Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

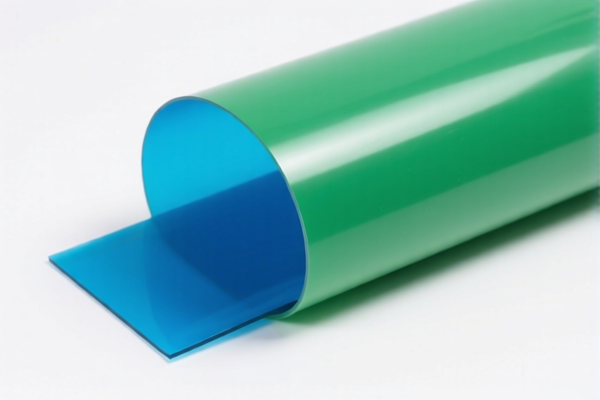

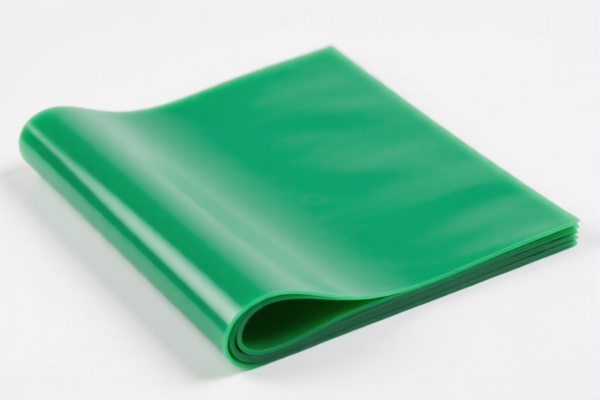

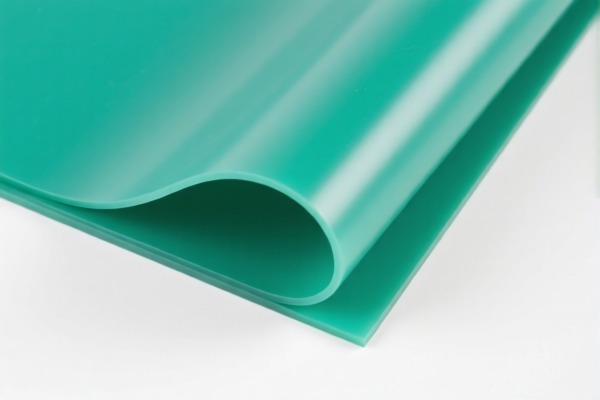

Product Name: PVC Coated Textile Antistatic Fabric

Classification HS Code Analysis:

Below are the HS codes and corresponding tax details for PVC-coated antistatic fabric:

✅ HS CODE: 3921121910

- Description: PVC-coated textile antistatic fabric fits this HS code description.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is one of the higher tax options. Consider verifying if this is the most accurate classification based on the fabric's composition and end use.

✅ HS CODE: 3921121500

- Description: PVC-coated antistatic fabric fits this HS code explanation.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher than the previous code. Ensure the fabric is not classified under a more specific code.

✅ HS CODE: 5903103000

- Description: PVC-coated antistatic fabric fits this HS code description.

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more favorable tax rate. Confirm if the fabric is a coated textile product and not a finished product.

✅ HS CODE: 3921121100

- Description: PVC-coated antistatic fabric fits this HS code description.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: A mid-range tax rate. Ensure the fabric is not classified under a more specific code.

✅ HS CODE: 5903102010

- Description: PVC-coated antistatic fabric fits this HS code description.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest tax rate among the options. However, ensure the fabric is indeed a coated textile and not a finished product.

📌 Important Reminders:

- Verify Material and Unit Price: Confirm the exact composition of the fabric (e.g., base textile, PVC coating thickness, and additives) to ensure correct classification.

- Check Required Certifications: Some HS codes may require specific certifications (e.g., antistatic properties, safety standards).

- April 11, 2025, Special Tariff: All listed codes are subject to an additional 30% tariff after this date. This is a critical date for customs clearance planning.

- Anti-Dumping Duties: Not applicable for this product category, but always check for any recent anti-dumping measures on related materials.

🛠️ Proactive Advice:

- Consult a Customs Broker: For accurate classification and tax calculation, especially if the product is complex or has multiple components.

- Update HS Code Classification: HS codes can change based on product updates or regulatory changes. Stay informed with the latest customs regulations.

Let me know if you need help with customs documentation or tariff calculation for a specific shipment.

Product Name: PVC Coated Textile Antistatic Fabric

Classification HS Code Analysis:

Below are the HS codes and corresponding tax details for PVC-coated antistatic fabric:

✅ HS CODE: 3921121910

- Description: PVC-coated textile antistatic fabric fits this HS code description.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is one of the higher tax options. Consider verifying if this is the most accurate classification based on the fabric's composition and end use.

✅ HS CODE: 3921121500

- Description: PVC-coated antistatic fabric fits this HS code explanation.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher than the previous code. Ensure the fabric is not classified under a more specific code.

✅ HS CODE: 5903103000

- Description: PVC-coated antistatic fabric fits this HS code description.

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more favorable tax rate. Confirm if the fabric is a coated textile product and not a finished product.

✅ HS CODE: 3921121100

- Description: PVC-coated antistatic fabric fits this HS code description.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: A mid-range tax rate. Ensure the fabric is not classified under a more specific code.

✅ HS CODE: 5903102010

- Description: PVC-coated antistatic fabric fits this HS code description.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest tax rate among the options. However, ensure the fabric is indeed a coated textile and not a finished product.

📌 Important Reminders:

- Verify Material and Unit Price: Confirm the exact composition of the fabric (e.g., base textile, PVC coating thickness, and additives) to ensure correct classification.

- Check Required Certifications: Some HS codes may require specific certifications (e.g., antistatic properties, safety standards).

- April 11, 2025, Special Tariff: All listed codes are subject to an additional 30% tariff after this date. This is a critical date for customs clearance planning.

- Anti-Dumping Duties: Not applicable for this product category, but always check for any recent anti-dumping measures on related materials.

🛠️ Proactive Advice:

- Consult a Customs Broker: For accurate classification and tax calculation, especially if the product is complex or has multiple components.

- Update HS Code Classification: HS codes can change based on product updates or regulatory changes. Stay informed with the latest customs regulations.

Let me know if you need help with customs documentation or tariff calculation for a specific shipment.

Customer Reviews

No reviews yet.