| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903101800 | Doc | 69.1% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903101500 | Doc | 37.5% | CN | US | 2025-05-12 |

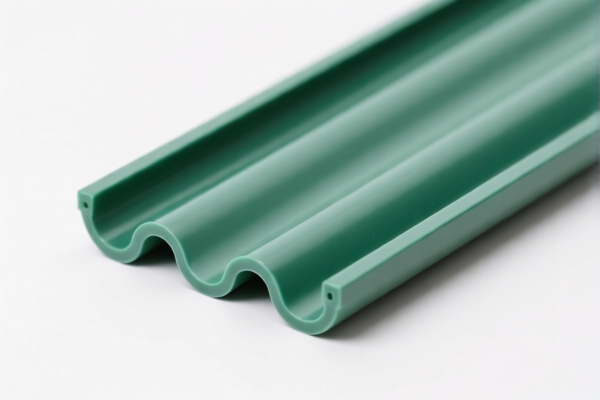

Product Classification: PVC Coated Anti-Aging Fabric

HS CODEs and Tax Information Summary:

- HS CODE: 3921121100

- Product Description: Plastic sheets, plates, or films (e.g., PVC-coated anti-aging fabric)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This classification applies to PVC-coated fabric treated as a plastic product rather than a textile.

-

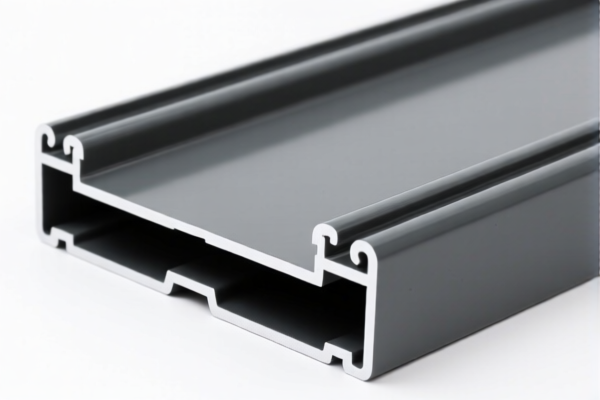

HS CODE: 5903101800

- Product Description: Textile products coated, impregnated, or laminated with plastics (e.g., PVC-coated polyester anti-aging fabric)

- Total Tax Rate: 69.1%

- Breakdown:

- Base Tariff: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a higher tax rate due to the textile base with plastic coating.

-

HS CODE: 5903102500

- Product Description: Textile products coated with plastics (e.g., PVC-coated polyester anti-aging fabric)

- Total Tax Rate: 62.5%

- Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: Slightly lower than 5903101800, but still higher than the plastic-only classification.

-

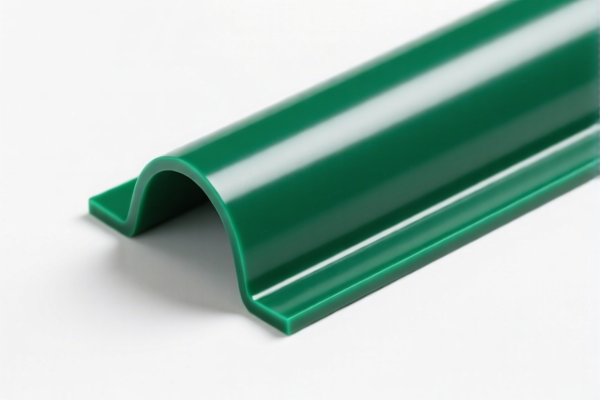

HS CODE: 5903102010

- Product Description: Textile products coated with plastics (e.g., PVC-coated UV-resistant fabric)

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is the lowest tax rate among the textile-based classifications, but still subject to the 2025.4.2 special tariff.

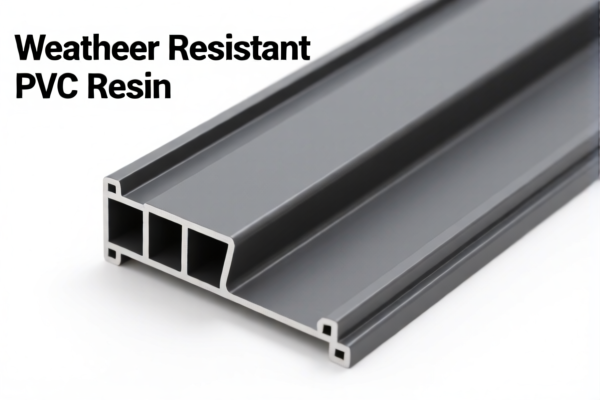

Key Considerations:

- Classification Choice Matters:

- If the fabric is primarily a textile with a PVC coating, it should be classified under HS CODE 5903.

-

If the fabric is treated more like a plastic film (e.g., used for industrial or construction purposes), HS CODE 3921 may be more appropriate.

-

Time-Sensitive Tariff Alert:

- After April 11, 2025, an additional 30% tariff will be applied to all the above HS codes.

-

This is a critical date for customs clearance planning and cost estimation.

-

Anti-Dumping Duties:

- If the product contains iron or aluminum components, additional anti-dumping duties may apply.

-

Confirm with customs or a trade compliance expert if your product includes such materials.

-

Certifications and Documentation:

- Verify if certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Ensure material composition and unit price are clearly documented to avoid classification disputes.

Proactive Advice:

- Confirm the primary use of the fabric (textile vs. plastic film) to determine the correct HS code.

- Review the product composition (e.g., base material, coating type, and thickness) to ensure accurate classification.

- Plan for the 2025.4.2 tariff increase by adjusting pricing or seeking alternative suppliers if necessary.

-

Consult a customs broker or trade compliance expert for final classification and documentation. Product Classification: PVC Coated Anti-Aging Fabric

HS CODEs and Tax Information Summary: -

HS CODE: 3921121100

- Product Description: Plastic sheets, plates, or films (e.g., PVC-coated anti-aging fabric)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This classification applies to PVC-coated fabric treated as a plastic product rather than a textile.

-

HS CODE: 5903101800

- Product Description: Textile products coated, impregnated, or laminated with plastics (e.g., PVC-coated polyester anti-aging fabric)

- Total Tax Rate: 69.1%

- Breakdown:

- Base Tariff: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is a higher tax rate due to the textile base with plastic coating.

-

HS CODE: 5903102500

- Product Description: Textile products coated with plastics (e.g., PVC-coated polyester anti-aging fabric)

- Total Tax Rate: 62.5%

- Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: Slightly lower than 5903101800, but still higher than the plastic-only classification.

-

HS CODE: 5903102010

- Product Description: Textile products coated with plastics (e.g., PVC-coated UV-resistant fabric)

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is the lowest tax rate among the textile-based classifications, but still subject to the 2025.4.2 special tariff.

Key Considerations:

- Classification Choice Matters:

- If the fabric is primarily a textile with a PVC coating, it should be classified under HS CODE 5903.

-

If the fabric is treated more like a plastic film (e.g., used for industrial or construction purposes), HS CODE 3921 may be more appropriate.

-

Time-Sensitive Tariff Alert:

- After April 11, 2025, an additional 30% tariff will be applied to all the above HS codes.

-

This is a critical date for customs clearance planning and cost estimation.

-

Anti-Dumping Duties:

- If the product contains iron or aluminum components, additional anti-dumping duties may apply.

-

Confirm with customs or a trade compliance expert if your product includes such materials.

-

Certifications and Documentation:

- Verify if certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Ensure material composition and unit price are clearly documented to avoid classification disputes.

Proactive Advice:

- Confirm the primary use of the fabric (textile vs. plastic film) to determine the correct HS code.

- Review the product composition (e.g., base material, coating type, and thickness) to ensure accurate classification.

- Plan for the 2025.4.2 tariff increase by adjusting pricing or seeking alternative suppliers if necessary.

- Consult a customs broker or trade compliance expert for final classification and documentation.

Customer Reviews

No reviews yet.