| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5903101500 | Doc | 37.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

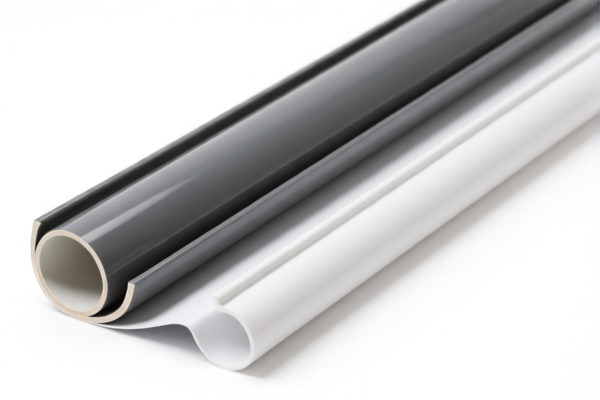

Product Name: PVC Coated Polyester Wall Fabric

Classification Analysis:

- HS CODE: 5903101500, 3921121500, 5903103000, 5903102010, 5903102500

(Multiple HS codes may apply depending on product specifics such as composition, weight, and intended use.)

🔍 Key Classification Notes:

- 5903101500

- Description: PVC-coated polyester wall fabric, where the plastic (PVC) weight exceeds 60% of the total product.

- Total Tax Rate: 37.5%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

-

Applicable if: PVC content is more than 60% of the total weight.

-

3921121500

- Description: Products made of plastic (PVC) combined with other materials, where the man-made fiber (polyester) weight is greater than any other single textile fiber.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Applicable if: The product is primarily composed of PVC with polyester as the dominant textile fiber.

-

5903103000

- Description: PVC-coated polyester fabric, classified under Chapter 59 (Textile Products).

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Applicable if: The product is a textile fabric with PVC coating.

-

5903102010

- Description: PVC-coated polyester fabric, where the coating is poly(vinyl chloride) and the base is man-made fibers.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Applicable if: The product is a textile fabric with PVC coating and polyester base.

-

5903102500

- Description: PVC-coated polyester wall fabric base, used for wallpaper.

- Total Tax Rate: 62.5%

- Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Applicable if: The product is a base fabric for wallpaper with PVC coating.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: Applies to all the above HS codes and adds 30.0% to the total tax rate. This is a time-sensitive policy and must be considered in customs clearance planning.

- Anti-dumping duties: Not applicable for this product category.

- Certifications: Ensure the product meets any required certifications (e.g., textile standards, environmental compliance) for import.

✅ Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of PVC and polyester in the product to determine the correct HS code.

- Check Unit Price: The tax rate may vary depending on the declared value and classification.

- Consult Customs Authority: For final confirmation, especially if the product is borderline between textile and plastic categories.

-

Document Preparation: Ensure all product specifications, including weight, composition, and intended use, are clearly documented for customs clearance. Product Name: PVC Coated Polyester Wall Fabric

Classification Analysis: -

HS CODE: 5903101500, 3921121500, 5903103000, 5903102010, 5903102500

(Multiple HS codes may apply depending on product specifics such as composition, weight, and intended use.)

🔍 Key Classification Notes:

- 5903101500

- Description: PVC-coated polyester wall fabric, where the plastic (PVC) weight exceeds 60% of the total product.

- Total Tax Rate: 37.5%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

-

Applicable if: PVC content is more than 60% of the total weight.

-

3921121500

- Description: Products made of plastic (PVC) combined with other materials, where the man-made fiber (polyester) weight is greater than any other single textile fiber.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Applicable if: The product is primarily composed of PVC with polyester as the dominant textile fiber.

-

5903103000

- Description: PVC-coated polyester fabric, classified under Chapter 59 (Textile Products).

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Applicable if: The product is a textile fabric with PVC coating.

-

5903102010

- Description: PVC-coated polyester fabric, where the coating is poly(vinyl chloride) and the base is man-made fibers.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Applicable if: The product is a textile fabric with PVC coating and polyester base.

-

5903102500

- Description: PVC-coated polyester wall fabric base, used for wallpaper.

- Total Tax Rate: 62.5%

- Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Applicable if: The product is a base fabric for wallpaper with PVC coating.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: Applies to all the above HS codes and adds 30.0% to the total tax rate. This is a time-sensitive policy and must be considered in customs clearance planning.

- Anti-dumping duties: Not applicable for this product category.

- Certifications: Ensure the product meets any required certifications (e.g., textile standards, environmental compliance) for import.

✅ Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of PVC and polyester in the product to determine the correct HS code.

- Check Unit Price: The tax rate may vary depending on the declared value and classification.

- Consult Customs Authority: For final confirmation, especially if the product is borderline between textile and plastic categories.

- Document Preparation: Ensure all product specifications, including weight, composition, and intended use, are clearly documented for customs clearance.

Customer Reviews

No reviews yet.