Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103110 | Doc | 59.2% | CN | US | 2025-05-12 |

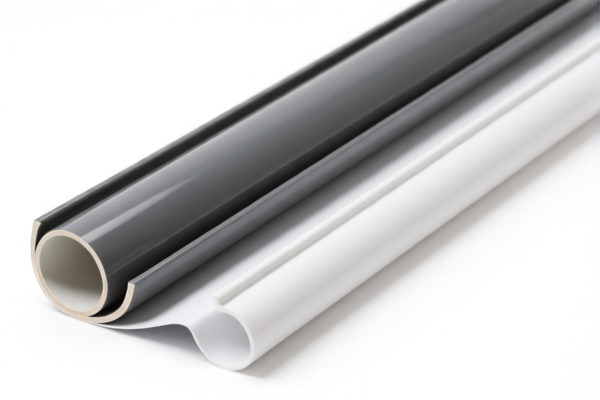

Product Name: PVC涂层梭织布壁布

Classification HS CODE: 5903103000

🔍 HS CODE Details:

- Full HS Code: 5903103000

- Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those with polyvinyl chloride (PVC), other than those in other categories.

- Product Type: PVC-coated woven fabric wall covering.

📊 Tariff Breakdown:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 57.7%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- No Anti-dumping duties on iron/aluminum: Not applicable for this product category.

- No specific anti-dumping duties on PVC: This product is not subject to any known anti-dumping duties on PVC materials.

📌 Proactive Advice:

- Verify Material Composition: Confirm that the product is indeed a woven fabric (not knitted or non-woven) and that it is PVC-coated.

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., fire resistance, environmental standards) for import into the destination country.

- Consult with Customs Broker: For accurate classification and tariff calculation, especially if the product has multiple layers or coatings.

- Document the Manufacturing Process: Provide detailed documentation on the coating process and material composition to support the HS code classification.

🧾 Summary Table:

| Tariff Component | Rate |

|---|---|

| Base Tariff | 2.7% |

| General Additional Tariff | 25.0% |

| Special Tariff (after 2025.4.11) | 30.0% |

| Total Tariff | 57.7% |

If you have further details about the product (e.g., thickness, end use, or country of origin), I can provide more tailored guidance.

Product Name: PVC涂层梭织布壁布

Classification HS CODE: 5903103000

🔍 HS CODE Details:

- Full HS Code: 5903103000

- Description: Textile fabrics impregnated, coated, covered or laminated with plastics, specifically those with polyvinyl chloride (PVC), other than those in other categories.

- Product Type: PVC-coated woven fabric wall covering.

📊 Tariff Breakdown:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 57.7%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- No Anti-dumping duties on iron/aluminum: Not applicable for this product category.

- No specific anti-dumping duties on PVC: This product is not subject to any known anti-dumping duties on PVC materials.

📌 Proactive Advice:

- Verify Material Composition: Confirm that the product is indeed a woven fabric (not knitted or non-woven) and that it is PVC-coated.

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., fire resistance, environmental standards) for import into the destination country.

- Consult with Customs Broker: For accurate classification and tariff calculation, especially if the product has multiple layers or coatings.

- Document the Manufacturing Process: Provide detailed documentation on the coating process and material composition to support the HS code classification.

🧾 Summary Table:

| Tariff Component | Rate |

|---|---|

| Base Tariff | 2.7% |

| General Additional Tariff | 25.0% |

| Special Tariff (after 2025.4.11) | 30.0% |

| Total Tariff | 57.7% |

If you have further details about the product (e.g., thickness, end use, or country of origin), I can provide more tailored guidance.

Customer Reviews

No reviews yet.