| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

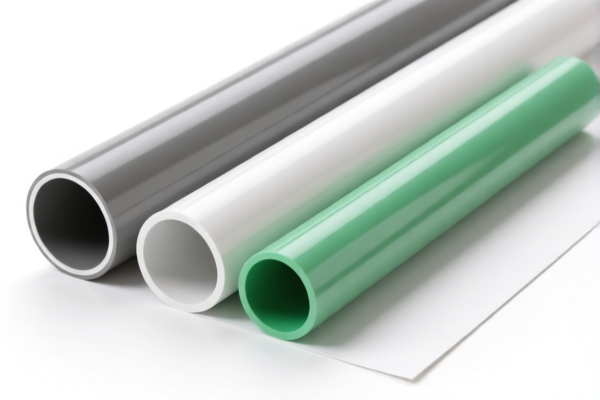

Product Classification: PVC Coated Non-Woven Wall Fabric

HS CODE: 3921121500, 5903102010, 5903103000

🔍 Classification Overview

PVC-coated non-woven wall fabric is a textile product coated with polyvinyl chloride (PVC). It is used for interior wall decoration and falls under different HS codes depending on the classification criteria, such as whether it is considered a textile product or a plastic product.

📦 HS Code Options and Tax Details

1. HS CODE: 3921121500

- Description: Plastic sheets, plates, films, foils and strips, of chlorinated polyethylene (PVC) or other chlorinated polyolefins, with textile materials combined

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This classification is more suitable for products that are primarily plastic with textile components.

2. HS CODE: 5903102010

- Description: Textiles impregnated, coated, covered or laminated with plastics, of polyvinyl chloride (PVC)

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is a textile-based classification, ideal for products where the textile component is dominant.

3. HS CODE: 5903103000

- Description: Textiles impregnated, coated, covered or laminated with plastics, of polyvinyl chloride (PVC), other

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is a catch-all category for PVC-coated textiles not covered by the above codes.

⚠️ Important Notes

- April 2, 2025 Special Tariff: All three codes are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for this product category.

- Certifications: Ensure the product meets relevant import standards (e.g., fire resistance, VOC emissions).

- Material Verification: Confirm the composition (PVC content, textile type) to ensure correct classification.

- Unit Price: Verify the unit price for accurate tax calculation, as some tariffs are based on value.

✅ Proactive Advice

- Confirm the primary material: Is the product more textile or plastic in nature? This will determine the correct HS code.

- Check for certifications: Some countries require fire safety or environmental compliance certifications for wall coverings.

- Consult customs broker: For complex classifications, a customs expert can help avoid misclassification penalties.

- Monitor policy updates: Tariff rates may change, especially after April 2, 2025. Stay informed.

Let me know if you need help determining the most appropriate HS code for your specific product.

Product Classification: PVC Coated Non-Woven Wall Fabric

HS CODE: 3921121500, 5903102010, 5903103000

🔍 Classification Overview

PVC-coated non-woven wall fabric is a textile product coated with polyvinyl chloride (PVC). It is used for interior wall decoration and falls under different HS codes depending on the classification criteria, such as whether it is considered a textile product or a plastic product.

📦 HS Code Options and Tax Details

1. HS CODE: 3921121500

- Description: Plastic sheets, plates, films, foils and strips, of chlorinated polyethylene (PVC) or other chlorinated polyolefins, with textile materials combined

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This classification is more suitable for products that are primarily plastic with textile components.

2. HS CODE: 5903102010

- Description: Textiles impregnated, coated, covered or laminated with plastics, of polyvinyl chloride (PVC)

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is a textile-based classification, ideal for products where the textile component is dominant.

3. HS CODE: 5903103000

- Description: Textiles impregnated, coated, covered or laminated with plastics, of polyvinyl chloride (PVC), other

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is a catch-all category for PVC-coated textiles not covered by the above codes.

⚠️ Important Notes

- April 2, 2025 Special Tariff: All three codes are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for this product category.

- Certifications: Ensure the product meets relevant import standards (e.g., fire resistance, VOC emissions).

- Material Verification: Confirm the composition (PVC content, textile type) to ensure correct classification.

- Unit Price: Verify the unit price for accurate tax calculation, as some tariffs are based on value.

✅ Proactive Advice

- Confirm the primary material: Is the product more textile or plastic in nature? This will determine the correct HS code.

- Check for certifications: Some countries require fire safety or environmental compliance certifications for wall coverings.

- Consult customs broker: For complex classifications, a customs expert can help avoid misclassification penalties.

- Monitor policy updates: Tariff rates may change, especially after April 2, 2025. Stay informed.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.