combination of plastic (PVC) and other materials (nylon), with nylon content exceeding any other single textile fiber.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This classification applies when the textile component (nylon) is the dominant fiber.

✅ HS CODE: 3921121100

- Description: PVC-coated nylon wall fabric, where the plastic (PVC) content exceeds 70% by weight and is combined with textile materials (nylon).

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is suitable when the plastic (PVC) weight is more than 70% of the total product.

✅ HS CODE: 5903102010

- Description: PVC-coated nylon waterproof fabric, where the fabric is coated with plastic (PVC) and is classified under the category of textile fabrics coated with plastic.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is suitable for waterproof fabrics with a high plastic content (over 70%).

✅ HS CODE: 5903102500

- Description: PVC-coated nylon fabric with waterproof coating, classified under the category of textile fabrics coated with plastic.

- Total Tax Rate: 62.5%

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is for coated fabrics with specific waterproofing properties.

✅ HS CODE: 5903901800

- Description: Nylon-coated wall fabric, where the fabric is coated with plastic and is not classified under Chapter 5902.

- Total Tax Rate: 63.0%

- Base Tariff: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: This code is for coated fabrics with nylon as the base textile.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of PVC and nylon in the product to determine the correct HS code.

- Check Unit Price and Certification: Ensure compliance with any required certifications (e.g., safety, environmental standards).

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs and plan accordingly.

- Consult Customs Authority: For complex cases, seek confirmation from local customs or a customs broker to avoid misclassification.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.