Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

Product Name: PVC涂层纺织品建筑用防护布

HS CODE: 3921121910

🔍 Product Classification Summary:

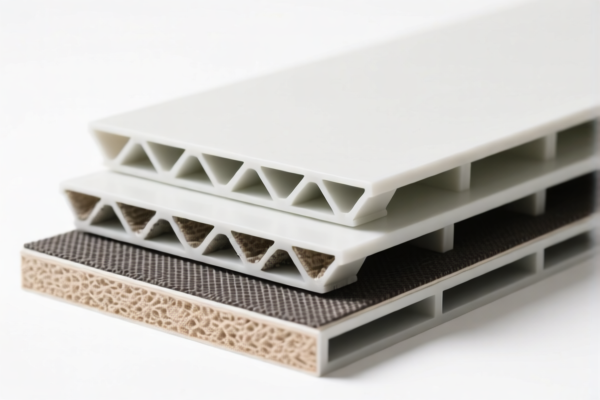

- This product falls under plastic sheets, plates, films, foils, and strips based on polyvinyl chloride (PVC) polymer, combined with textile materials.

- It is commonly used for construction protective covers, outdoor covers, anti-pollution covers, radiation protection covers, etc.

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-Dumping Duties Mentioned: As of now, no specific anti-dumping duties on iron or aluminum are applicable to this product.

- Certifications Required: Ensure the product meets customs and safety standards (e.g., fire resistance, environmental compliance) if applicable.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm that the product is indeed PVC-coated textile fabric and not a different material (e.g., pure plastic or non-PVC-coated fabric).

- Check Unit Price and Packaging: Customs may assess based on unit price and packaging method to determine if the classification is accurate.

- Review Required Certifications: Some countries may require safety certifications or environmental compliance documents for imported protective covers.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could affect your import costs significantly.

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product's specifications and end-use.

Product Name: PVC涂层纺织品建筑用防护布

HS CODE: 3921121910

🔍 Product Classification Summary:

- This product falls under plastic sheets, plates, films, foils, and strips based on polyvinyl chloride (PVC) polymer, combined with textile materials.

- It is commonly used for construction protective covers, outdoor covers, anti-pollution covers, radiation protection covers, etc.

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-Dumping Duties Mentioned: As of now, no specific anti-dumping duties on iron or aluminum are applicable to this product.

- Certifications Required: Ensure the product meets customs and safety standards (e.g., fire resistance, environmental compliance) if applicable.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm that the product is indeed PVC-coated textile fabric and not a different material (e.g., pure plastic or non-PVC-coated fabric).

- Check Unit Price and Packaging: Customs may assess based on unit price and packaging method to determine if the classification is accurate.

- Review Required Certifications: Some countries may require safety certifications or environmental compliance documents for imported protective covers.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could affect your import costs significantly.

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product's specifications and end-use.

Customer Reviews

No reviews yet.